Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

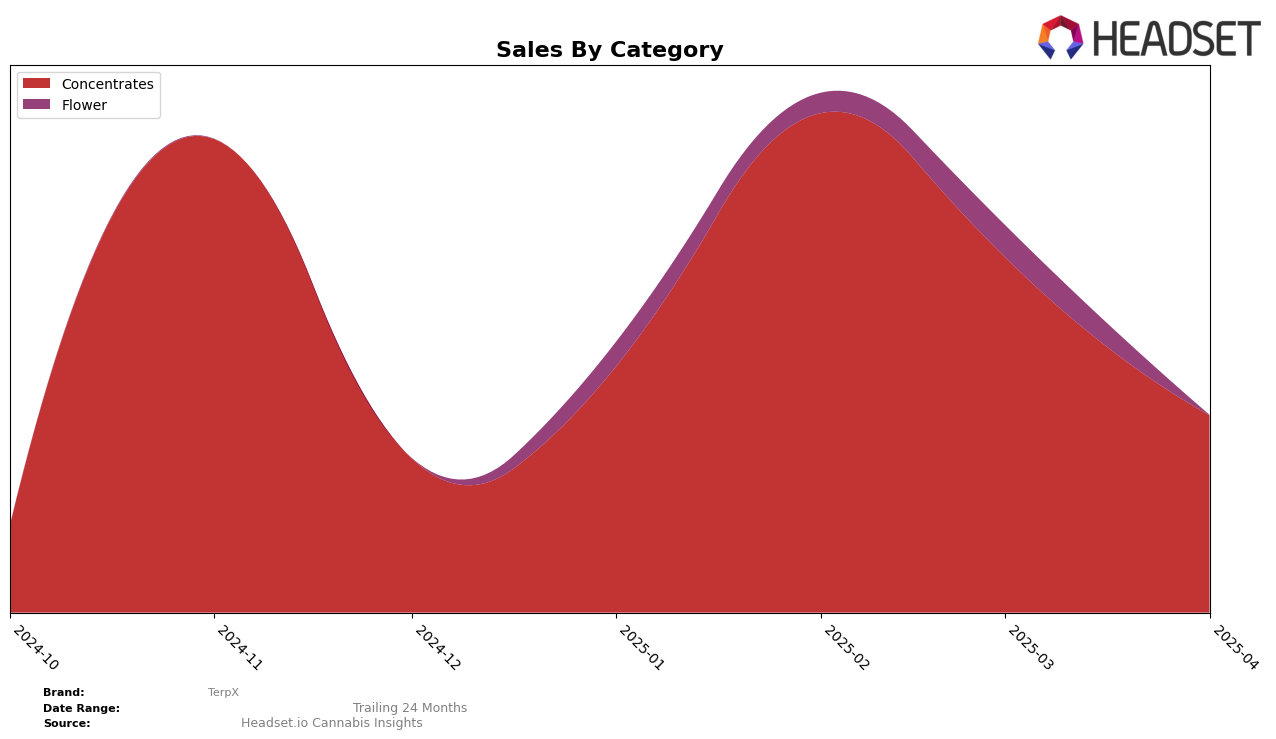

In the New Jersey market, TerpX has shown some fluctuations in its performance within the Concentrates category. Starting the year in 18th place, the brand improved to 16th in February, indicating a positive reception or perhaps a strategic push in sales efforts. However, this upward movement was not sustained, as March saw a return to the 18th position, followed by a further decline to 22nd in April. This suggests potential challenges in maintaining momentum or increased competition in the market. Notably, the sales figures reflect this volatility, with a peak in February but a significant drop by April, hinting at possible seasonal trends or inventory issues.

Despite these challenges, TerpX's ability to remain within the top 30 brands in the Concentrates category throughout the first four months of 2025 is noteworthy. Being consistently ranked, albeit with some fluctuations, suggests a stable presence in the New Jersey market, even as they strive to climb higher in the rankings. The absence of a top 30 ranking in other states or categories could be a strategic focus on strengthening their position in New Jersey or a reflection of the competitive landscape in other regions. This performance analysis highlights the importance for TerpX to potentially explore diversification or targeted marketing strategies to capitalize on their brand presence.

Competitive Landscape

In the New Jersey concentrates market, TerpX experienced fluctuations in its ranking and sales performance from January to April 2025. Starting at 18th place in January, TerpX improved to 16th in February but then dropped back to 18th in March and fell out of the top 20 by April. This decline in rank is mirrored by a decrease in sales, from a peak in February to a significant drop in April. In contrast, Space Ranger consistently outperformed TerpX, maintaining a higher rank and sales volume, despite a slight decline from 12th to 18th place over the same period. Meanwhile, Lily Extracts showed a more stable performance, closely trailing TerpX initially but surpassing it by April. These trends suggest that while TerpX has potential for growth, it faces stiff competition from brands like Space Ranger and Lily Extracts, which are capturing more market share in New Jersey's concentrates category.

Notable Products

In April 2025, Moon Pie Sugar (1g) emerged as the top-performing product for TerpX, securing the number one rank in the Concentrates category with sales of 196 units. Moon Pie Cured Resin Sugar (1g) climbed to the second position from fifth in February, showing a significant increase in popularity. Animal Star Cookies Crushed Diamonds (1g) held the third spot, dropping from its top position in March. The product Animal Star Cookies Cured Resin (1g) did not rank in April, despite being third in March. Blueberry Pancake (1g) from the Flower category, which was consistently ranked fifth in earlier months, did not make it into the top ranks in April.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.