Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

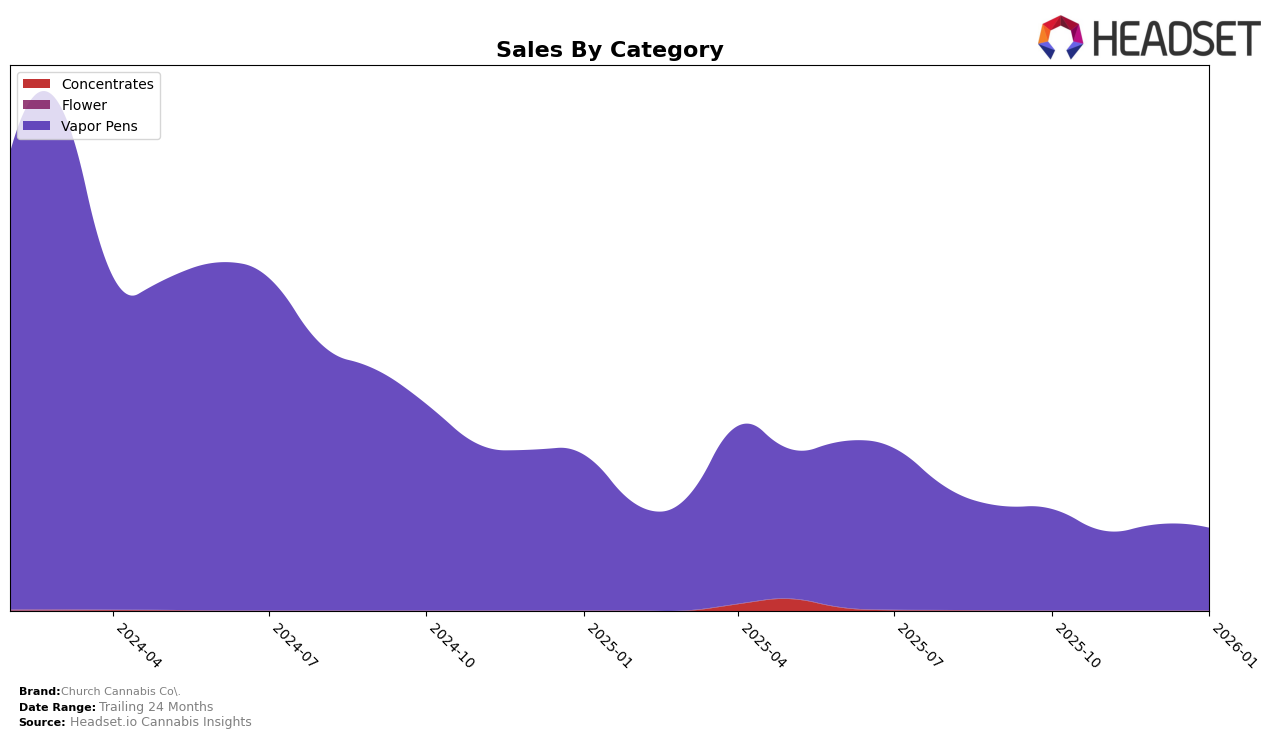

Church Cannabis Co. has shown varied performance across different states and categories in recent months. In the Michigan market, the brand's presence in the Vapor Pens category has seen some fluctuations. Despite a slight dip in ranking from 61st in December 2025 to 65th in January 2026, the brand experienced a notable increase in sales from October to December, peaking at over $128,000 in December. This indicates a possible seasonal spike or successful promotional efforts during the holiday season, although maintaining consistent ranking remains a challenge as they have yet to break into the top 30.

Meanwhile, in Nevada, Church Cannabis Co. has maintained a steadier presence in the Vapor Pens category, consistently ranking within the top 30. The brand's ranking fluctuated slightly from 19th in October 2025 to 25th in January 2026. Although sales saw a decline from October to December, there was a recovery in January. This suggests that while the brand has a solid foothold in Nevada, it faces competitive pressures that impact its sales and ranking. Notably, being consistently ranked within the top 30 in Nevada highlights the brand's relative strength in this market compared to Michigan.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Church Cannabis Co. has experienced fluctuating rankings over the months from October 2025 to January 2026, indicating a dynamic market presence. Despite a slight dip in January 2026, Church Cannabis Co. maintained a relatively stable position, hovering around the mid-60s in rank. This stability is noteworthy when compared to competitors like Skymint, which saw more significant rank fluctuations, dropping to 82 in November 2025 before climbing to 60 by January 2026. Meanwhile, Rkive Cannabis consistently outperformed Church Cannabis Co., maintaining a higher rank, though it showed a downward trend from October 2025 to January 2026. Strait-Fire and Monopoly Melts also present competitive pressures, with Strait-Fire achieving a rank of 66 in January 2026, closely matching Church Cannabis Co.'s performance. These insights suggest that while Church Cannabis Co. holds a competitive position, it faces challenges from both established and emerging brands, necessitating strategic efforts to enhance market share and sales growth.

Notable Products

In January 2026, Church Cannabis Co.'s top-performing product was the Ice Cream Cake Live Resin Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from December 2025 with sales of 659 units. The Forbidden Fruit Live Resin Cartridge (1g) also held steady in second place within the same category, showing a significant increase in sales from 411 units in December 2025 to 603 units in January 2026. The Runtz Distillate Cartridge (1g) debuted at third place, marking its first appearance in the rankings. The Rainbow Belts Distillate Disposable (1g) followed in fourth, while the Alaskan Thunder Fuck Liquid Diamond Distillate Disposable (1g), which was third in previous months, dropped to fifth place, with sales decreasing from 352 units in December 2025 to 273 units in January 2026. This shift indicates a strong preference among customers for the live resin products over the distillate options.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.