Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

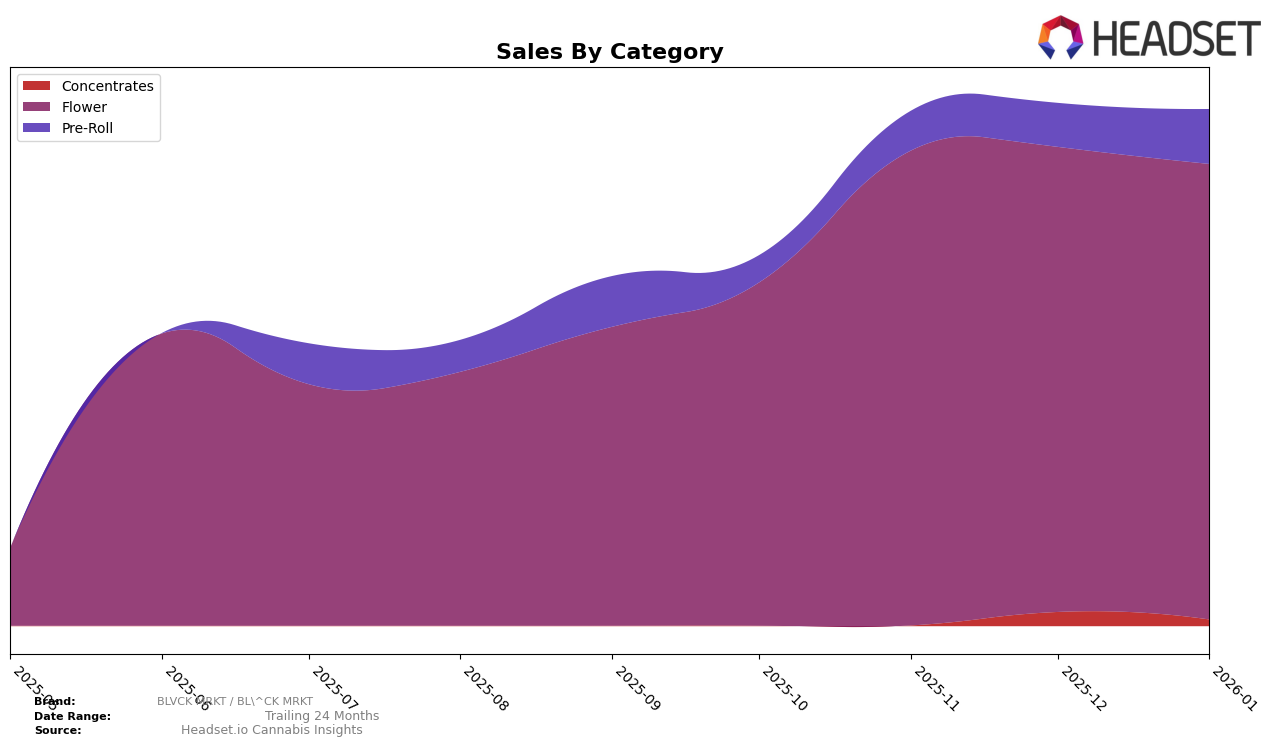

BLVCK MRKT / BL^CK MRKT has shown a noteworthy performance in the Maryland market, particularly in the Flower category. The brand climbed from the 29th position in October 2025 to 21st by November, maintaining a steady presence around the 22nd and 23rd spots in the following months. This consistent ranking indicates a solid foothold in the Flower category, with sales peaking in November 2025 before experiencing a gradual decline. In contrast, the brand's entry into the Concentrates category was less prominent, only breaking into the top 30 in January 2026, suggesting room for growth in this segment.

The Pre-Roll category saw a positive trajectory for BLVCK MRKT / BL^CK MRKT, moving from 42nd place in October 2025 to 33rd by January 2026 in Maryland. This upward trend highlights a growing consumer interest in their Pre-Roll offerings. While not yet in the top 30, the brand's steady climb suggests potential for further advancement if current trends continue. The absence of rankings in the Concentrates category for the earlier months could be seen as a challenge, but their eventual entry into the top 30 by January 2026 might indicate strategic shifts or product improvements that could bolster their future performance in this area.

Competitive Landscape

In the competitive landscape of the Maryland flower market, BLVCK MRKT / BL^CK MRKT has shown a notable improvement in its rank, moving from 29th in October 2025 to 23rd by January 2026. This upward trend in rank is indicative of a strategic positioning that has allowed the brand to surpass competitors like Cookies and In House, both of which have fluctuated in their rankings, with Cookies reaching as high as 21st and In House peaking at 22nd. Despite the competitive pressure, BLVCK MRKT / BL^CK MRKT's sales have remained relatively stable, showcasing resilience against brands like Savvy, which experienced a significant drop in sales from October 2025 to January 2026. This steady performance suggests that BLVCK MRKT / BL^CK MRKT is effectively capturing market share, potentially due to a strong brand presence or customer loyalty, positioning it well for continued growth in the Maryland flower category.

Notable Products

In January 2026, Murphyz Law (3.5g) maintained its position as the top-performing product for BLVCK MRKT / BL^CK MRKT, recording impressive sales of 4470 units. Black Runtz (3.5g) followed closely in second place, despite a slight decrease in sales compared to December 2025. Zagave (3.5g) emerged as a strong contender, securing the third spot, marking its debut in the rankings. Han Solo Burger (14g) and Han Solo (3.5g) rounded out the top five, with the former making its first appearance in the rankings. Notably, Murphyz Law (3.5g) has consistently held the top rank since December 2025, showcasing its sustained popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.