Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

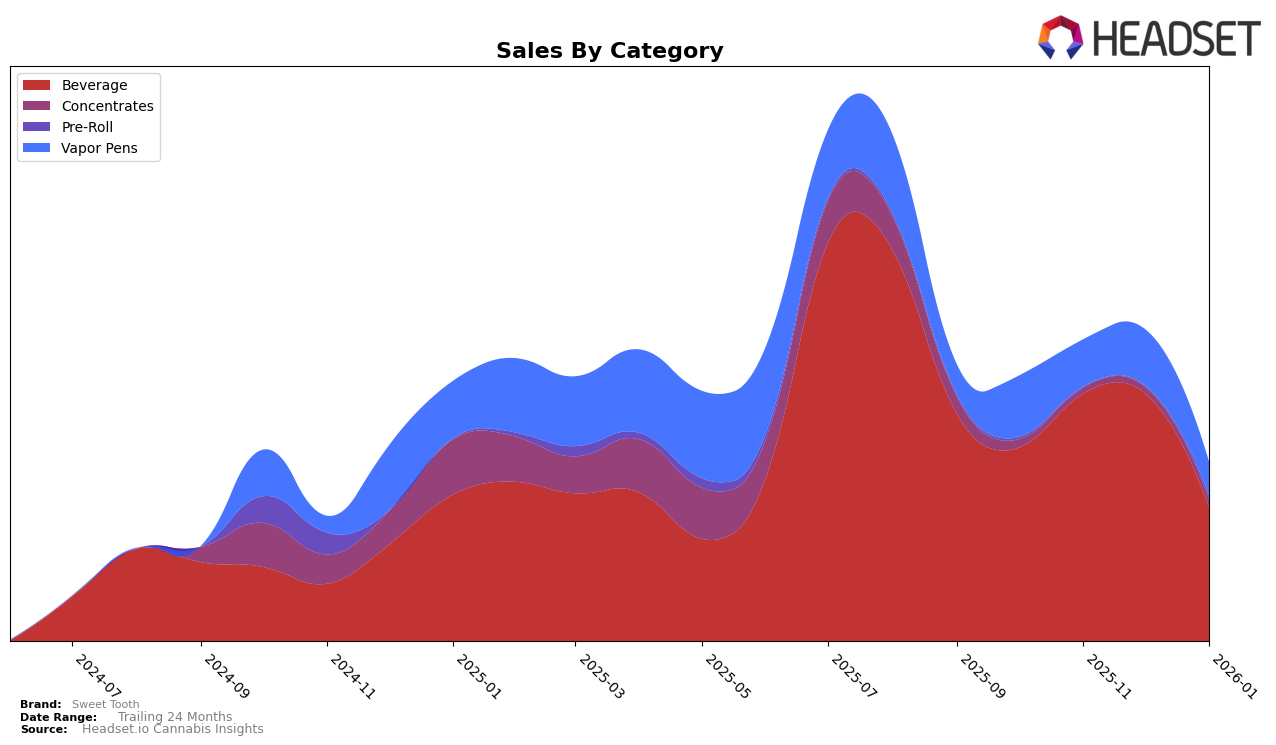

Sweet Tooth's performance in the British Columbia market has shown notable fluctuations across the beverage category. In October 2025, Sweet Tooth was ranked 6th, a strong position that indicated a solid market presence. However, by January 2026, their ranking had dropped to 17th. This decline suggests potential challenges in maintaining competitive positioning or shifts in consumer preferences. Despite these changes, the brand experienced an interesting sales trajectory, with sales peaking in November and December 2025 but then decreasing significantly in January 2026. Such movements highlight the importance of understanding seasonal demand and market dynamics in the cannabis beverage sector.

It is worth noting that Sweet Tooth did not appear in the top 30 rankings for any other states or provinces in the provided data, indicating that their market presence may be limited to British Columbia within this specific category. This could point to either a strategic focus on this region or challenges in expanding their footprint across other markets. The absence from top rankings in other areas may suggest potential growth opportunities if they can adapt their strategies to meet varying consumer demands across different regions. Understanding these dynamics is crucial for brands looking to expand their reach and optimize their performance across diverse markets.

Competitive Landscape

In the competitive landscape of the beverage category in British Columbia, Sweet Tooth has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 6th in October, Sweet Tooth saw a decline to 11th place in both November and December, eventually dropping further to 17th in January. This downward trend in rank is mirrored by a significant decrease in sales, particularly between December and January. In contrast, competitors such as Second Nature and Sheeesh! have maintained relatively stable positions, with Sheeesh! even improving its rank from 18th in November to 14th in December. The consistent sales performance of these competitors, despite Sweet Tooth's initial higher sales in November and December, suggests a potential shift in consumer preferences or competitive strategies that Sweet Tooth may need to address to regain its market standing.

Notable Products

In January 2026, Sweet Tooth's top-performing product was the Root Beer Float Sparkling Beverage (10mg THC, 355ml), maintaining its number one rank from December 2025 with sales of 961 units. The Fizzy Peach Live Rosin Sparkling Beverage (10mg THC, 355ml) held steady at the second position, consistent with its rank from the previous month. Spiced Apple Soda (10mg THC, 355ml) remained in third place, showing stable performance over the past three months. Chocolope Distillate Cartridge (1g) entered the rankings at fourth place, while Orange Punch Distillate Cartridge (1g) reappeared in fifth place after being unranked in December. The beverage category continues to dominate Sweet Tooth's sales, with vapor pens making a notable entry into the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.