Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

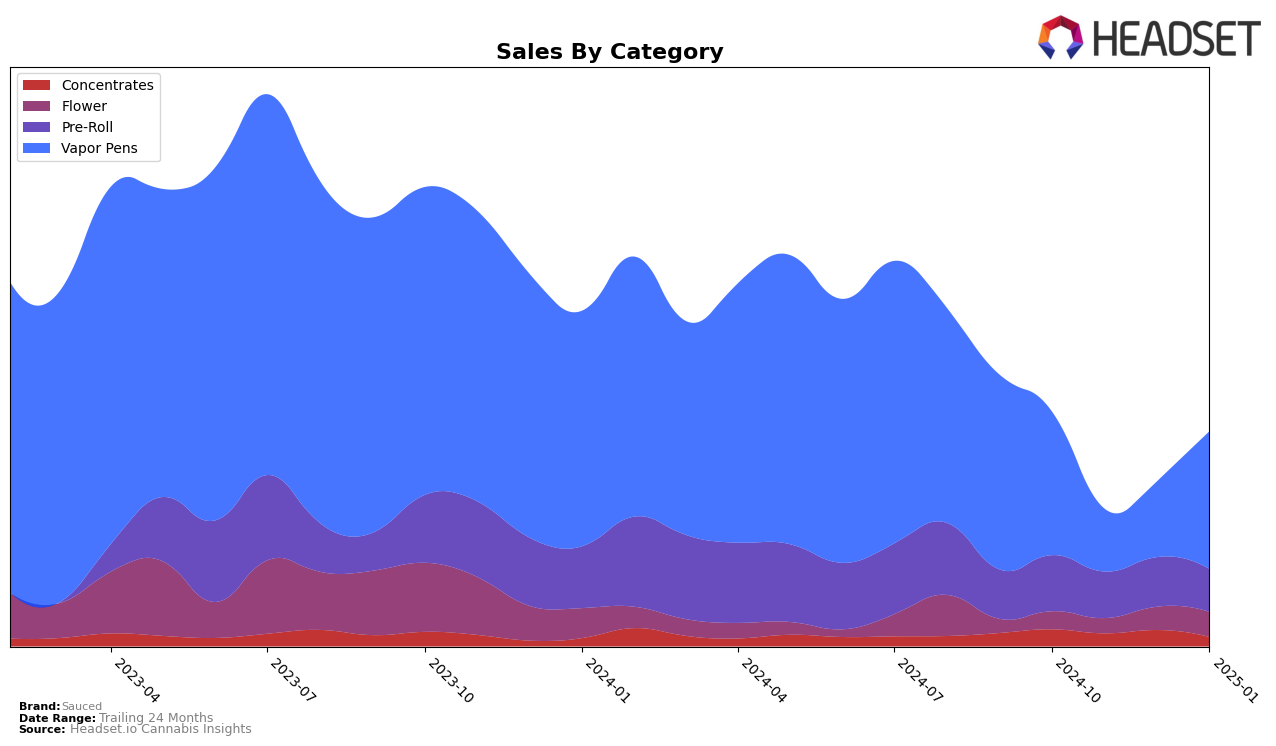

In the ever-evolving cannabis market, Sauced has demonstrated notable performance across various states and product categories. In California, the brand was absent from the top 30 rankings for Vapor Pens from October 2024 through January 2025, indicating a challenging competitive environment in this category. Conversely, in Nevada, Sauced's presence in the Vapor Pens category has been more stable, maintaining a rank within the top 30 throughout the same period, with a slight improvement from 29th in November to 25th in January. This suggests a more favorable reception or strategic positioning in Nevada's Vapor Pens market compared to California.

Focusing on the Flower category in Nevada, Sauced showed a positive trajectory, climbing from 85th to 68th place from October 2024 to January 2025. This upward movement in rankings could reflect a successful marketing strategy or product innovation that resonates with consumers in this state. However, it's important to note that while Sauced has made strides in some categories and regions, its absence from the top 30 in certain areas like California's Vapor Pens category highlights the competitive challenges the brand faces. Understanding these dynamics can provide valuable insights into the brand's strategic focus and areas for potential growth.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Sauced has demonstrated a stable yet challenging position. Over the months from October 2024 to January 2025, Sauced's rank has fluctuated slightly, moving from 24th to 25th, indicating a consistent presence within the top 30 but not breaking into the top 20. This stability contrasts with brands like Polaris MMJ, which showed a more volatile rank, peaking at 21st in December before dropping back to 26th in January. Meanwhile, Spiked Flamingo has shown a gradual improvement, surpassing Sauced by moving from 29th to 24th over the same period. Although Sauced's sales figures have seen some fluctuations, they remain competitive, especially when compared to brands like Church Cannabis Co., which experienced a significant drop in rank and sales. This data suggests that while Sauced maintains a steady market presence, there is room for strategic growth to improve its rank and capitalize on the fluctuating positions of its competitors.

Notable Products

In January 2025, Alien Rock Candy (3.5g) from Sauced emerged as the top-performing product, climbing to the number one rank with notable sales of 1271 units. Granddaddy Purple Live Resin Disposable (1g) secured the second position, improving from fourth place in December 2024. White Widow Live Resin Disposable (1g) made its debut in the rankings at the third spot. Space Octane Infused Pre-Roll 5-Pack (3g) moved up to fourth place, up from fifth in December. Jet Fuel Infused Pre-Roll 5-Pack (3g) dropped to fifth position, showing a slight decline from its third-place ranking in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.