Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

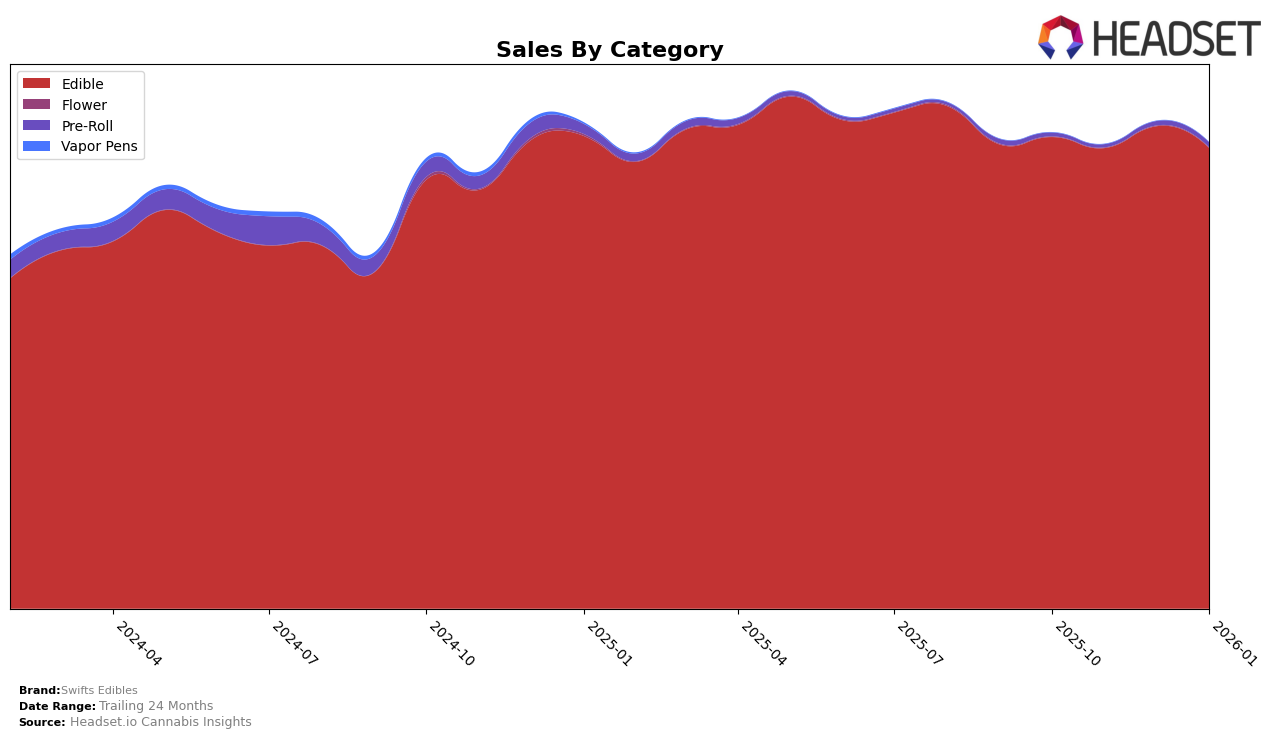

Swifts Edibles has maintained a consistent presence in the Edible category within the state of Washington. Over the past few months, the brand has consistently held the 7th position in the rankings from October 2025 through January 2026. This stability in ranking suggests a strong and steady consumer base in the state, despite a slight fluctuation in sales figures. For instance, while sales decreased from October to November, they rebounded in December, showing resilience and potential for growth in this market.

It's noteworthy that Swifts Edibles has not appeared in the top 30 brands in any other states or provinces, indicating that their market presence is currently concentrated in Washington. This could be seen as a limitation in their market reach, but also as an opportunity for strategic expansion into new regions. The brand's ability to maintain a top 10 position consistently in Washington's Edible category suggests a strong product-market fit that could potentially be leveraged in other markets with the right approach.

Competitive Landscape

In the Washington edible cannabis market, Swifts Edibles consistently maintained its position at rank 7 from October 2025 to January 2026. This stability in ranking suggests a steady consumer base, although it trails behind competitors like Craft Elixirs and Good Tide, which held ranks 5 and 6 respectively during the same period. The sales figures for Swifts Edibles showed minor fluctuations, with a slight dip from November to January, indicating potential seasonal impacts or competitive pressures. Meanwhile, Ceres and Smokiez Edibles, ranked 8 and 9, respectively, exhibited lower sales, which could suggest that Swifts Edibles is effectively capturing a larger market share within its tier. The consistent ranking of Swifts Edibles amidst these competitors highlights its resilience and potential for growth if it can capitalize on market trends or innovate its product offerings.

Notable Products

For January 2026, Swifts Edibles' top-performing product remained the CBD/CBN/CBG/THC Max Milk Chocolate Peanut Butter Cups 10-Pack, maintaining its first-place ranking with sales of 2629 units. The CBD/THC/CBG/CBN Huckleberry Max Gummies 10-Pack also held steady in second place, showing a slight decrease in sales compared to December 2025. The Sativa Peanut Butter Dark Chocolate Cups 10-Pack rose to third place, improving its position from fourth in December 2025. The CBD/CBN/CBG/THC 6:1:1:2 Pink Lemonade Max Gummies 10-Pack moved up to fourth place, recovering from a fifth-place ranking in December. Notably, the CBD Huckleberry Max Gummies 10-Pack entered the rankings for the first time in January, securing fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.