Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

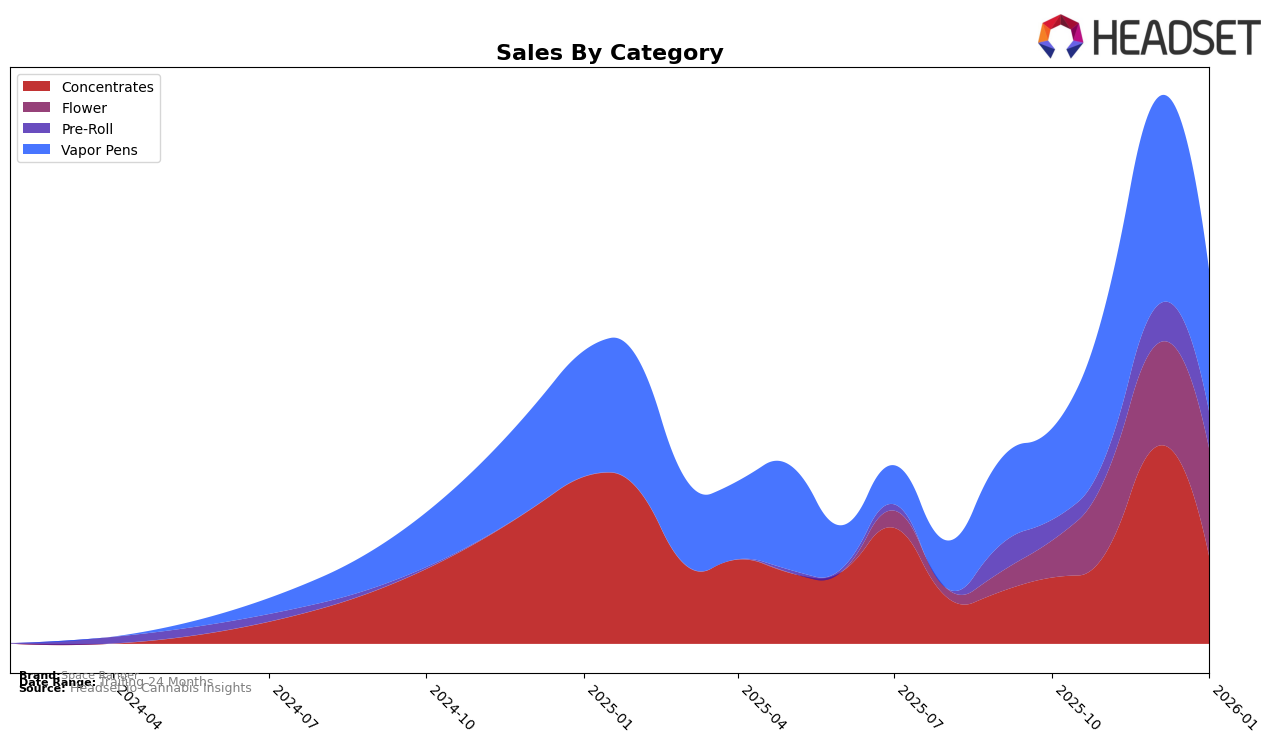

Space Ranger has demonstrated varied performance across different categories in New Jersey. In the Concentrates category, the brand showed a significant leap in rankings from 23rd in October 2025 to 11th in December 2025, although it slipped back to 24th in January 2026. This fluctuation could indicate a competitive market or seasonal demand changes. Meanwhile, in the Flower category, Space Ranger has been making steady progress, climbing from 86th place in October 2025 to 73rd by January 2026, suggesting a gradual increase in consumer preference or improved distribution strategies.

In the Pre-Roll category, Space Ranger was not in the top 30 until December 2025, when it entered the rankings at 77th and improved slightly to 76th in January 2026. This late entry might reflect a new product launch or marketing effort. On the other hand, the Vapor Pens category shows a more stable performance, with Space Ranger consistently ranking within the top 70, peaking at 47th in December 2025 before settling at 54th in January 2026. This indicates a relatively strong presence in the vapor pen market, although there is room for improvement to reach higher ranks consistently.

Competitive Landscape

In the competitive landscape of vapor pens in New Jersey, Space Ranger has shown a notable upward trend in rankings from October 2025 to January 2026. Initially ranked at 64th in October, Space Ranger improved its position to 49th by November and maintained a relatively stable rank around the mid-40s through December, before slightly dropping to 54th in January. This positive trajectory in rank correlates with an increase in sales, particularly notable between October and December, where sales more than doubled. In comparison, Flower by Edie Parker experienced a decline in both rank and sales, dropping from 24th to 52nd, while Brute's Roots and Rosin King of Jersey showed fluctuating ranks with relatively stable sales. Full Tilt Labs had a missing rank in November, indicating they were not in the top 20, but saw a sales increase in December. These dynamics suggest that Space Ranger is gaining traction in the market, potentially capitalizing on the declining performance of some competitors, and positioning itself as a brand to watch in the New Jersey vapor pen category.

Notable Products

In January 2026, the top-performing product for Space Ranger was Meteor Melon x Solstice Infused Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place ranking from October 2025 with a notable sales figure of 873 units. Rocket Pop x Cake n Cookies (3.5g) in the Flower category improved its position to second place, up from third in the previous two months. Rocket Fuel Distillate Distillate Cartridge (0.5g) in the Vapor Pens category slipped to third place, down from second in December 2025. Baja Blaster x Banana Mochi Liquid Diamonds & Sauce Cartridge (1g), also in Vapor Pens, moved up to fourth place after being fifth in December. Rocket Fuel x Tropical Teleport Distillate Cartridge (0.5g) entered the rankings for the first time in January, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.