Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

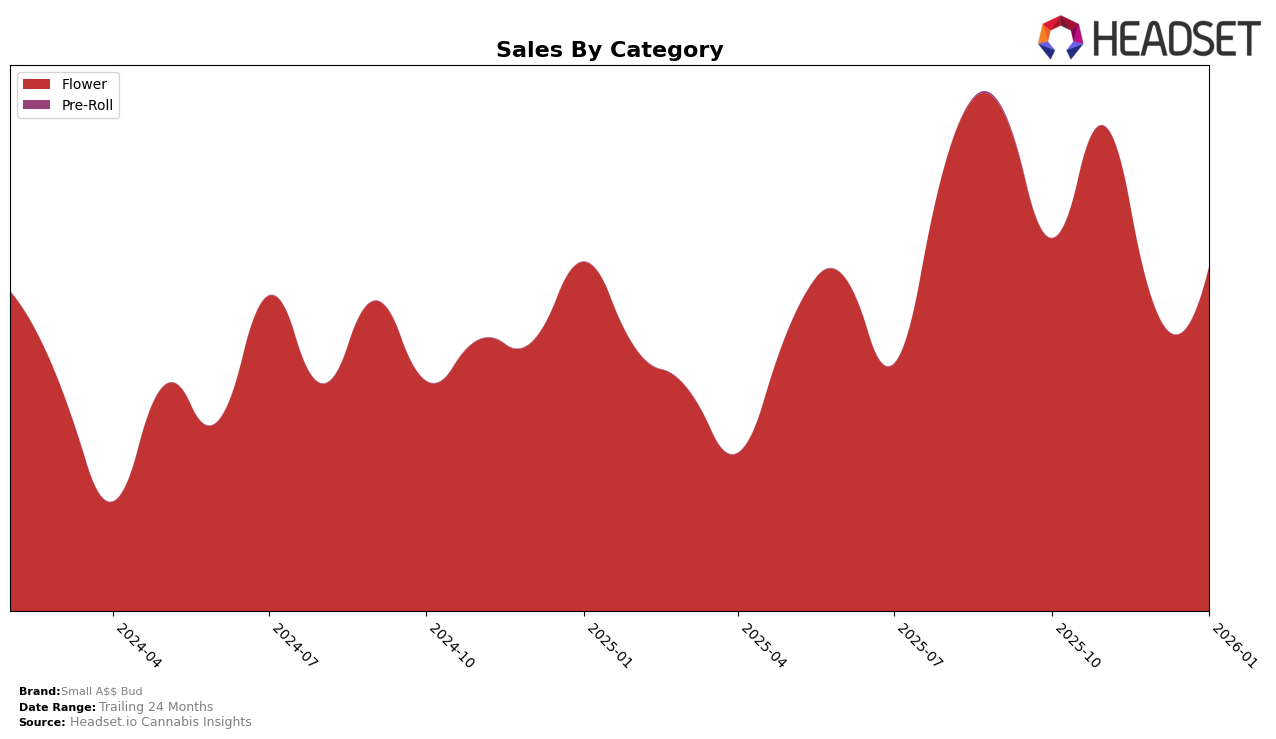

In the state of Maryland, Small A$$ Bud has shown a noteworthy trajectory in the Flower category. Starting with a rank of 28 in October 2025, the brand climbed to rank 20 by November, indicating a positive reception among consumers. However, a slight dip occurred in December as they fell to rank 27, before regaining some ground in January 2026 with a rank of 24. This fluctuation in rankings suggests a competitive market environment where Small A$$ Bud is making strides but also facing challenges. The sales figures reflect this dynamic, with a peak in November 2025, followed by a decrease in December, and a partial recovery in January.

Conversely, in New York, Small A$$ Bud did not make it into the top 30 rankings in the Flower category from November 2025 to January 2026, following an initial position of 78 in October. This absence from the rankings may indicate a tougher market penetration or stronger competition in New York, where consumer preferences might differ from those in Maryland. The initial sales figures in October were relatively modest, and the lack of subsequent ranking data suggests that the brand is struggling to establish a significant presence in this state. This contrast between states highlights the varying market dynamics and consumer preferences that Small A$$ Bud must navigate to enhance its performance across different regions.

Competitive Landscape

In the Maryland flower category, Small A$$ Bud has shown fluctuating performance in recent months, with its rank improving from 28th in October 2025 to 20th in November 2025, before dropping to 27th in December 2025 and slightly recovering to 24th in January 2026. This volatility in rank highlights the competitive nature of the market, with brands like Cookies and In House consistently ranking higher, despite some fluctuations of their own. Notably, BLVCK MRKT / BL^CK MRKT has maintained a relatively stable position, often outperforming Small A$$ Bud. Meanwhile, Happy Eddie has seen a decline, which could present an opportunity for Small A$$ Bud to capture some of its market share. Overall, while Small A$$ Bud's sales have shown resilience, particularly with a significant spike in November 2025, the brand faces stiff competition that requires strategic efforts to maintain and improve its market position.

Notable Products

In January 2026, the top-performing product from Small A$$ Bud was Lemon Berry Cookies Smalls (14g) in the Flower category, with sales reaching 366 units. Following closely, Chem x Chocolate (14g) secured the second position, while Glitter Bomb Smalls (14g) ranked third. Biker Kush (14g) improved its ranking from fifth in December 2025 to fourth in January 2026, maintaining stable sales figures with 241 units sold. McRuntz (14g) entered the top five, ranking fifth for the month. Notably, Lemon Berry Cookies Smalls (14g) and Chem x Chocolate (14g) were new entries to the top ranks, showcasing significant sales strength compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.