Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

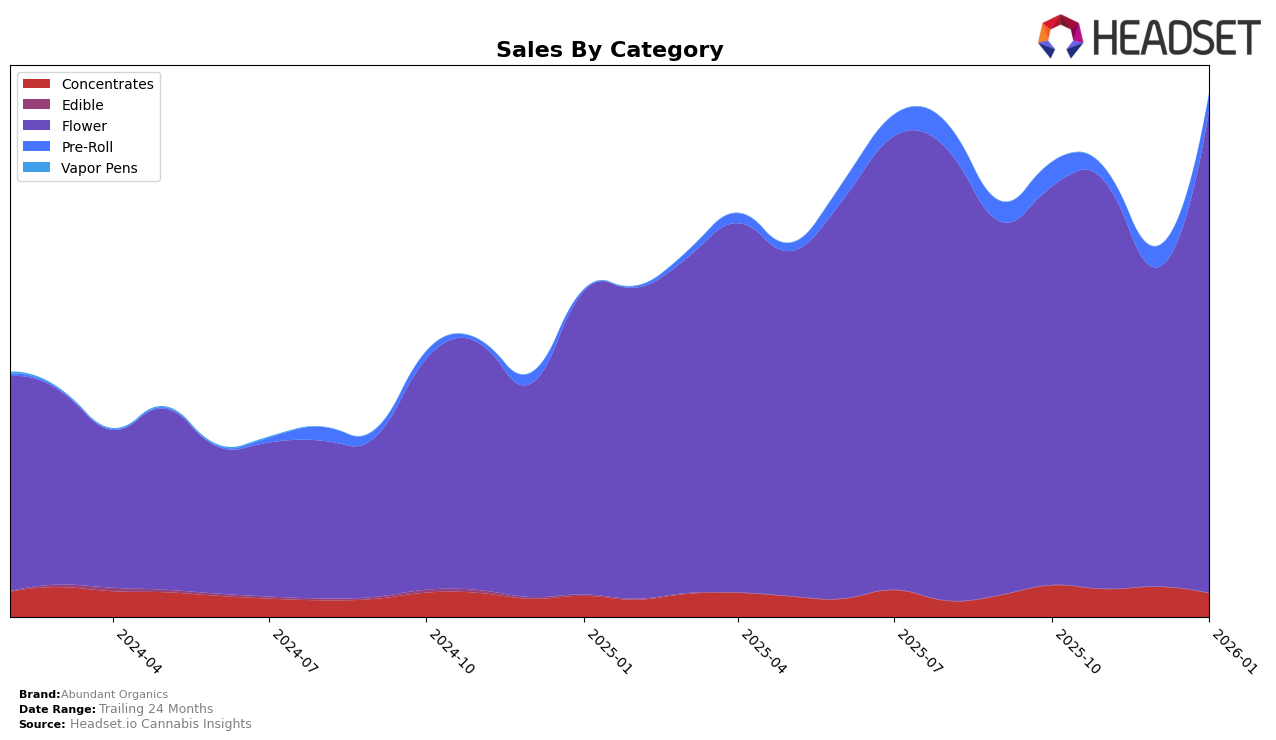

Abundant Organics has shown a varied performance across different categories in Arizona. In the Concentrates category, the brand has maintained a presence within the top 30, although its ranking has fluctuated slightly, moving from 17th in October 2025 to 20th by January 2026. This indicates a slight decline in market position despite consistent sales figures. Meanwhile, in the Flower category, Abundant Organics demonstrated notable resilience and growth, improving its rank from 8th in October to 7th in January, with December witnessing a temporary dip to 15th. This upward trend in the Flower category suggests a robust demand and effective market strategy, especially given the significant sales increase in January 2026.

Conversely, the Pre-Roll category presents a challenge for Abundant Organics in Arizona. The brand did not secure a spot within the top 30 rankings across the months from October 2025 to January 2026, indicating a need for strategic improvements in this category. The sales figures reflect a fluctuating pattern, with a noticeable drop in November, followed by a partial recovery in December, yet remaining below the top tier. This suggests that while the brand is performing well in some areas, there are opportunities for growth and improvement in others, particularly in the Pre-Roll segment, where market presence could be strengthened.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, Abundant Organics has experienced notable fluctuations in its market position over the past few months. Starting in October 2025, Abundant Organics was ranked 8th, maintaining this position in November before dropping to 15th in December, and then rebounding to 7th by January 2026. This volatility contrasts with the more stable performance of competitors like Fade Co., which consistently ranked between 6th and 8th, and Curaleaf, which held steady around the 9th position. Meanwhile, Dr. Greenthumb's showed a strong performance, peaking at 6th place in January. The most striking rise came from Fenix, which surged from 20th in October to 5th by January, indicating a significant upward trend in sales. These dynamics suggest that while Abundant Organics managed to recover its rank by January, it faces stiff competition, particularly from brands like Fenix that are rapidly gaining market share.

Notable Products

In January 2026, the top-performing product from Abundant Organics was Black Dog Pre-Roll (1g) in the Pre-Roll category, achieving the highest sales with 1598 units sold. Viennetta Pre-Roll (1g) also performed strongly, securing the second position with notable sales figures. Kush Sorbet (14g) in the Flower category ranked third, indicating strong demand for larger quantity products. Funk Ready (14g) experienced a slight decline from second place in December 2025 to fourth in January 2026, showing a shift in consumer preference. On Point (14g) entered the top five for the first time, demonstrating a growing interest in this product category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.