Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

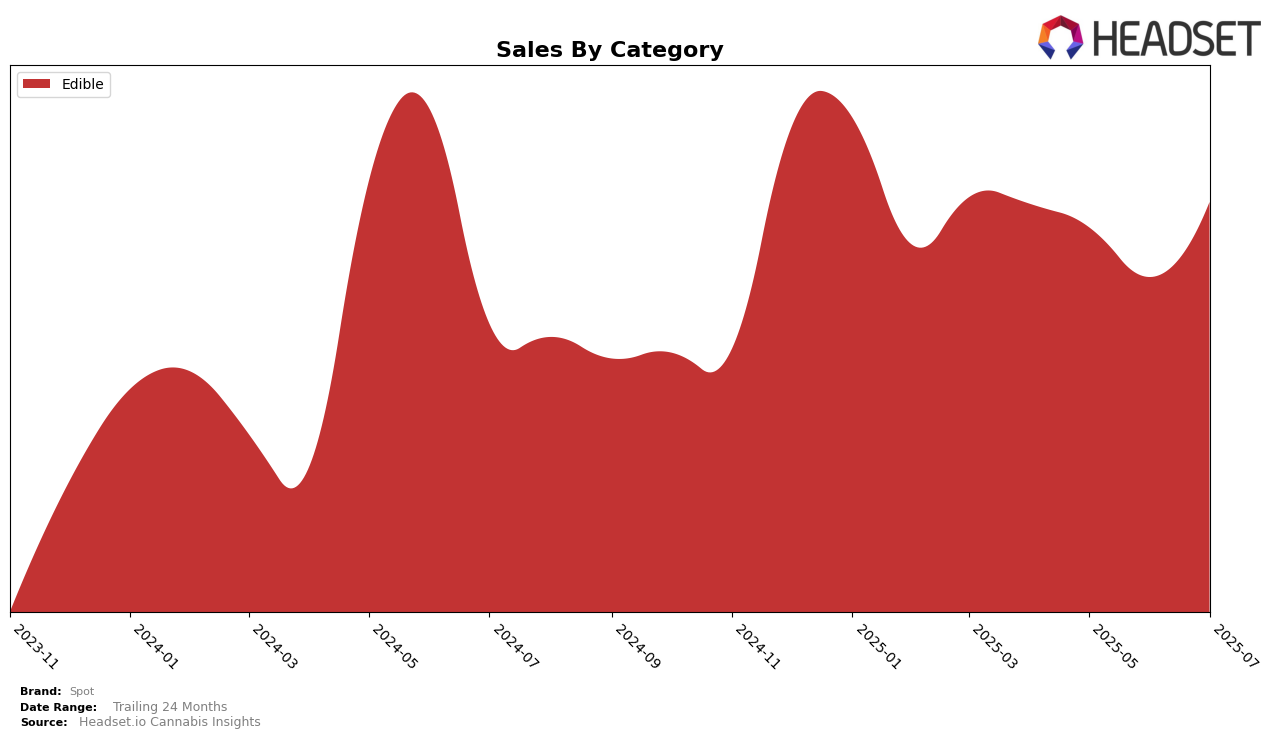

Spot has shown notable performance in the Edible category across different regions, with particularly interesting movements in Ontario. After hovering just outside the top 30 for three consecutive months, Spot finally broke into the rankings in July 2025, securing the 28th position. This upward trajectory in Ontario indicates a positive reception to their product offerings, despite a dip in sales in May and June. The resurgence in July sales, reaching $12,486, suggests a recovery and potential growth in consumer interest.

While Spot's entry into the top 30 in Ontario is a positive development, it's important to note that the brand's absence from the top 30 in other states or provinces could imply room for improvement or strategic adjustments. Being outside the top 30 in other regions might mean Spot is facing stiff competition or market challenges that need addressing. This mixed performance highlights the varying dynamics Spot encounters in different markets, offering insights into where the brand could focus its efforts to enhance its standing across the board.

