Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

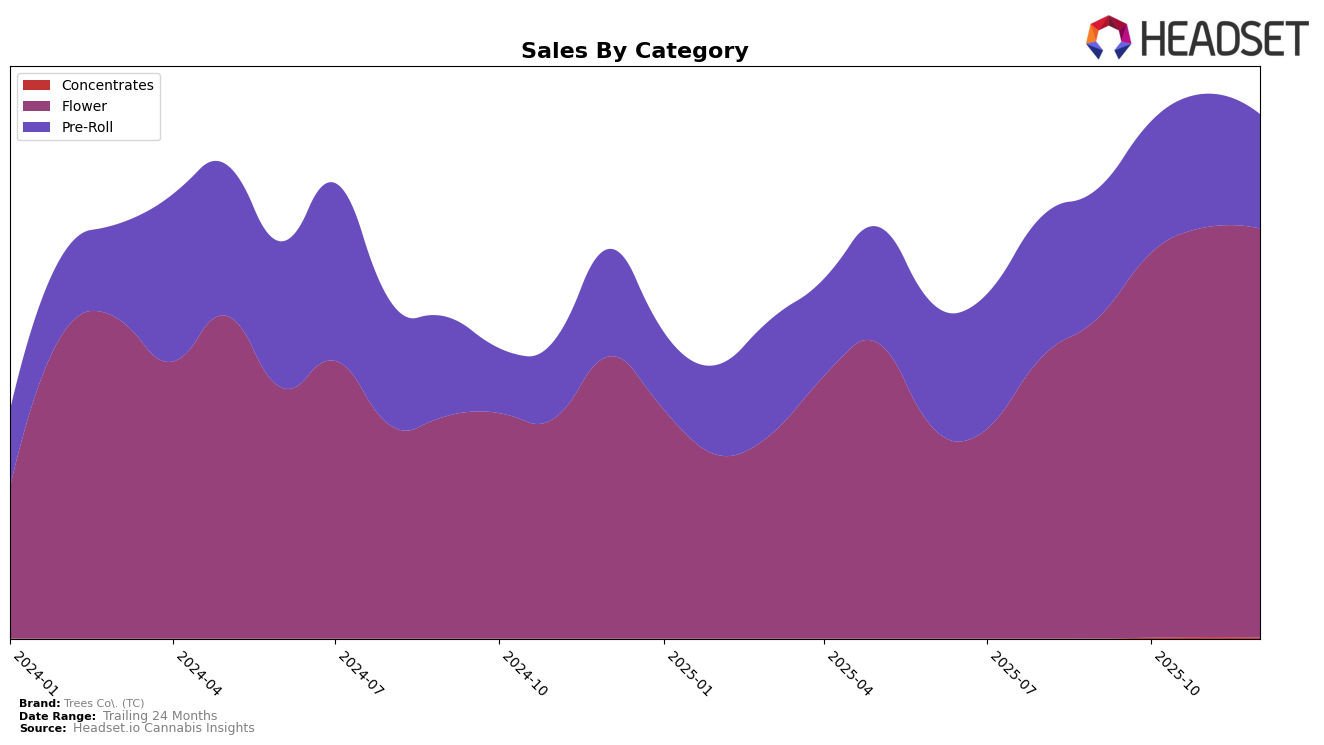

Trees Co. (TC) has shown a notable upward trajectory in the Massachusetts flower category, moving from a rank of 27 in September 2025 to 19 by December 2025. This positive trend is supported by a steady increase in sales, indicating a growing consumer preference for Trees Co.'s flower products. The brand's consistent climb in rankings suggests a successful strategy in capturing market share, making it a brand to watch in the Massachusetts flower market. However, it is important to note that Trees Co. was not ranked in the top 30 in some other categories, which could imply areas for potential growth or a need for strategic adjustments.

In contrast, the performance of Trees Co. in the pre-roll category in Massachusetts presents a mixed picture. While the brand managed to break into the top 30 in November 2025, reaching a rank of 29, it fell back to 38 in December, indicating volatility and potential challenges in maintaining a foothold in this segment. This fluctuation highlights the competitive nature of the pre-roll market and suggests that Trees Co. may need to reassess its approach to sustain and improve its ranking. The absence of Trees Co. in the top 30 in some months could be seen as an opportunity for the brand to innovate and differentiate its offerings in this category.

Competitive Landscape

In the Massachusetts flower category, Trees Co. (TC) has shown a steady improvement in its ranking, moving from 27th place in September 2025 to 19th by December 2025. This upward trajectory is indicative of a positive sales trend, as TC's sales figures have consistently increased over these months. Notably, Good Chemistry Nurseries also improved its rank, moving from 20th to 17th, with a steady increase in sales, which suggests a competitive market environment. Meanwhile, Grassroots and Commcan have shown significant rank improvements, with Grassroots climbing from 26th to 18th and Commcan from 33rd to 20th, reflecting strong sales growth. Conversely, Bostica, despite starting at a higher rank of 12th, has experienced a decline to 21st, suggesting a decrease in sales momentum. This competitive landscape highlights Trees Co. (TC)'s resilience and potential for further growth amidst dynamic market shifts.

Notable Products

In December 2025, the top-performing product for Trees Co. (TC) was Melonade Gibson (3.5g) in the Flower category, which climbed to the first rank with sales reaching 3,261 units. The So F'n Gassy Pre-Roll (1g) held the second position, dropping from its previous first place in November. Chem Dog (3.5g) made a strong debut in the third position, while Chem Dog Pre-Roll (1g) and Champagne Showers Pre-Roll (1g) secured the fourth and fifth ranks, respectively. Notably, Melonade Gibson (3.5g) showed significant growth, rising from fourth place in November. The Pre-Roll category saw a reshuffling as So F'n Gassy Pre-Roll (1g) experienced a decline in sales compared to prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.