Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Connected Cannabis Co. has shown varying performance across different categories and states. In Arizona, the brand has seen a notable shift in its Flower category rankings, starting at 15th in October 2025 and dropping to 22nd by January 2026. This decline in ranking coincides with a decrease in sales from October to January. In the Pre-Roll category, Connected Cannabis Co. maintained a mid-tier presence, although it slipped from 21st to 30th over the same period, indicating a potential area of concern. The Vapor Pens category displayed more stability, maintaining a rank in the low 20s to high 20s, suggesting a consistent but not leading presence in this segment.

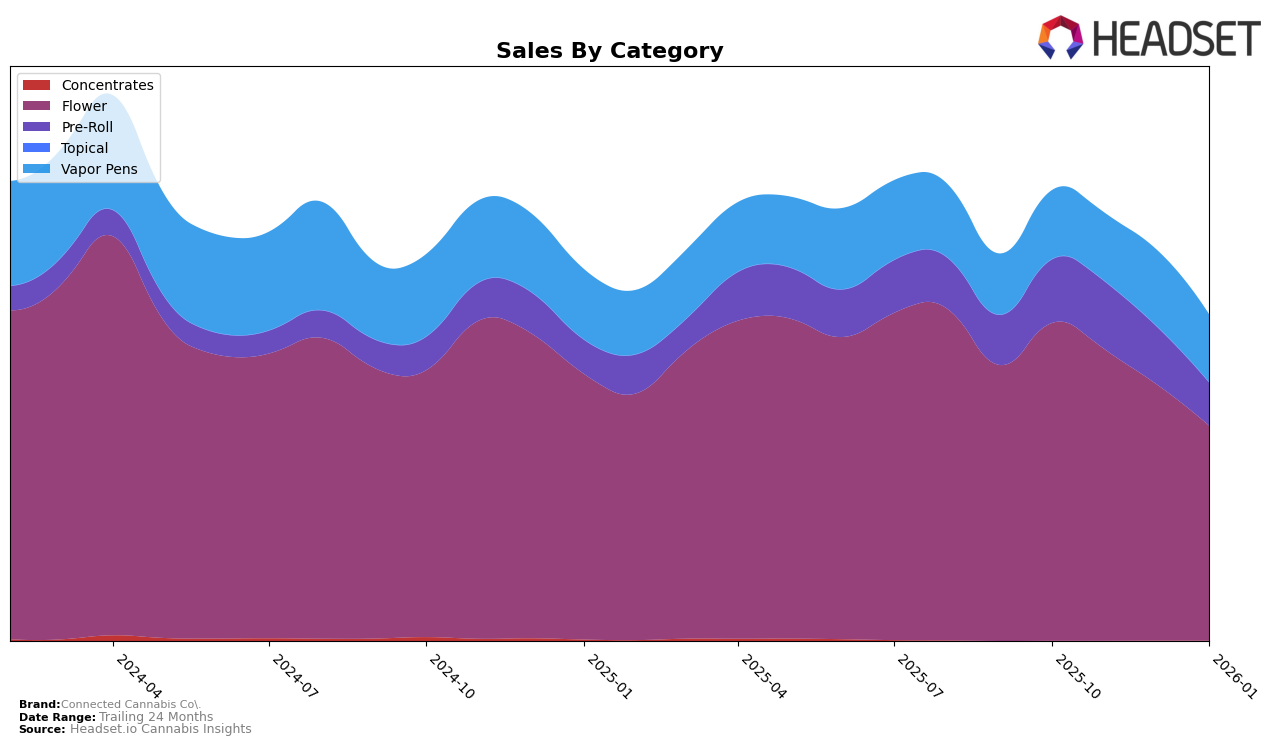

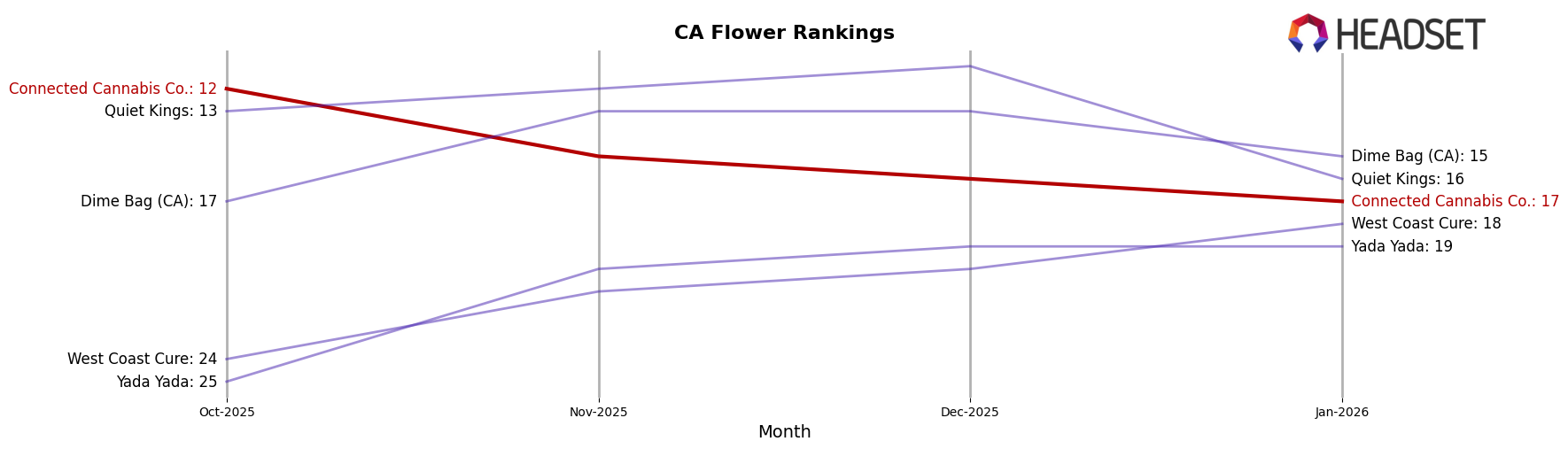

In contrast, California presents a different picture for Connected Cannabis Co. The Flower category, while still experiencing a downward trend, maintained a stronger position, starting at 12th and ending at 17th. This indicates that while the brand is facing challenges, its Flower products remain relatively competitive in California. However, the Pre-Roll and Vapor Pens categories show a stark absence from the top rankings, with Pre-Rolls never breaking into the top 30 and Vapor Pens fluctuating near the bottom, suggesting these areas may require strategic attention. This mixed performance across states and categories highlights the brand's need to evaluate its market strategies to enhance its standing and capture greater market share.

Competitive Landscape

