Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

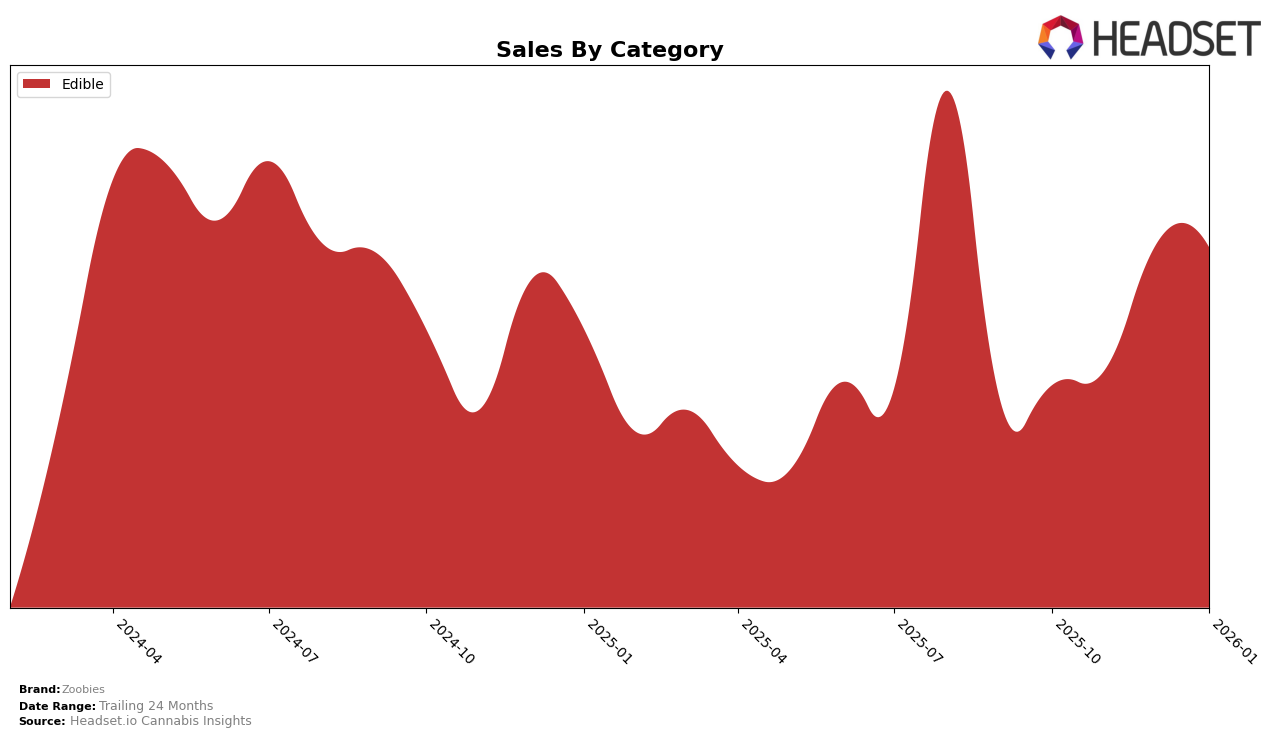

Zoobies has shown varied performance across different states and categories in recent months. In the Colorado edible market, Zoobies maintained a fairly stable presence, hovering around the lower end of the top 30 brands. Despite a slight dip to the 27th position in November 2025, the brand regained momentum, climbing back to 22nd by January 2026. This indicates a consistent demand for their edible products, with sales figures reflecting a general upward trend, peaking in December 2025. However, the fact that Zoobies never broke into the top 20 suggests there is still room for growth and potential market share expansion in Colorado.

