Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

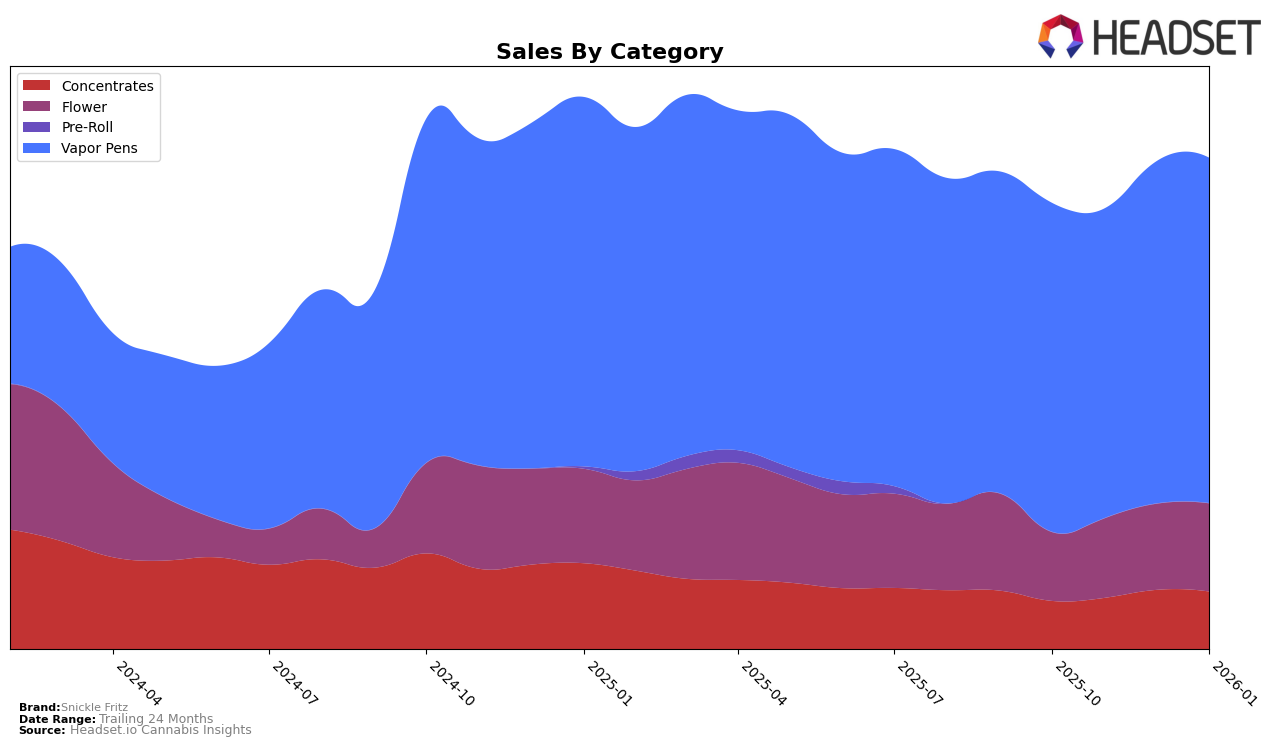

In the state of Washington, Snickle Fritz has shown notable performance in the Concentrates category. The brand has experienced a steady climb from a rank of 13 in October 2025 to 10 by January 2026, indicating a positive trend in market presence and consumer preference. This upward movement is accompanied by an increase in sales, which suggests that Snickle Fritz is successfully capturing a larger share of the market in this category. However, in the Flower category, Snickle Fritz did not make it into the top 30 rankings until November 2025, where it started at rank 35 and improved slightly to 33 by January 2026. This late entry into the top rankings could be seen as a challenge, but the gradual improvement indicates potential growth opportunities for the brand in this segment.

