Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

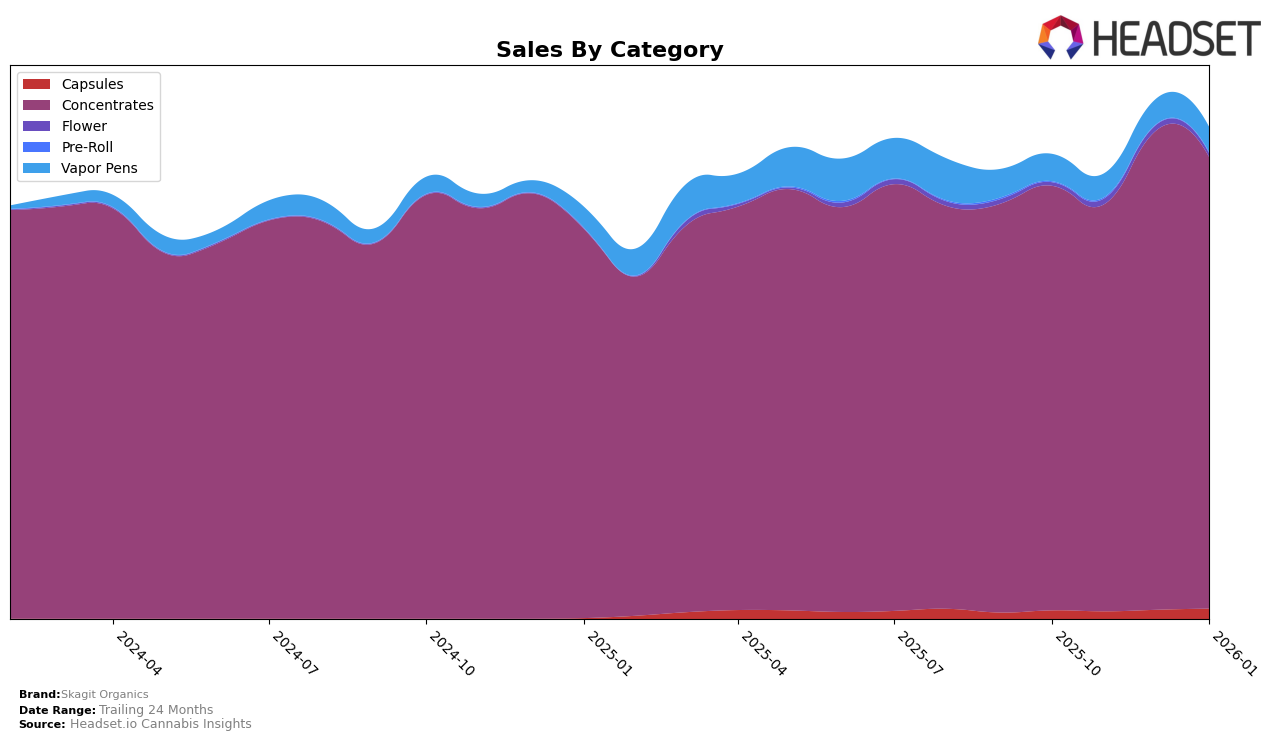

Skagit Organics has shown a consistent presence in the Concentrates category within the state of Washington. Over the past few months, the brand has maintained a steady ranking, holding the 7th position from November 2025 to January 2026 after a slight drop from 6th in October 2025. This stability suggests a solid consumer base and effective market strategies in Washington's competitive concentrates sector. Despite the slight fluctuation in their ranking, the brand's sales performance demonstrated resilience, with an increase in sales from November to December 2025, followed by a slight decline in January 2026.

Interestingly, Skagit Organics does not appear in the top 30 rankings for any other states or provinces, indicating a potential area for growth or a strategic decision to focus heavily on the Washington market. The absence of their ranking outside Washington could be seen as a limitation in their market reach or an opportunity to expand their brand presence. This focused approach, while beneficial in maintaining a strong foothold in Washington, leaves room for speculation on whether Skagit Organics plans to diversify its market strategy in the future.

Competitive Landscape

In the Washington concentrates market, Skagit Organics has maintained a consistent presence, holding the 7th rank from November 2025 through January 2026. This stability is noteworthy given the competitive landscape, where brands like Forbidden Farms and Constellation Cannabis have shown fluctuations in their rankings. Forbidden Farms consistently outperformed Skagit Organics, holding the 5th position in both October 2025 and January 2026, while Constellation Cannabis saw a rise to 5th place in November and December before dropping to 6th in January. Meanwhile, Phat Panda remained close in rank, oscillating between 8th and 10th place. Skagit Organics' stable ranking amidst these shifts suggests a solid customer base, though the brand may need to innovate or enhance marketing strategies to climb higher, especially as competitors like Pacific & Pine made significant gains, jumping from 14th in October to 8th by December 2025.

Notable Products

In January 2026, the top-performing product for Skagit Organics was Original - Blue Dream RSO (1g) in the Concentrates category, maintaining its leading position from November 2025 after briefly dropping to second place in December. The 9lb Hammer RSO Tanker (1g) climbed to the second spot, improving from its consistent third place in the previous months. Original - Durban Poison RSO Tanker (1g) rose to third place, showing steady performance with a slight rise from its fourth position in the preceding months. Meanwhile, Grand Daddy Purple RSO Tanker (1g) experienced a drop, falling to fourth place from its top rank in December. Notably, Original - Blue Dream RSO (1g) achieved sales of 764 units, showcasing its continued popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.