Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

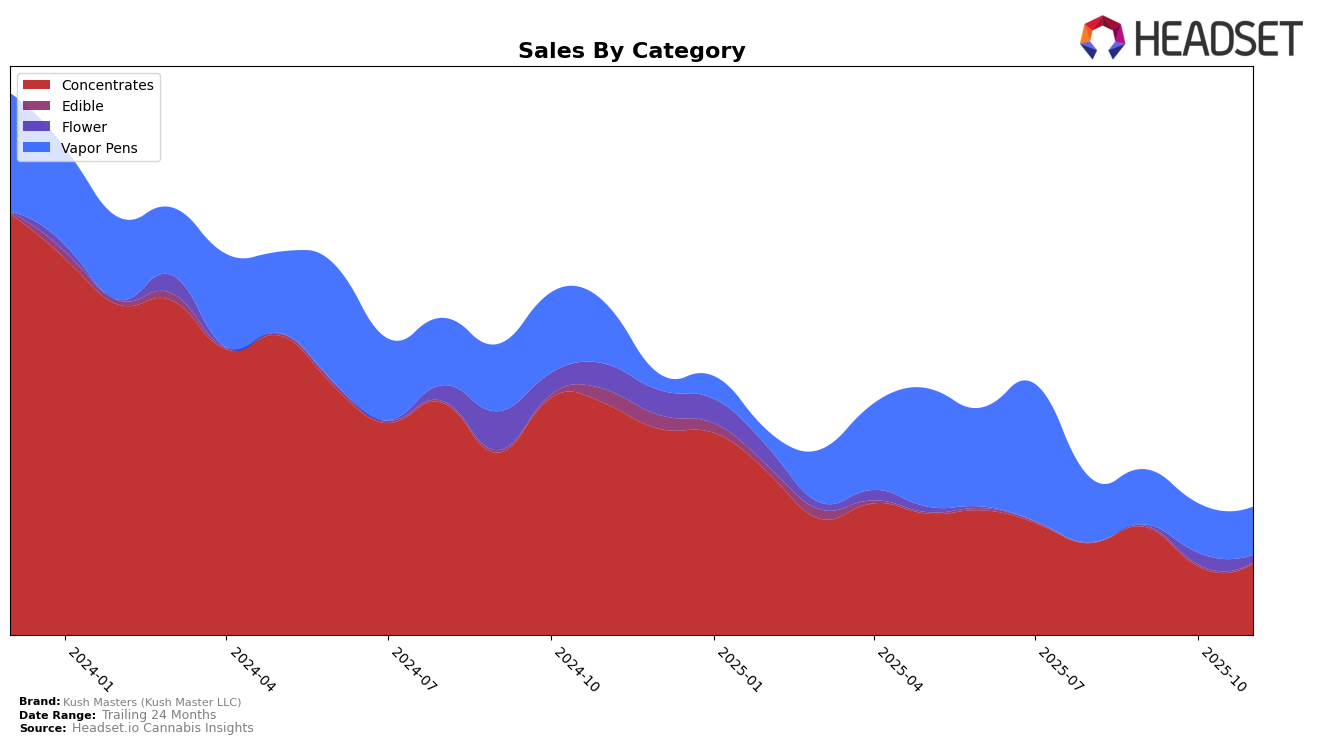

Kush Masters (Kush Master LLC) has shown a varied performance across different product categories and states. In the Colorado market, the brand has maintained a presence in the Concentrates category, although with some fluctuations. Starting in August 2025, they were ranked 28th, improved to 25th in September, but then dropped to 33rd in October before climbing back to 29th in November. This movement indicates a competitive landscape where Kush Masters is managing to stay relevant, albeit with challenges in maintaining a consistently strong position. Notably, their absence from the top 30 in October highlights a potential area for strategic improvement.

In the Vapor Pens category within Colorado, Kush Masters has shown a more stable yet modest performance. They have consistently hovered around the 60th position, with a slight improvement from 61st in August to 58th by November 2025. This indicates a steady demand for their vapor pen products, although they remain outside the top 30, suggesting room for growth in market share. The sales figures reflect a gradual decline over the months, which might require a strategic pivot or marketing push to enhance their standing in this category. Overall, while Kush Masters has maintained a foothold in both categories, there is potential for increased market penetration, particularly in the Vapor Pens segment.

Competitive Landscape

In the competitive landscape of the Colorado concentrates market, Kush Masters (Kush Master LLC) has experienced notable fluctuations in its ranking and sales performance over recent months. In August 2025, Kush Masters was ranked 28th, improving to 25th in September, but then dropping to 33rd in October before recovering slightly to 29th in November. This volatility contrasts with the more stable performance of competitors like Newt Brothers Artisanal and Next1 Labs LLC, which have maintained more consistent rankings. Notably, Bud Fox Supply Co experienced a significant drop from 15th to 30th in November, indicating potential market shifts that could benefit Kush Masters if leveraged strategically. Meanwhile, White Mousse has shown a remarkable rise from 51st in August to 33rd in November, suggesting a growing competitive threat. These dynamics highlight the importance for Kush Masters to adapt its strategies to stabilize its market position and capitalize on emerging opportunities within the Colorado concentrates sector.

Notable Products

In November 2025, the top-performing product for Kush Masters (Kush Master LLC) was Banana Cake Wax (1g) in the Concentrates category, which climbed from fifth place in August to secure the number one spot with sales reaching 935 units. Lazer Beamz Cured Resin Cartridge (1g) in the Vapor Pens category held steady in the top rankings, moving from second place in September to first in October, and then settling at second place in November with 790 units sold. New entries in the rankings for November include Peach Maraschino Wax (1g) and Pink Certz Shatter (1g), both securing third place in the Concentrates category. The Colorado Trail Shatter (1g) also made its debut in the rankings, achieving fourth place in the same category. These shifts indicate a dynamic market where new products are gaining traction and established ones are maintaining strong performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.