Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

In the state of Massachusetts, Stingers has shown a promising upward trajectory in the Pre-Roll category. Although they were not in the top 30 brands in November 2025, by February 2026, they climbed to the 62nd spot, indicating a positive trend in consumer acceptance. This progression is underscored by a steady increase in sales from $69,217 in November to $96,533 in February. However, in the Vapor Pens category, Stingers only appeared in the rankings in February 2026, debuting at 87th place. This suggests that while their Pre-Roll products are gaining traction, there might be opportunities to strengthen their presence in the Vapor Pens market in Massachusetts.

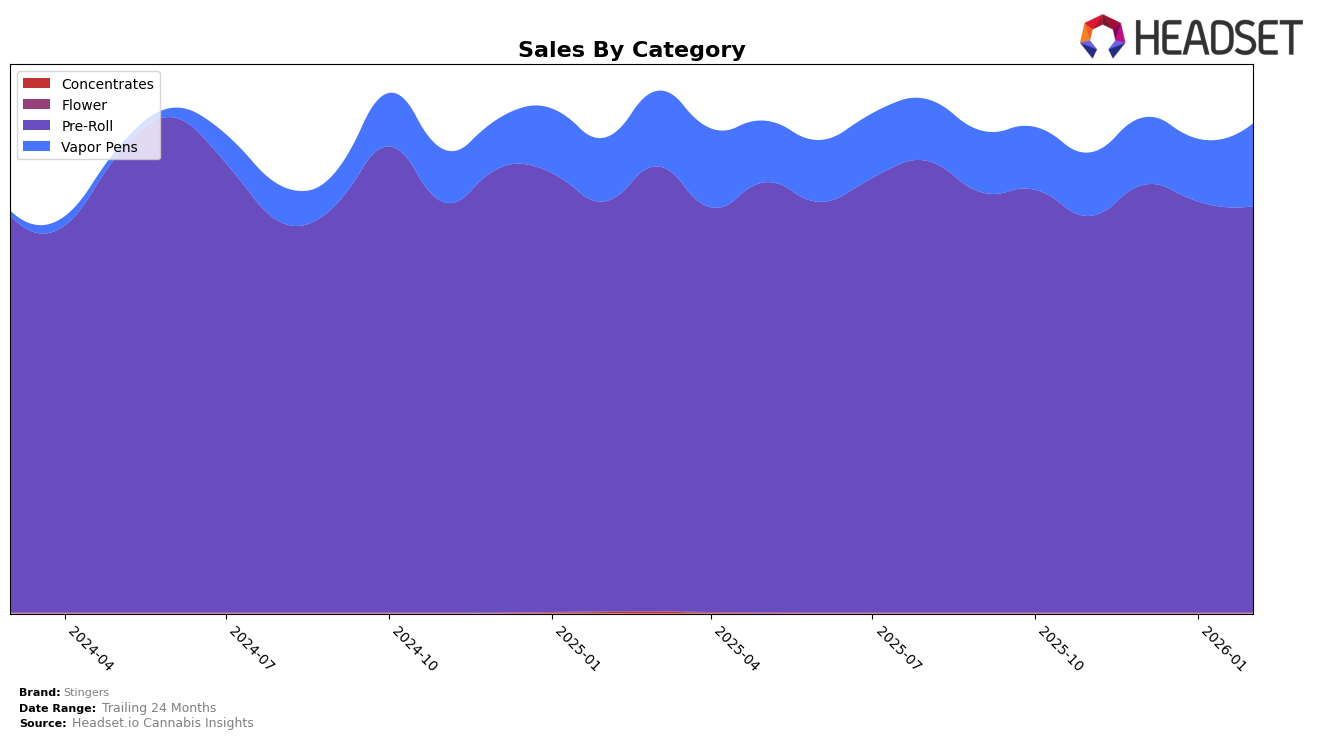

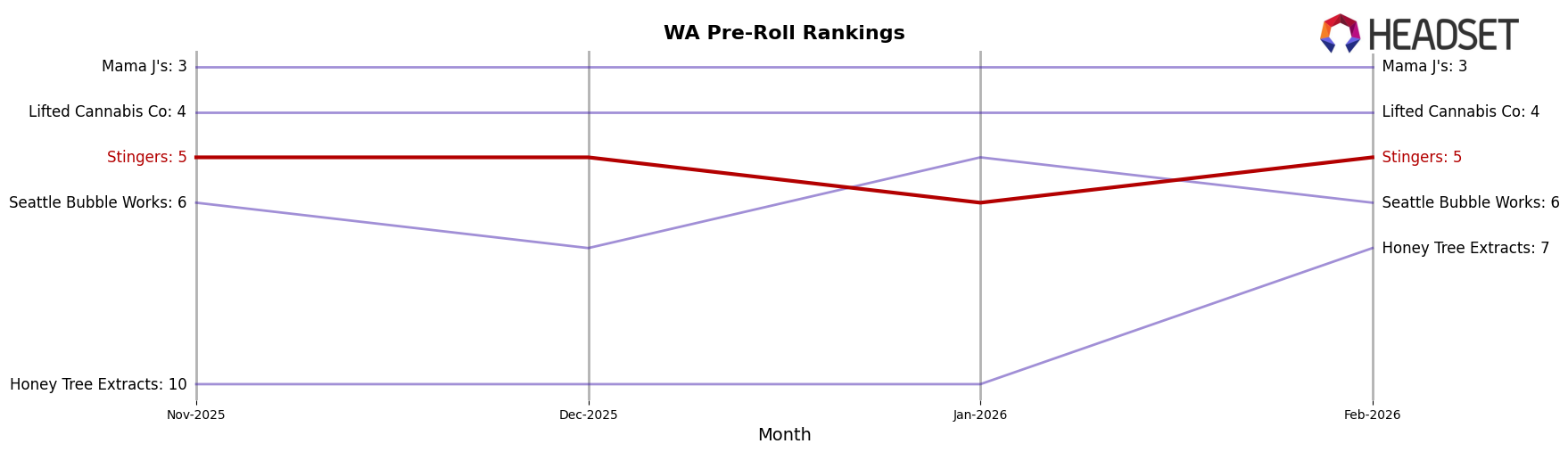

Meanwhile, in Washington, Stingers has maintained a strong position in the Pre-Roll category, consistently ranking within the top 10. Despite a slight dip in January, where they moved to 6th place, they quickly regained their 5th position by February 2026. This stability highlights their strong foothold in the Washington Pre-Roll market. However, their performance in the Vapor Pens category has been less stable, with rankings fluctuating between 54th and 60th place over the months. This suggests that while Stingers has a solid reputation with Pre-Rolls, there may be room for improvement in their Vapor Pens offerings to capture a larger market share in Washington.