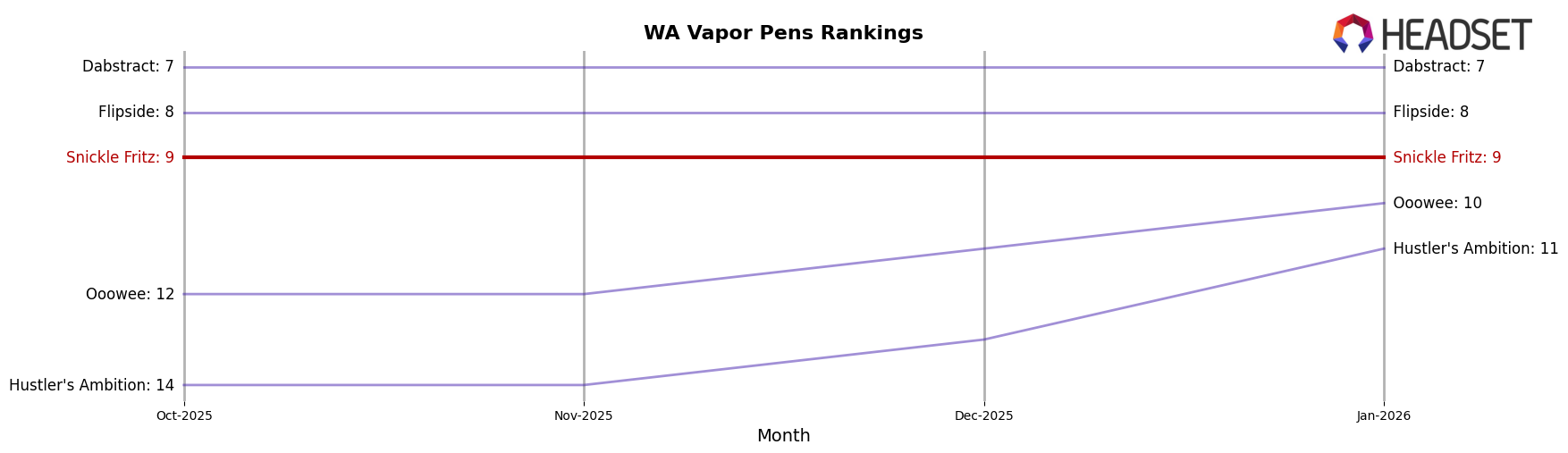

Snickle Fritz has maintained a consistent performance in the Vapor Pens category in Washington, consistently holding the 9th position from October 2025 through January 2026. This stability in ranking, despite fluctuations in sales, suggests that the brand has a strong foothold in this category. The consistency in ranking amidst varying sales figures could imply that while the competition is fierce, Snickle Fritz has managed to maintain its market share effectively. The brand’s ability to sustain its position in the Vapor Pens category highlights its resonance with consumers and suggests a solid strategy in place to maintain its standing in this competitive market.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Snickle Fritz consistently maintained its 9th place rank from October 2025 to January 2026. Despite stable rankings, Snickle Fritz experienced fluctuations in sales, with a notable increase from November to December 2025. This positions Snickle Fritz closely behind Flipside, which held a steady 8th rank and slightly higher sales figures. Meanwhile, Dabstract consistently outperformed both brands, maintaining a solid 7th rank with significantly higher sales. On the other hand, Ooowee showed an upward trajectory, moving from 12th to 10th place, potentially posing a future threat to Snickle Fritz's position. Hustler's Ambition also demonstrated growth, climbing from 14th to 11th place, indicating a competitive market where Snickle Fritz must strategize to maintain or improve its standing.

Notable Products

For January 2026, the top-performing product from Snickle Fritz is the Slurricane Distillate Cartridge (1g) in the Vapor Pens category, maintaining its number one rank consistently over the past four months with sales of 7,361 units. The Hawaiian Zkittlez Distillate Cartridge (1g) holds the second position, mirroring its high rank from October and December, though it experienced a slight drop in sales compared to previous months. The Lemon Cherry Gelato Distillate Cartridge (1g) remains stable at third place, showing a consistent ranking pattern since November 2025. Grape Goji Distillate Cartridge (1g) continues to secure the fourth position, maintaining a steady sales trajectory. Notably, the Pineapple Upside Down Cake Distillate Cartridge (1g) entered the rankings in December 2025 and holds the fifth spot in January 2026, indicating a solid market entry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.