Competitive Landscape

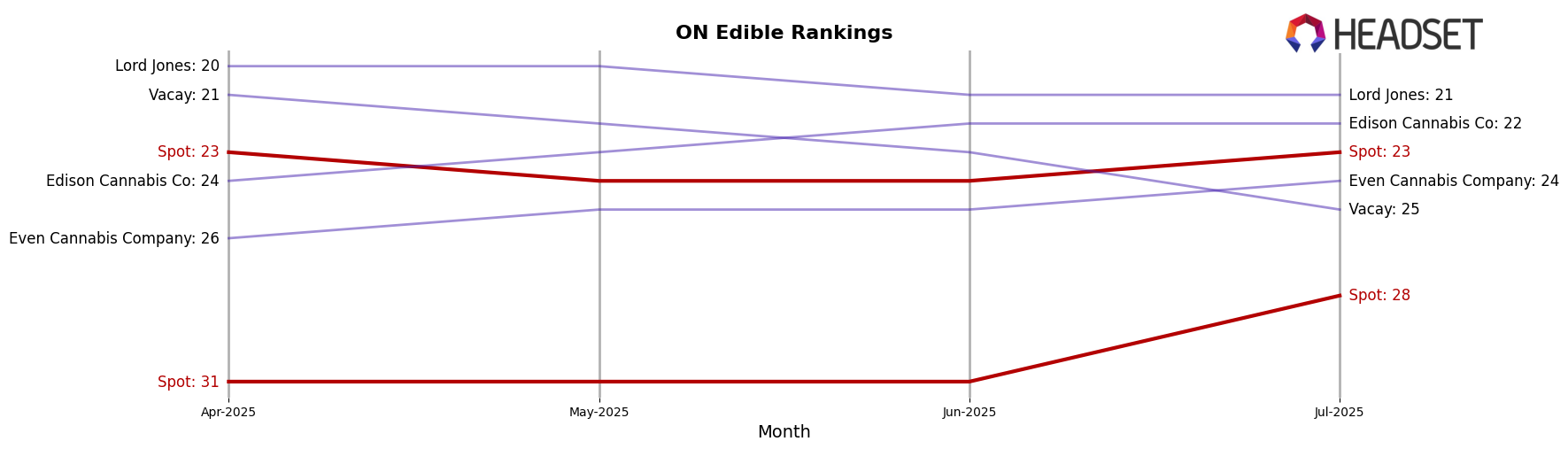

In the Ontario edible market, Spot has consistently ranked just outside the top 20 from April to July 2025, maintaining a rank of 23rd or 24th. This stability suggests a steady presence, although it trails behind competitors like Lord Jones, which consistently ranks around 20th and has significantly higher sales figures. Meanwhile, Edison Cannabis Co has shown a positive trend, improving its rank from 24th in April to 22nd by July, with sales also on the rise. In contrast, Vacay has seen a decline, dropping from 21st to 25th, indicating potential challenges. Spot's sales have fluctuated slightly, with a notable dip in June, but they remain relatively stable overall. This competitive landscape highlights the need for Spot to innovate or enhance its offerings to climb into the top 20 and compete more effectively with brands like Lord Jones and Edison Cannabis Co.

Notable Products

In July 2025, the top-performing product for Spot was Tropical Berry Blast Soft Chew (10mg) in the Edible category, maintaining its first-place rank from previous months with sales reaching 3071 units. The CBN/THC 4:1 Hybrid Raspberry Chews 2-Pack (40mg CBN, 10mg THC) consistently held the second position throughout the months. The CBD/THC 4:1 Sour Pomegranate Soft Chews 2-Pack (40mg CBD, 10mg THC) climbed up to the third position from fourth in the previous two months. Meanwhile, the CBG:THC 1:1 Sour Watermelon Chews 2-Pack (10mg CBG, 10mg THC) maintained its third-place rank from June. These rankings highlight a stable performance for Spot's edible products, with slight shifts in consumer preferences within the top tier.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.