Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

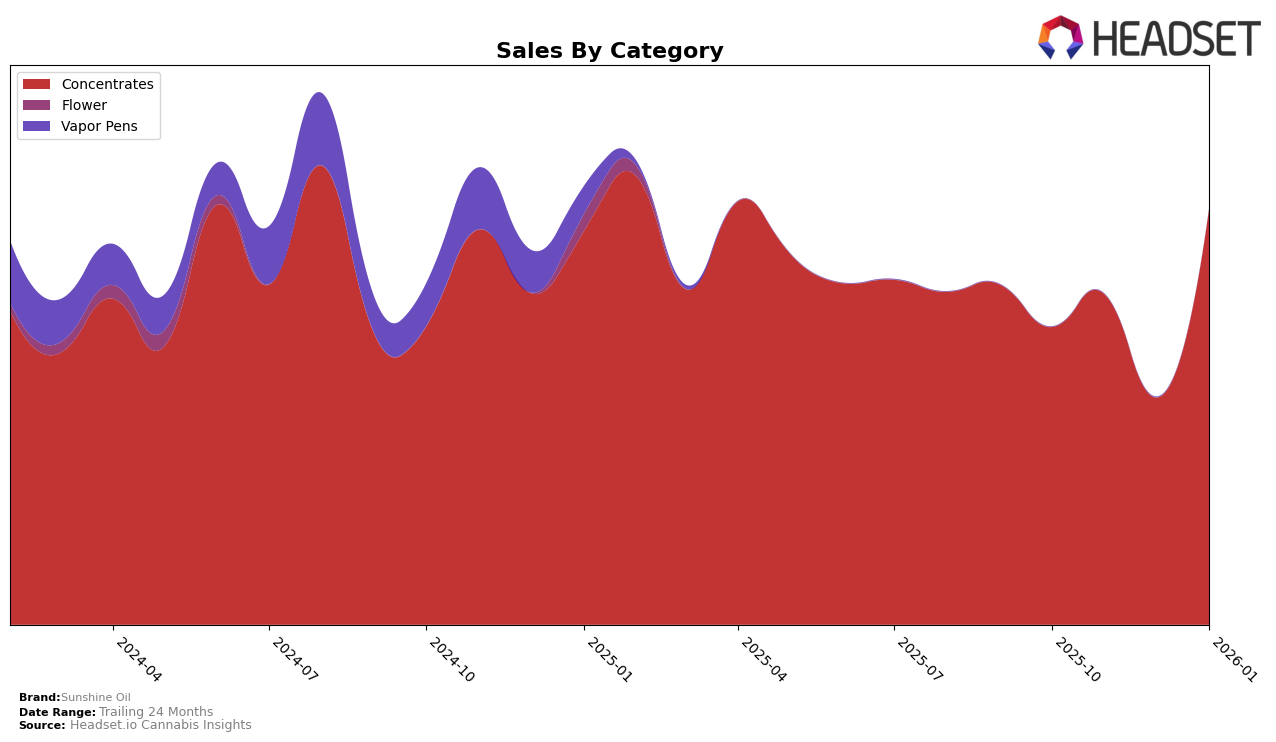

Sunshine Oil has demonstrated notable fluctuations across different categories and states, with its performance in the Concentrates category in Oregon being particularly interesting. From October 2025 to January 2026, the brand's rank in Oregon's Concentrates category improved significantly, moving from 19th to 15th place. This upward trend suggests a growing consumer preference or effective market strategies, as evidenced by the increase in sales from $97,743 in October to $137,216 in January. However, the dip in December to 25th place is a point of concern, indicating potential volatility or seasonal challenges that the brand may need to address.

Despite these improvements in Oregon, Sunshine Oil's absence from the top 30 rankings in other states and categories during the same period raises questions about its market penetration and brand recognition outside of its stronghold. This absence could be seen as a missed opportunity for Sunshine Oil to diversify its market presence and capitalize on emerging trends in other regions. The brand's concentrated success in Oregon suggests a need for strategic expansion and adaptation to different market dynamics if it aims to replicate its success in other states or categories. By analyzing these trends, Sunshine Oil can identify areas for growth and potential challenges that may arise in their expansion efforts.

Competitive Landscape

In the competitive landscape of the Oregon concentrates market, Sunshine Oil has demonstrated notable fluctuations in its ranking over the past few months, reflecting a dynamic market position. Starting from October 2025, Sunshine Oil was ranked 19th, improving to 16th in November, but then dropping out of the top 20 in December, before rebounding to 15th in January 2026. This volatility contrasts with competitors like Echo Electuary and Focus North, which maintained more stable rankings, although Focus North did experience a slight decline from 10th to 14th over the same period. Meanwhile, Gorge Grown and Private Stash have shown a gradual improvement in their standings, with Gorge Grown climbing from 23rd to 16th and Private Stash moving from 20th to 17th. Sunshine Oil's sales trajectory, with a noticeable dip in December followed by a recovery in January, suggests a potential for growth if they can stabilize their market presence amidst these competitive pressures.

Notable Products

In January 2026, Sunshine Oil's top-performing product was Gorilla Sherbert Crumble (2g) in the Concentrates category, securing the first rank with sales of 797 units. Cheat Code Shatter (1g) followed closely as the second-best seller in the same category. Phunky Punch Sugar Wax (2g) and Cheesy Chunk Sugar Wax (2g) held the third and fourth positions, respectively. Nacho Tres Crumble (1g) experienced a slight decline, dropping from third place in December 2025 to fifth in January 2026. These rankings highlight a stable preference for concentrates, with Gorilla Sherbert Crumble emerging as a new leader in the new year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.