Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

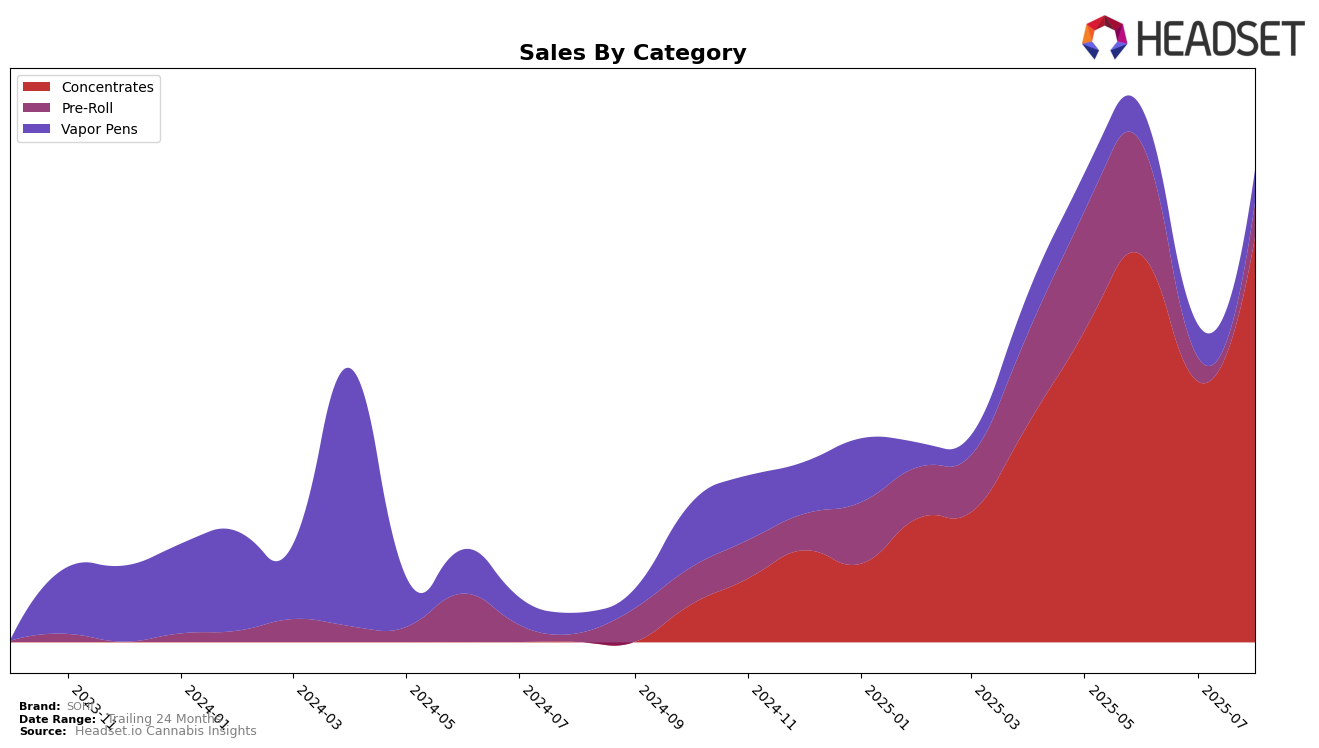

SOHI's performance in the Michigan market has shown some interesting fluctuations over the past few months, particularly in the Concentrates category. In May 2025, SOHI was ranked 29th, but saw a notable improvement in June, climbing to the 23rd position. However, they fell out of the top 30 in July, only to rebound to the 25th spot in August. This pattern suggests that while SOHI has the potential to capture a larger market share, there may be underlying challenges affecting their consistency. The brand's peak performance in June was accompanied by an increase in sales, which indicates a positive consumer response during that period.

It's worth noting that SOHI's absence from the top 30 in July could be seen as a setback, potentially due to increased competition or market dynamics that favored other brands. However, their ability to regain a position within the top 30 by August indicates resilience and adaptability. The fluctuations in their ranking highlight the competitive nature of the Concentrates category in Michigan and underscore the importance of strategic positioning and marketing efforts to maintain a strong presence. Observing these movements can provide insights into how SOHI might adjust their strategies to improve stability and growth in the future.

Competitive Landscape

In the competitive landscape of Michigan's concentrates category, SOHI has shown a dynamic shift in its market position over the summer of 2025. Starting at rank 29 in May, SOHI improved to 23rd in June, although it faced a setback in July, dropping to 34th, before rebounding to 25th in August. This fluctuation highlights a volatile market presence, yet the August recovery suggests resilience and potential for growth. In comparison, Rise (MI) and Traphouse Cannabis Co. experienced a downward trend, with Traphouse Cannabis Co. falling from 10th to 24th place by August, indicating a significant decline in market traction. Meanwhile, Distro 10 showed a remarkable climb from 59th to 27th, suggesting an aggressive market strategy that could pose a competitive threat. SOHI's ability to regain its rank in August, despite the competitive pressure, underscores its potential to stabilize and enhance its market share in the coming months.

Notable Products

In August 2025, Royal Highness Live Resin Sugar & Sauce (1g) emerged as the top-performing product for SOHI, climbing to the number one spot with sales of 4,489 units. Purple Punch Live Resin Sugar & Sauce (1g) made a significant leap to second place, up from fifth in July, with notable sales growth. Northern Lights Live Resin Sugar & Sauce (1g) slipped to third place, maintaining strong sales performance. Sour Diesel Live Resin Sugar & Sauce (1g) entered the top five at fourth place, showcasing strong market entry. OG Kush Live Resin Sugar & Sauce (1g) rounded out the top five, dropping from third place in July, yet still maintaining robust sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.