Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

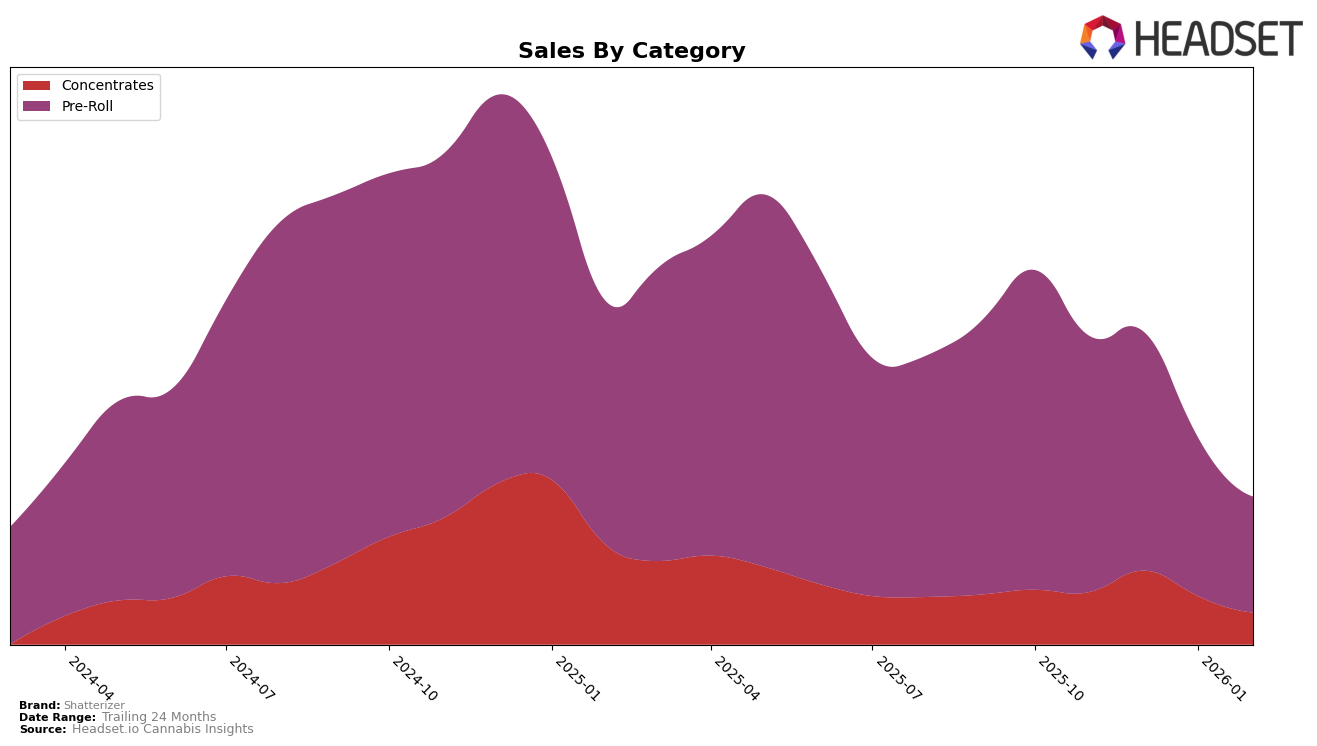

In the Ontario market, Shatterizer has demonstrated a steady presence in the Concentrates category. From November 2025 to February 2026, the brand maintained a consistent ranking, hovering around the 10th position, before slightly dropping to 12th in February. This slight decline could be attributed to a decrease in sales from December to February, indicating potential challenges in maintaining its competitive edge in the Concentrates category. However, the fact that Shatterizer remained within the top 15 suggests a relatively solid market position, albeit with room for improvement in sustaining or growing its market share.

Conversely, Shatterizer's performance in the Pre-Roll category in Ontario highlights a different narrative. The brand did not break into the top 30 rankings at any point from November 2025 to February 2026. This absence from the top tier may indicate either a strategic focus on other categories or a need to reevaluate their approach in the Pre-Roll segment. The declining sales figures over these months reflect this challenge, suggesting that Shatterizer might need to innovate or adjust its offerings to capture a more significant share of the Pre-Roll market in Ontario.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Shatterizer has experienced a notable decline in rank over the past few months, slipping from 42nd in November 2025 to 50th by February 2026. This downward trend in rank is mirrored by a decrease in sales, highlighting potential challenges in maintaining market share. In contrast, brands like SUPER TOAST have shown an upward trajectory, climbing from 66th to 49th place, with sales figures reflecting a positive growth trend. Similarly, Big Bag O' Buds has made significant strides, improving its rank from 70th to 51st, suggesting a successful strategy in capturing consumer interest. Meanwhile, Community Cannabis c/o Purple Hills and Jays (Canada) have maintained relatively stable positions, indicating consistent performance in the market. These dynamics suggest that Shatterizer may need to reassess its competitive strategy to regain momentum and improve its standing in this evolving market.

Notable Products

In February 2026, the top-performing product from Shatterizer was the 8 Ball Kush Shatter Double Infused Pre-Roll (1g), maintaining its first-place rank for four consecutive months with sales of 5,397 units. The Rockstar Shatter Diamonds & Kief Infused Pre-Roll (1g) held steady in second place, showing consistent performance from January. The 8 Ball Kush Shatter (1g) improved its ranking from fourth to third place from January to February, indicating a positive trend. The Slurricane Double Infused Pre-Roll (1g) experienced a drop, moving from third to fourth place, while the Pink Gas Shatter Infused Pre-Roll (1g) remained in fifth place, highlighting a decrease in its sales momentum. Overall, the rankings reflect some shifts in consumer preference, with 8 Ball Kush products showing strong market appeal.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.