Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

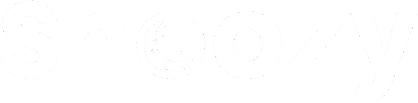

Snoozy has demonstrated a consistent performance in the Edible category within New York, maintaining a steady rank of 18th place from October 2025 through January 2026. This stability in ranking suggests a solid market presence and consumer loyalty within the state. Notably, the brand experienced a positive sales trend, with sales figures increasing from $205,425 in October to $248,626 in January. This upward movement in sales, despite a static rank, indicates a growing demand for Snoozy's products, which could be attributed to seasonal trends or successful marketing strategies.

However, the absence of Snoozy in the top 30 brands in other states or provinces highlights potential areas for growth or market entry. The brand's current focus on New York might suggest a strategic choice to consolidate its market share in a competitive environment before expanding further. This approach could be beneficial in reinforcing brand strength and optimizing resources. Observers and potential investors might find it intriguing to monitor how Snoozy leverages its New York success to explore opportunities in new markets or categories.

Competitive Landscape

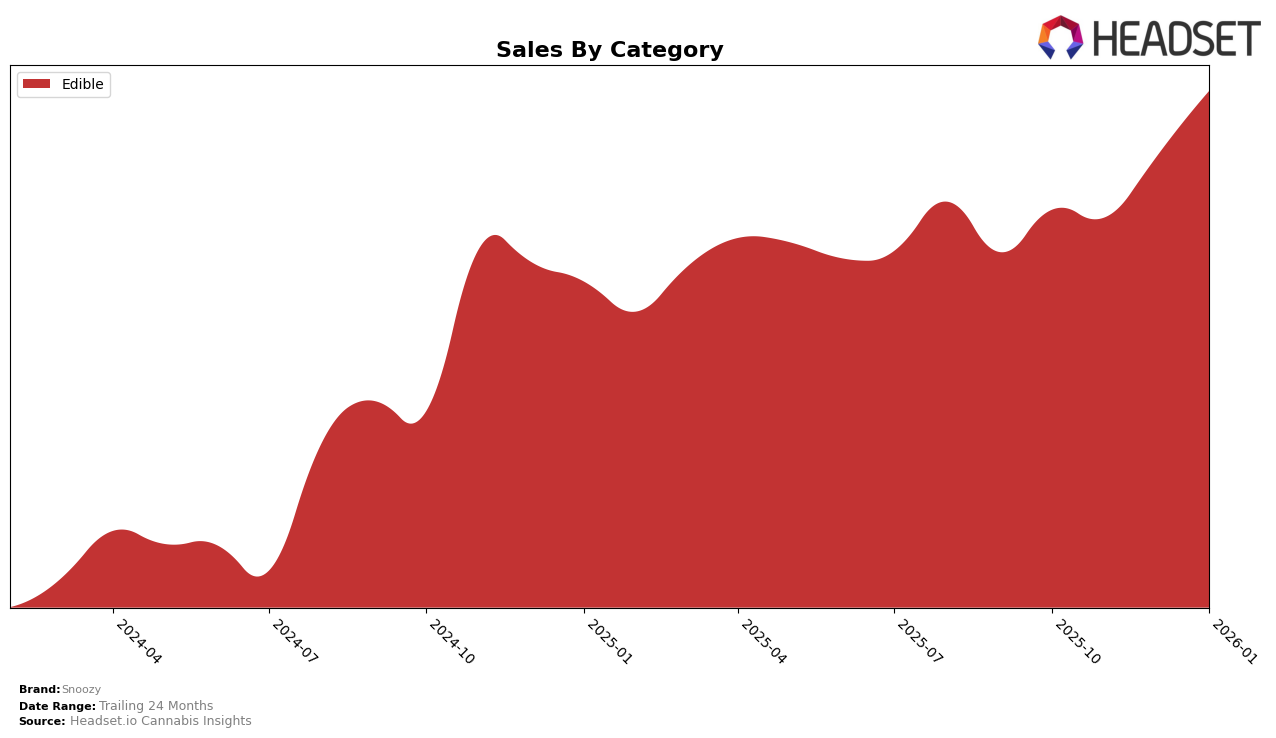

In the competitive landscape of the edible category in New York, Snoozy maintained a consistent rank of 18th from October 2025 through January 2026. This stability in rank is notable given the fluctuations observed among its competitors. For instance, Heavy Hitters consistently held a higher rank at 15th and 16th, with sales figures significantly surpassing Snoozy's, indicating a strong market presence. Meanwhile, Punch Extracts / Punch Edibles experienced a volatile ranking, dropping out of the top 20 in October 2025 and re-entering at 20th by January 2026, showing a dramatic sales increase during this period. Generic AF showed a positive trend, moving from 21st to 19th, suggesting a competitive threat to Snoozy's position. Despite these shifts, Snoozy's steady rank indicates resilience, although it may need to strategize to improve its sales growth and compete with brands like Foy, which consistently outperformed Snoozy in both rank and sales.

Notable Products

In January 2026, Snoozy's top-performing product was the CBD/THC 4:1 Free Mind Strawberry Gummies 20-Pack, which maintained its number one rank for four consecutive months, achieving sales of 2517 units. The Sleep with Benefits - CBD/THC/CBN 1:1:1 Raspberry Flavored Bedtime Gummies 20-Pack held the second position, showing a consistent climb from third place in the previous months. The CBD/THC/CBN 10:10:5 Raspberry Flavored Bedtime Chews 20-Pack ranked third, dropping from its initial top position in October 2025. The CBD/CBG/THC 1:1:1 New Morning Highs Orange Flavored Daytime Gummies 20-Pack and the CBD/THC 4:1 Love is All You Need Peach Flavored Intimacy Gummies maintained their fourth and fifth positions, respectively, throughout the months leading up to January 2026. This stability in rankings indicates a strong consumer preference for Snoozy's edible product line.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.