Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

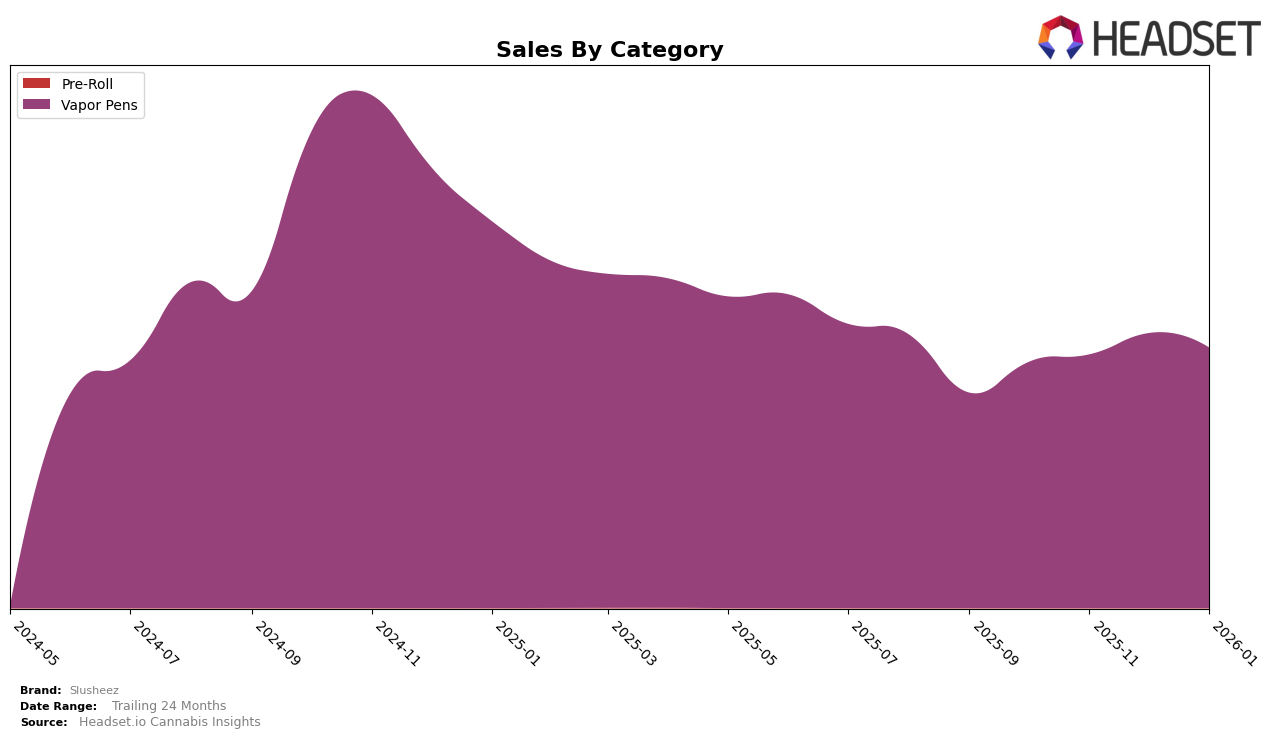

Slusheez has demonstrated a consistent performance in the Vapor Pens category within the Washington market. Over the span from October 2025 to January 2026, the brand maintained a steady presence, holding the 19th position for three consecutive months before climbing to 16th in January 2026. This upward movement suggests a positive reception and possibly increased consumer demand or improved distribution strategies. Despite a slight dip in sales from December to January, Slusheez's overall sales trend indicates a robust market presence, with sales peaking in December 2025.

However, it's important to note that Slusheez's visibility in other states and categories is limited, as they did not appear in the top 30 rankings outside of Washington for this period. This absence in the rankings could be seen as a challenge, highlighting potential areas for growth or expansion. The brand's concentrated performance in Washington might suggest a need to explore market penetration strategies in other regions or to diversify their product offerings to capture a broader audience. Understanding these dynamics can provide valuable insights into Slusheez's strategic positioning and future opportunities in the cannabis market.

Competitive Landscape

In the Washington Vapor Pens category, Slusheez has shown a notable upward trajectory in its rankings, moving from 19th place in October 2025 to 16th by January 2026. This positive shift indicates a strengthening market position, especially when compared to competitors like Forbidden Farms, which fluctuated between 22nd and 18th place during the same period. Meanwhile, Plume (WA) also experienced a rise, surpassing Slusheez in December 2025 but maintaining only a slight edge by January 2026. Lifted Cannabis Co held steady in the 13th and 14th positions, indicating a stable yet more dominant presence in the market. Slusheez's consistent sales growth, peaking in December 2025, suggests a robust demand for its products, positioning it well against competitors like Regulator, which saw a decline in both rank and sales over the same timeframe. This competitive landscape highlights Slusheez's potential for continued growth and increased market share in the Washington Vapor Pens sector.

Notable Products

In January 2026, the top-performing product for Slusheez was the Watermelon Wave Distillate Disposable (1g) in the Vapor Pens category, maintaining its consistent first-place ranking since October 2025 with sales of 1697 units. The Blue Razz Distillate Cartridge (1g) climbed to the second spot, showing an improvement from its fourth-place position in November 2025. Peach Ringz Distillate Disposable (1g) ranked third, having fluctuated in the rankings over the past months but consistently staying in the top five. Honey Dew High-Chew Distillate Disposable (1g) moved up to fourth place, indicating a steady increase in popularity. Meanwhile, Mango Punch Distillate Disposable (1g) re-entered the top five, securing fifth place despite not being ranked in the previous two months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.