Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

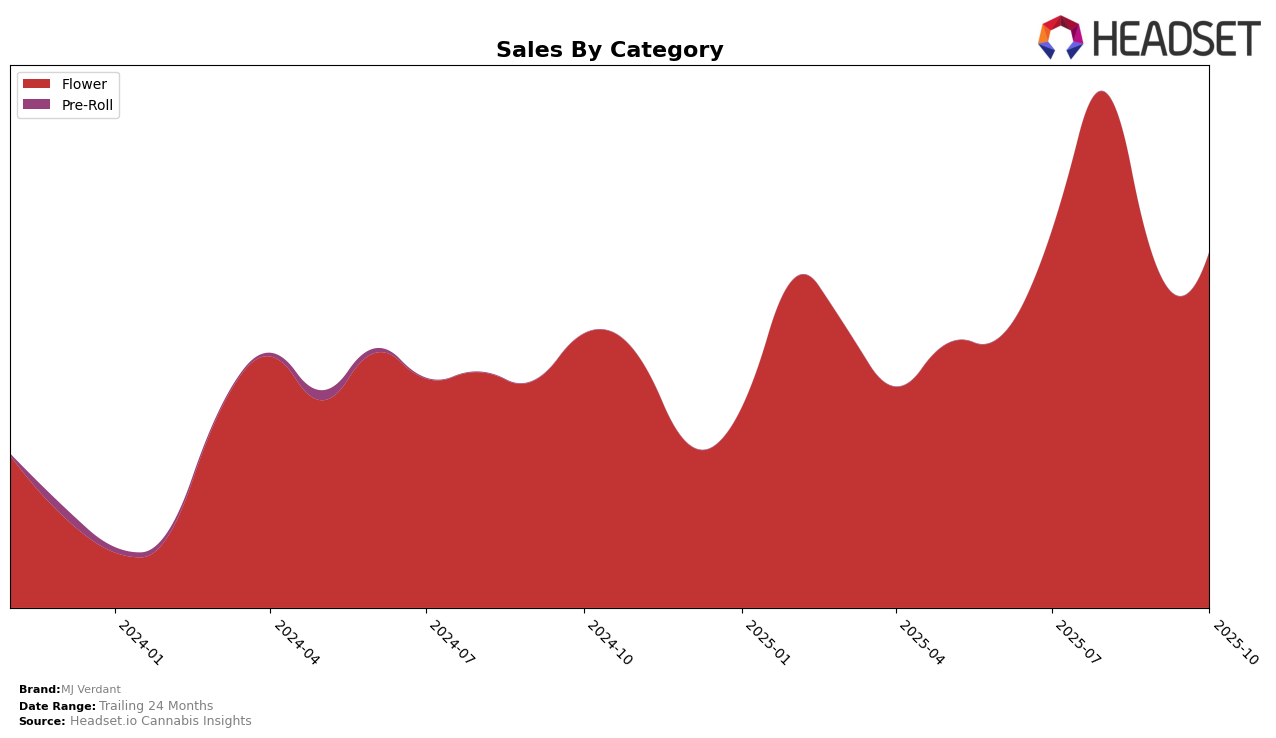

In the Michigan market, MJ Verdant's performance in the Flower category has shown notable fluctuations over the past few months. Starting from a rank of 26 in July 2025, the brand made a significant leap to 15 in August, suggesting a strong competitive presence during that period. However, this momentum was not sustained as the brand's ranking dropped to 25 in September and further to 28 in October. The sales figures reflect this volatility, with a peak in August at approximately $1.36 million, followed by a decline in the subsequent months. This indicates that while MJ Verdant experienced a temporary boost, maintaining a consistent upward trajectory in Michigan's Flower category remains a challenge.

Interestingly, the absence of MJ Verdant in the top 30 rankings for certain months in Michigan emphasizes the competitive nature of the market. Not being in the top 30 for October suggests a need for strategic adjustments to regain market share. These ranking dynamics highlight the importance of understanding market trends and consumer preferences to sustain growth. The fluctuations in their ranking also point to potential opportunities for improvement in brand positioning and product offerings to better meet consumer demand in Michigan. As the market continues to evolve, MJ Verdant's ability to adapt and innovate will be crucial for future success.

Competitive Landscape

In the competitive landscape of the Michigan flower category, MJ Verdant has experienced notable fluctuations in its ranking over the past few months. Despite a strong performance in August 2025, where it climbed to the 15th position, MJ Verdant's rank slipped to 28th by October 2025. This decline in rank is significant when compared to competitors like Light Sky Farms, which improved its position from 78th in July to 27th in October, showcasing a consistent upward trend. Meanwhile, Heavyweight Heads and Muha Meds have shown varying performances, with Heavyweight Heads dropping from 20th to 26th and Muha Meds fluctuating but maintaining a competitive edge. Plant Nerd also saw a decline, moving from 16th to 29th. These dynamics suggest that while MJ Verdant has faced challenges in maintaining its rank, the competitive environment remains fluid, offering opportunities for strategic positioning and growth in sales.

Notable Products

In October 2025, the top-performing product for MJ Verdant was Frost Berry OG Smalls (Bulk) in the Flower category, securing the number 1 rank with sales of 38,478 units. Tangerine Dream (Bulk), also in the Flower category, dropped to the second position from its previous top rank in September. Tropical Rabbit Smalls (Bulk) emerged as a strong contender, ranking third without being listed in the top ranks in prior months. Blue Java (1g) and Donkey Butter (Bulk) rounded out the top five, ranking fourth and fifth, respectively, and both making their debut in the top ranks. This month saw significant shifts in product rankings, with new entries and changes in the leaderboard compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.