Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

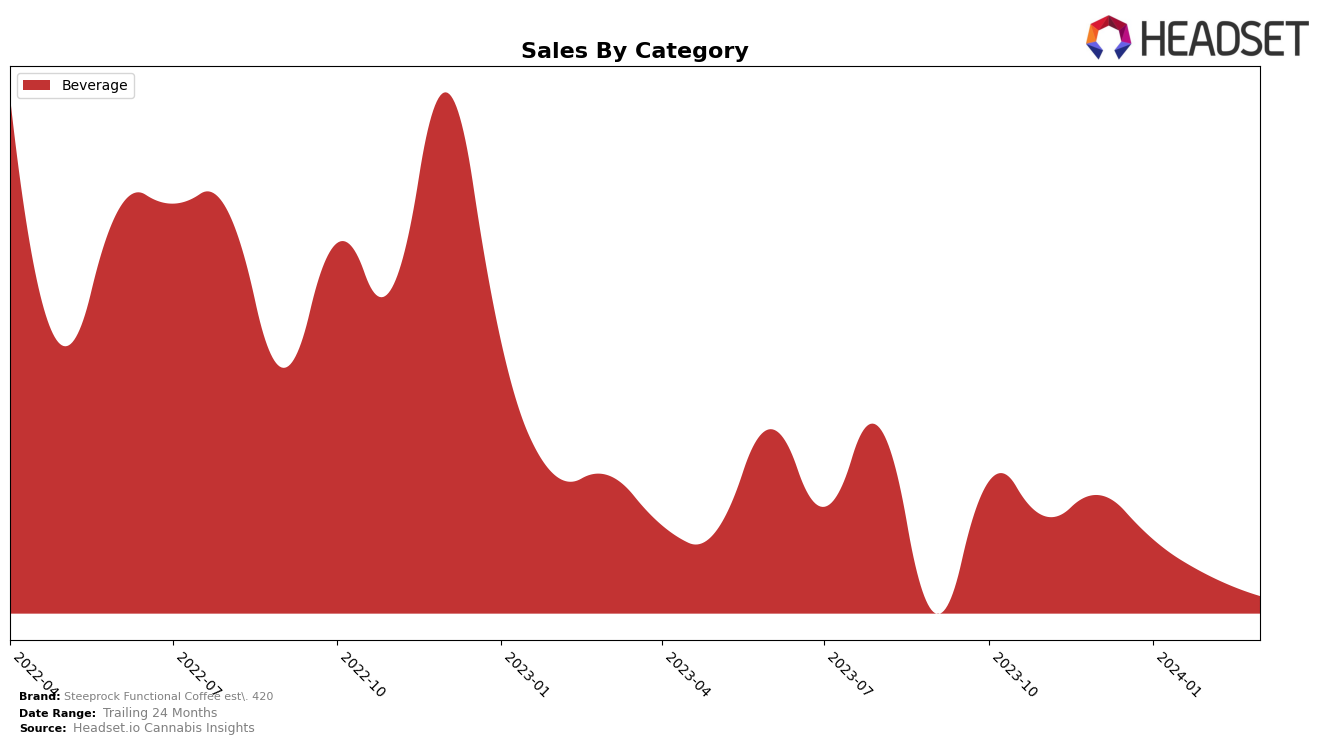

In the competitive cannabis market of Ontario, Steeprock Functional Coffee est. 420 has shown a consistent presence in the beverage category, albeit with a slight downward trend in rankings from December 2023 to March 2024, moving from rank 49 to 48. This movement indicates a struggle to climb the ranks against competitors, despite being within the top 50 brands. The sales figures reflect a declining trend as well, with December 2023 sales at 2777 units dropping to 1389 units by March 2024. This decline in both rank and sales suggests that the brand may need to reassess its market strategies or product offerings to bolster its position in Ontario's cannabis market.

Conversely, in Saskatchewan, Steeprock Functional Coffee est. 420 was not ranked in December 2023, which could be viewed negatively as it indicates the brand was not among the top 30 in the beverage category at that time. However, it made a notable entrance in January 2024 at rank 26 and managed to improve its position to rank 22 in February before slipping back to rank 26 in March. This fluctuation in rankings, coupled with a significant drop in sales from February to March (from 377 units to 194 units), suggests a volatile market presence in Saskatchewan. The initial entry and subsequent ranking improvements could indicate a growing interest or a successful marketing push, but the brand will need to address the challenges to maintain and improve its market position further.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, Steeprock Functional Coffee est. 420 has shown a notable performance amidst its competitors. Despite fluctuating ranks from December 2023 to March 2024, moving from 49th to 48th place, it has maintained a consistent presence in the market. Notably, its sales trajectory, while experiencing a dip in January 2024, saw a gradual recovery in the following months, indicating resilience and a steady consumer base. Competitors such as Everie, The Green Organic Dutchman, Nuveev, and Bedfellows Liquid Arts have also experienced shifts in their ranks and sales, with Everie and The Green Organic Dutchman showing a decrease in rank over the same period. This competitive analysis highlights the dynamic nature of the beverage market in Ontario, with Steeprock Functional Coffee est. 420 demonstrating a competitive edge through its ability to maintain and slightly improve its market position amidst these fluctuations.

Notable Products

In March 2024, Steeprock Functional Coffee est. 420 saw THC Coffee Pods 2-Pack (10mg) leading its sales with 100 units sold, marking its rise to the top from the previous months where it was ranked second. Following closely, CBD:THC 5:1 Est. 420 Coffee Pods 2-Pack (50mg CBD, 10mg THC) secured the second position, maintaining a consistent performance from the preceding months. Hash Rosin Hot Chocolate Pods 2-Pack (10mg), previously a top seller, experienced a significant drop in sales, landing it in third place with only 28 units sold. This shift highlights a change in consumer preference within the beverage category. The sales figures and rankings indicate a dynamic market, with THC Coffee Pods 2-Pack (10mg) emerging as the most preferred product by the end of March 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.