Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

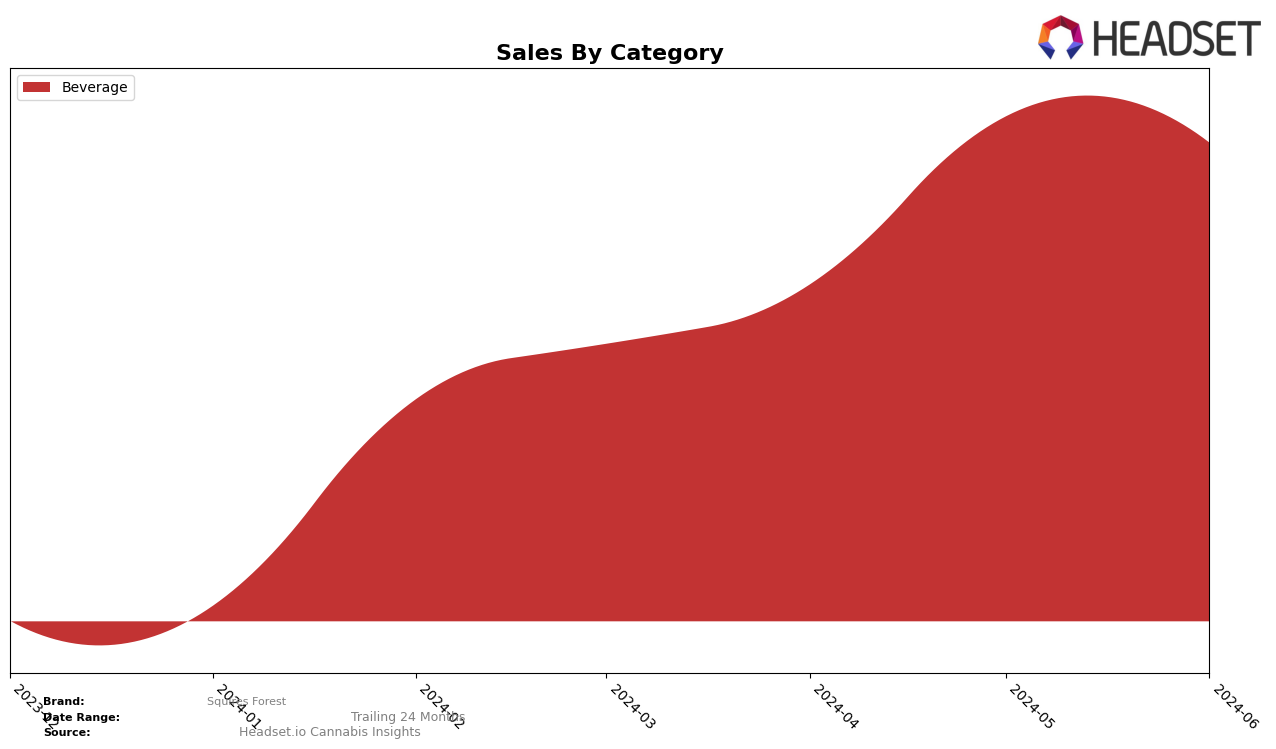

Squires Forest has shown a consistent presence in the Beverage category in Massachusetts. Over the past four months, the brand has maintained a ranking within the top 20, starting at 17th place in both March and April, improving to 15th in May, and slightly dipping to 16th in June. This steady performance indicates a strong foothold in the Massachusetts market, with a notable peak in sales during May, where they saw a significant increase to 32,828 units sold. The slight decline in June does not overshadow the overall upward trend observed in the spring months.

While Squires Forest has managed to stay competitive in Massachusetts, their absence from the top 30 rankings in other states and categories could be a point of concern. This lack of presence suggests potential areas for growth and expansion. The brand's ability to improve its rankings within Massachusetts demonstrates a robust market strategy that could be replicated in other regions. However, the challenge remains to break into these new markets and categories to diversify their influence and reduce dependency on a single state. Monitoring future performance will be crucial to understanding whether Squires Forest can leverage its current success to achieve broader market penetration.

Competitive Landscape

In the Massachusetts cannabis beverage market, Squires Forest has experienced notable fluctuations in its rank and sales over the past few months. Despite a steady position at rank 17 in March and April 2024, Squires Forest improved to rank 15 in May before slightly declining to rank 16 in June. This trend indicates a competitive but volatile market landscape. Competitors like High Tide and Wynk have shown varied performances, with High Tide dropping out of the top 20 in June and Wynk experiencing a significant decline from rank 14 in March to rank 18 in June. Meanwhile, Sip and Nectar have maintained relatively stable positions, with Nectar consistently ranking higher than Squires Forest. These dynamics suggest that while Squires Forest is gaining traction, it faces stiff competition from more established brands, necessitating strategic marketing and product differentiation to climb higher in the rankings and boost sales.

Notable Products

In June 2024, the top-performing product from Squires Forest was Raspberry Lime Hash Rosin Elixir (100mg), which maintained its first-place ranking from the previous month with notable sales of 511 units. Blueberry Lemon Hash Rosin Elixir (100mg) secured the second spot, climbing from its third-place position in May 2024. Blueberry Lemon Hash Rosin Elixir (10mg) showed a consistent performance, ranking third in June 2024, up from fourth place in May. Mandarin Mango Hash Rosin Elixir (100mg) experienced a drop, falling to fourth place from its previous top position in May 2024. Finally, Mandarin Mango Hash Rosin Elixir (10mg) remained steady in fifth place, showing a slight increase in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.