Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

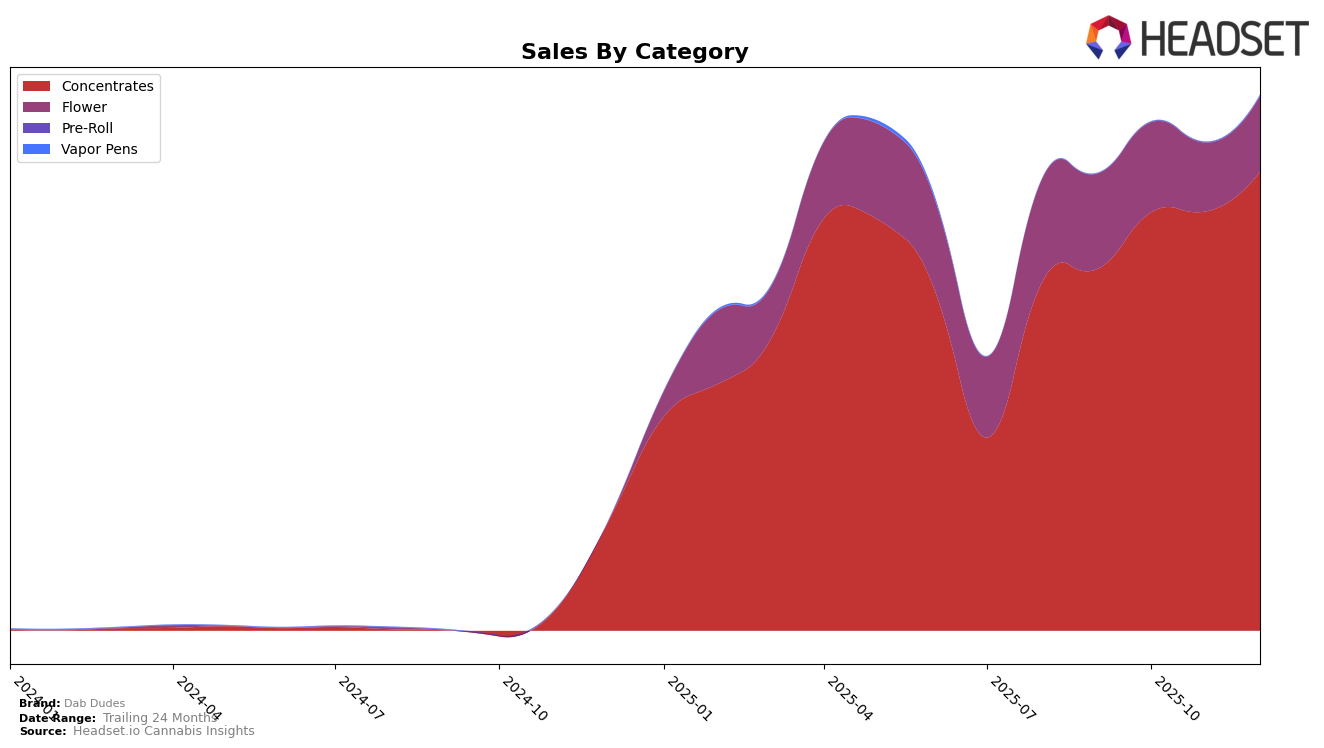

In the state of Washington, Dab Dudes has shown consistent performance in the Concentrates category. Over the last few months of 2025, the brand has maintained a position within the top 15, demonstrating a stable presence in the market. Starting in September at rank 14, Dab Dudes improved to rank 12 in October, before slipping back to 14 in November and then slightly recovering to 13 in December. This fluctuation suggests a competitive landscape, but the brand's ability to remain within the top 15 indicates solid consumer demand and effective market strategies. The upward trend in sales from October to December, culminating in a notable increase in December, reflects the brand's resilience and potential for further growth.

While Dab Dudes has maintained a steady ranking in Washington, it's noteworthy that the brand is absent from the top 30 in other states and categories, which could be a concern or an opportunity for market expansion. The absence from rankings in other regions might suggest a concentrated focus or limited distribution, which could either be a strategic choice or a limitation in market penetration. For stakeholders and potential investors, understanding the brand's performance across different states and categories could provide insights into potential areas for growth or necessary adjustments in strategy.

Competitive Landscape

In the Washington concentrates market, Dab Dudes has shown a steady performance with a slight improvement in rank from September to December 2025. Starting at 14th place in September, Dab Dudes climbed to 12th in October, before settling back to 13th by December. This indicates a consistent demand for their products, albeit with a competitive landscape. Notably, Snickle Fritz experienced a more volatile ranking, dropping from 8th in September to 13th in October, before recovering to 12th in December, suggesting fluctuating sales dynamics. Meanwhile, Tasty Terps maintained a stronger position, consistently ranking higher than Dab Dudes, despite a slight dip in December. Crystal Clear showed a similar pattern to Dab Dudes, indicating competitive parity. Interestingly, Hustler's Ambition made significant strides, moving from outside the top 20 in September to 15th by December, highlighting a potential emerging competitor. These dynamics suggest that while Dab Dudes maintains a stable market presence, there is a need to strategize against both established and emerging brands to enhance their market position further.

Notable Products

In December 2025, Dab Dudes' top-performing product was Orangutan Titties BHO Sugar Wax (1g) in the Concentrates category, maintaining its number one rank for four consecutive months, with an impressive sales figure of 4948. Blue Dream Wax (1g) secured the second position, recovering from a third-place ranking in November 2025. Wedding Cake Wax (1g) ranked third, experiencing a slight drop from its second position in November. Alaskan White Widow BHO Wax (1g) climbed to fourth place, showing a positive trend since its introduction in November. Grape Ape Wax (1g) rounded out the top five, slipping one spot from its previous fourth-place ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.