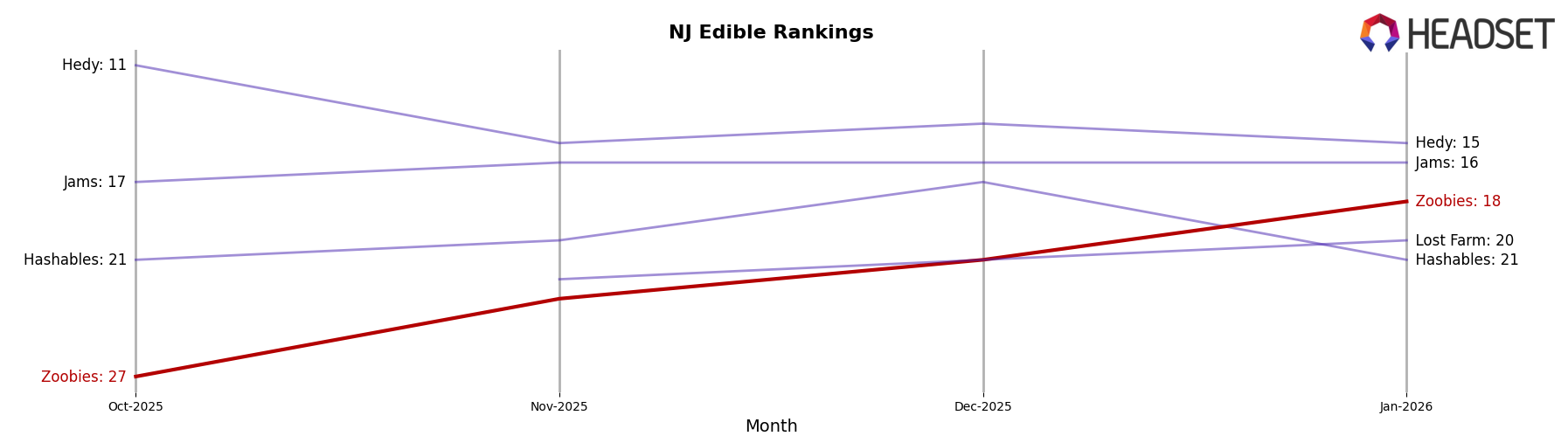

In contrast, Zoobies has experienced a more pronounced positive trajectory in the New Jersey edible market. Starting from the 27th position in October 2025, Zoobies improved its ranking significantly, reaching the 18th spot by January 2026. This upward movement is accompanied by a notable increase in sales, particularly from October to November 2025. The consistent climb in rankings suggests that Zoobies is gaining stronger traction and consumer acceptance in New Jersey, highlighting a successful strategy or product appeal in this market. However, the brand's absence from the top 10 indicates there is still a competitive landscape to navigate.

Competitive Landscape

In the competitive landscape of the edible cannabis category in New Jersey, Zoobies has shown a promising upward trajectory in its rankings, moving from 27th place in October 2025 to 18th by January 2026. This improvement in rank is indicative of Zoobies' growing market presence, as it has managed to surpass brands like Hashables, which fluctuated between the 17th and 21st positions during the same period. Meanwhile, Hedy maintained a stronger position, consistently ranking in the top 15, although its sales showed a declining trend. Jams remained stable at 16th place, suggesting steady performance. Lost Farm experienced inconsistency, missing from the top 20 in December 2025 but reappearing in January 2026. Zoobies' consistent rise in rank and sales, despite the competitive pressures, highlights its potential to capture a larger market share in the coming months.

Notable Products

In January 2026, the top-performing product for Zoobies was the Hybrid Mixed Fruit RSO Gummies 10-Pack (100mg), which climbed to the first position with sales reaching 4360 units. The Indica Sour Fruit Gummies 10-Pack (100mg) dropped to second place, despite a strong showing in previous months. Mixed Fruit Gummies (100mg) maintained a steady third place from December 2025 to January 2026. Sativa Mixed Fruit RSO Gummies 10-Pack (100mg) held its rank at fourth, showing a gradual increase in sales over the months. The Indica Mixed Fruit RSO Gummies 10-Pack (100mg) remained consistent in fifth place, showing a modest sales increase since December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.