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Washington, Stingers has demonstrated a resilient performance, maintaining a stable rank between 5th and 6th place from November 2025 to February 2026. Despite a slight dip in January 2026, where Stingers fell to 6th place, the brand quickly rebounded to 5th place in February 2026. This fluctuation is notable as it highlights Stingers' ability to recover amidst a competitive market. In comparison, Seattle Bubble Works experienced a similar rank fluctuation, while Lifted Cannabis Co and Mama J's consistently held higher positions at 4th and 3rd respectively. Meanwhile, Honey Tree Extracts showed a significant improvement, moving from 10th to 7th place by February 2026. These dynamics suggest that while Stingers is holding its ground, there is an opportunity for strategic initiatives to enhance its market position against rising competitors like Honey Tree Extracts.

Notable Products

In February 2026, the top-performing product for Stingers was the 9lb Hammer Infused Pre-Roll 2-Pack (1g) in the Pre-Roll category, reclaiming its position as the number one product with sales of 1998 units. This product consistently held the top rank from November 2025 through December 2025, briefly slipping to second place in January 2026. The Dutch Haze Infused Pre-Roll 2-Pack (1g) debuted in February 2026 at the second rank, indicating strong initial performance. Pineapple Express Infused Pre-Roll (1g) and Grape Ape Infused Pre-Roll (1g) followed closely, holding the third and fourth ranks respectively, showing a solid entrance into the market. The Super Stinger - Granddaddy Purple Infused Pre-Roll 2-Pack (1g) dropped to fifth place after being consistently second in the months of November and December 2025, suggesting a shift in consumer preference or increased competition.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.