Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

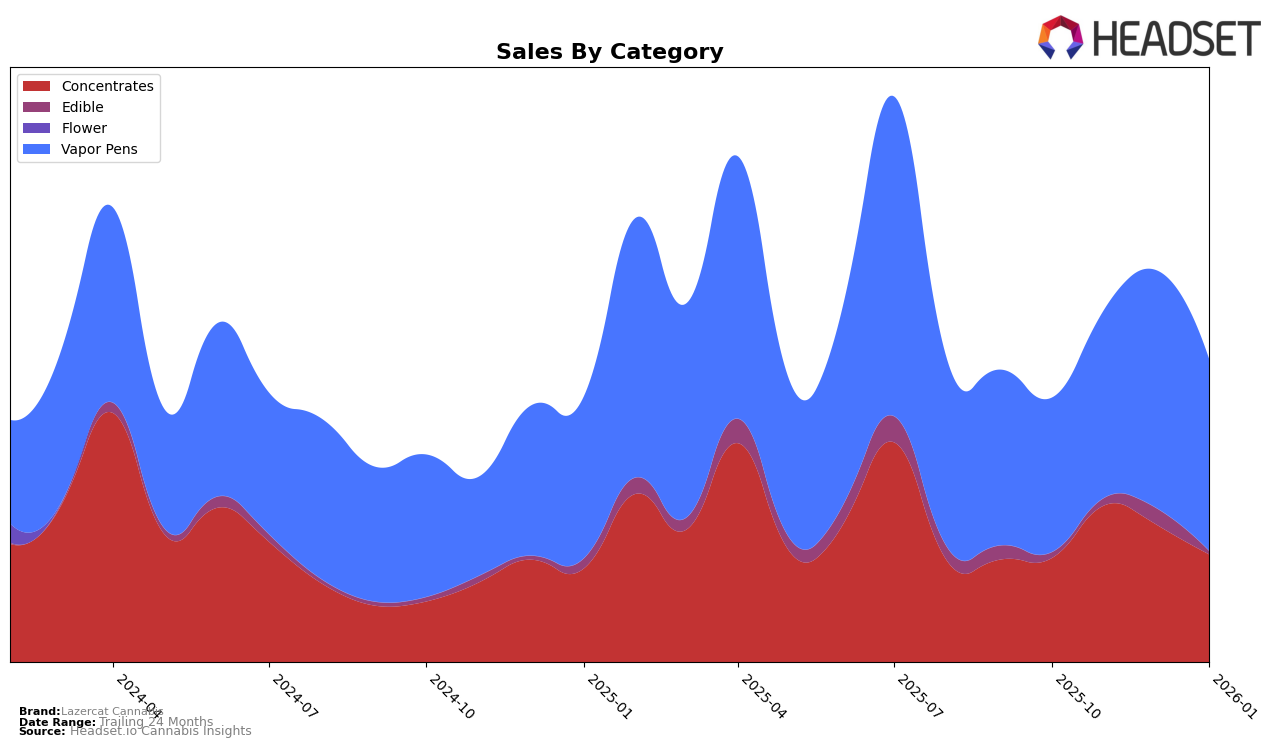

Lazercat Cannabis has shown varied performance across different product categories in Colorado. In the Concentrates category, the brand experienced notable fluctuations in its rankings, moving from 24th in October 2025 to 15th in November, then slightly dropping to 16th in December and further to 22nd in January 2026. This movement suggests a competitive market where maintaining a consistent rank is challenging. Despite these fluctuations, the brand's sales figures in this category saw a peak in November with $177,509, indicating a successful strategy or product launch during that period. However, in the Edible category, Lazercat Cannabis did not rank within the top 30 until January 2026, when it achieved the 31st position, highlighting a potential area for growth or increased focus to improve their standing.

In the Vapor Pens category, Lazercat Cannabis demonstrated a more stable trajectory. Starting at 36th in October 2025, the brand improved its position to 32nd in November and further to 30th in December, maintaining this rank into January 2026. This steady upward movement indicates a positive reception and possibly increasing consumer preference or loyalty towards their vapor pen products. The sales figures corroborate this trend, with a significant increase in sales from $174,223 in October to a peak of $268,513 in December. The ability to maintain a top 30 position in such a competitive category suggests that Lazercat Cannabis is effectively leveraging its brand strengths and market strategies to enhance its presence in the Colorado market.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Lazercat Cannabis has shown a steady improvement in its rankings over the months from October 2025 to January 2026, moving from 36th to 30th place. This upward trend indicates a positive reception in the market, although it still trails behind competitors like TasteBudz (CO) and Binske, which have fluctuated within the top 30. Notably, TasteBudz (CO) has maintained a relatively stable position, consistently ranking within the top 28, while Binske experienced a significant jump in December 2025, reaching 23rd place before dropping again. Meanwhile, Flyin' Hawaiian Farms showed a notable improvement in January 2026, surpassing Lazercat Cannabis by securing the 29th position. Despite these challenges, Lazercat Cannabis's consistent sales growth suggests a strengthening brand presence, although it still has room to catch up with its higher-ranked competitors.

Notable Products

In January 2026, the top-performing product for Lazercat Cannabis was Marley Punch Live Rosin Cartridge (0.5g) in the Vapor Pens category, securing the first rank with sales of 412 units. OG Nog Live Rosin Disposable (0.5g) followed closely in second place, while Cosmic Citrus Cider Live Rosin Disposable (0.5g) held the third position, both within the Vapor Pens category. Pulp Friction Royal Jelly Live Rosin (4g) from the Concentrates category achieved the fourth rank. Notably, GMO Rosin Disposable (0.5g) dropped from second place in December 2025 to fifth in January 2026. These rankings reflect a strong preference for vapor pen products, with slight shifts in consumer preferences from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.