Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

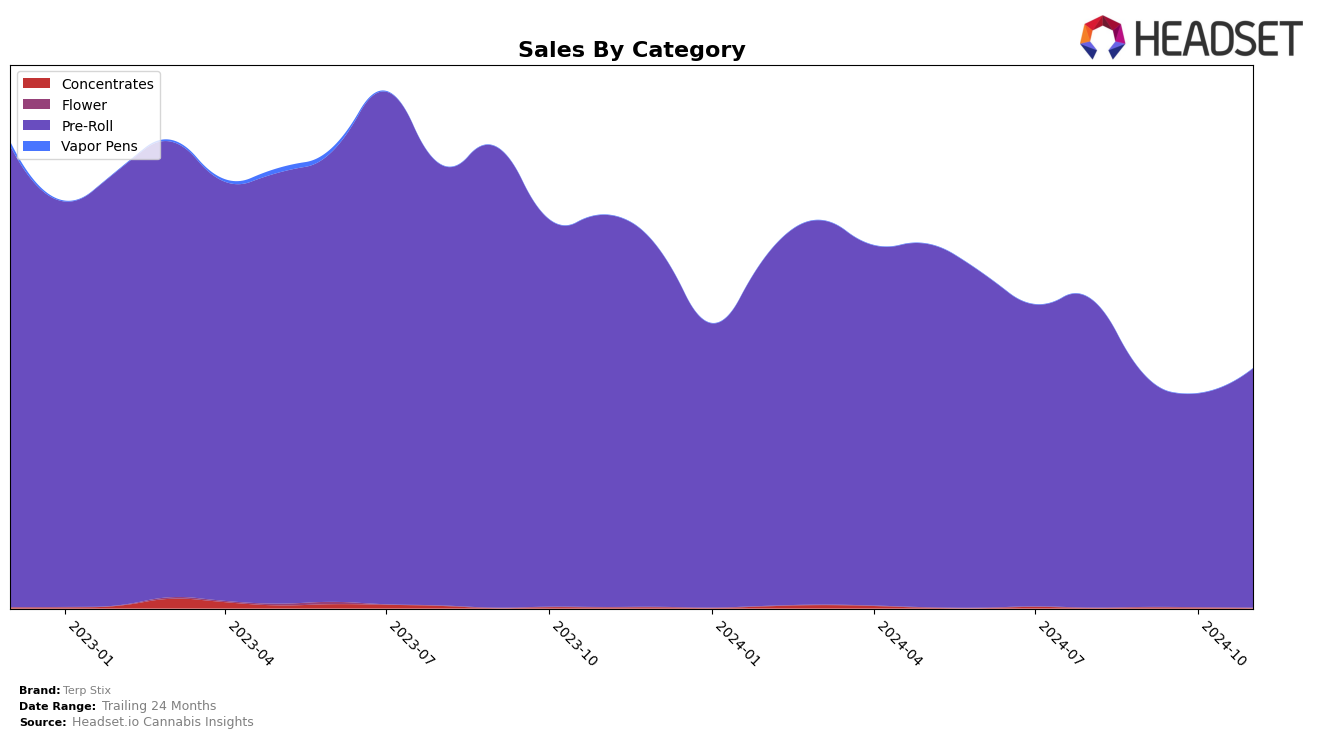

Terp Stix has shown a varied performance across different states and categories, with notable movements in the pre-roll segment. In Massachusetts, the brand has experienced fluctuations in its rankings over the months, starting at 33rd place in August 2024 and dropping to 40th in September and October, before climbing back to 29th in November. This indicates a recovery in market presence, potentially due to strategic changes or seasonal demand shifts. Meanwhile, in Washington, Terp Stix has consistently hovered around the mid-40s in ranking, with a slight improvement from 49th in August to 45th in November. This stability suggests a steady, albeit modest, foothold in the region.

On the other hand, Illinois presents a challenging market for Terp Stix, as it did not make it into the top 30 pre-roll brands during the months analyzed. This absence from the top rankings could indicate either a highly competitive environment or the need for Terp Stix to enhance its market strategies in the state. Despite these challenges, the overall sales trend in Massachusetts, where the brand saw an increase in November sales compared to October, suggests potential for growth if similar strategies are applied elsewhere. It's noteworthy that while Terp Stix's sales figures in Washington show a gradual decline, the brand's ability to maintain its ranking position indicates a loyal customer base that could be leveraged for future growth.

Competitive Landscape

In the Massachusetts pre-roll category, Terp Stix has experienced notable fluctuations in its market position over the past few months. As of November 2024, Terp Stix improved its rank to 29th, a significant rise from its 40th position in both September and October, indicating a positive trend in sales performance. This upward movement contrasts with brands like Strane, which also improved its rank to 28th in November from 32nd in October, but with a less pronounced sales increase. Meanwhile, Ocean Breeze maintained a stable rank at 33rd, suggesting a more consistent but less dynamic market presence. Impressed showed a dramatic rise from 67th in October to 30th in November, indicating a significant surge in sales. Additionally, Trees Co. (TC) improved its rank to 27th in November from 41st in October, showcasing a robust recovery. These shifts highlight a competitive landscape where Terp Stix's recent gains could position it for further growth if it continues to capitalize on its current momentum.

Notable Products

In November 2024, Blueberry Infused Pre-Roll (1g) maintained its position as the top-performing product for Terp Stix, consistently holding the number one rank since August, with sales reaching 2,647 units. Blue Dream Infused Pre-Roll (1g) also retained its second place from October, showing an upward trend in sales over the past few months. Pineapple Infused Pre-Roll (1g) remained steady in third place, recovering from a dip in October. Tigers Blood Infused Pre-Roll (1g) secured the fourth rank, showing consistency in its performance since reappearing in October. Notably, the Blue Dream Infused Pre-Roll 2-Pack (1g) entered the rankings for the first time in November, debuting at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.