In the competitive landscape of the California flower category, Connected Cannabis Co. has experienced a notable decline in rank and sales over recent months. Starting from a rank of 12th in October 2025, the brand has slipped to 17th by January 2026, indicating a downward trend. This decline is contrasted by competitors like Dime Bag (CA), which improved its position from 17th to 15th, and West Coast Cure, which climbed from 24th to 18th. Additionally, Quiet Kings maintained a stronger presence, peaking at 11th in December before dropping to 16th in January. The sales figures reflect these shifts, with Connected Cannabis Co.'s sales decreasing steadily, while competitors like Dime Bag (CA) saw an increase in sales during the same period. This competitive pressure suggests that Connected Cannabis Co. may need to reassess its strategies to regain market share and improve its standing in the California flower market.

Notable Products

In January 2026, Connected Cannabis Co.'s top-performing product was Permanent Marker (3.5g) in the Flower category, maintaining its leading position from the previous two months with a notable sales figure of 6979 units. Jack of Diamonds (3.5g) held steady in the second spot, reflecting consistent consumer preference. Ghost OG (3.5g) secured the third rank, showing a slight decline in sales compared to December 2025. Biscotti (3.5g) remained in the fourth position, despite a continued drop in sales from previous months. Silver Spoon (3.5g) re-entered the rankings at fifth place, indicating a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.