Oct-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

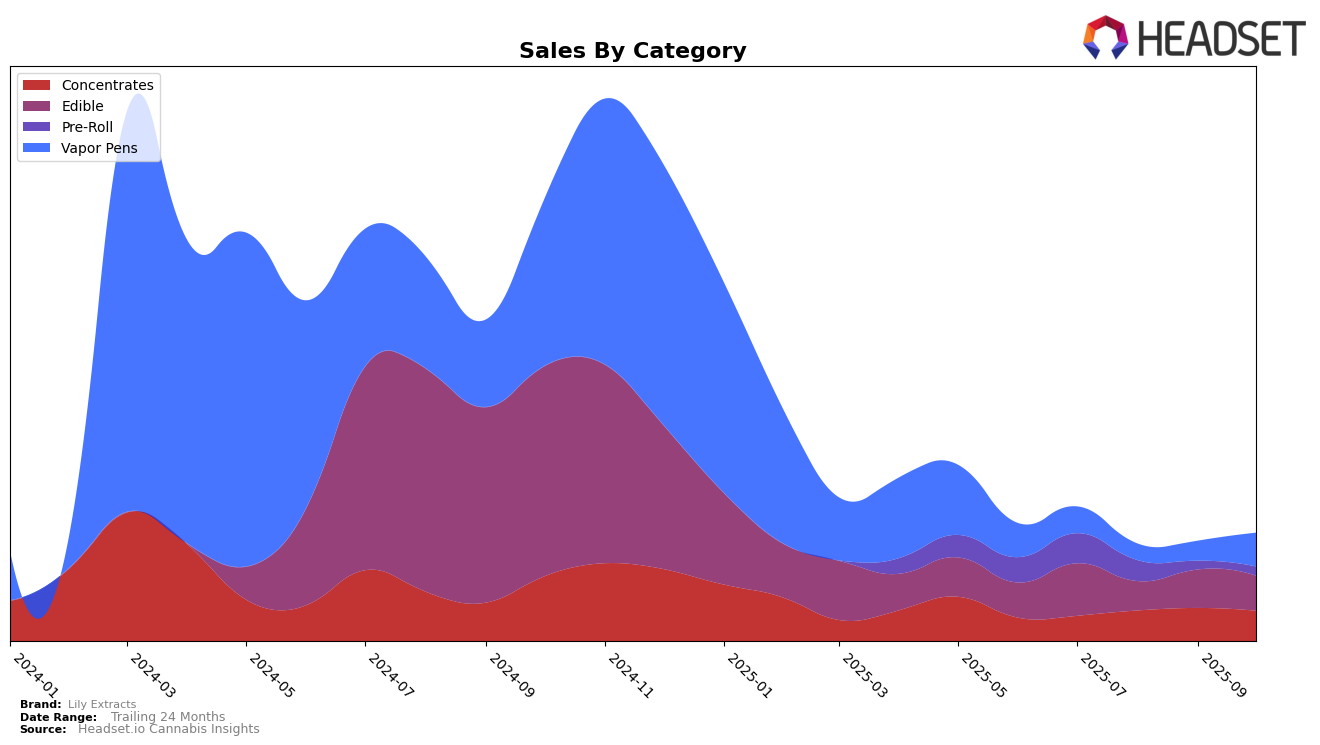

Lily Extracts has demonstrated notable performance trends across various product categories in New Jersey. In the Concentrates category, the brand maintained a relatively stable presence, fluctuating slightly between the 22nd and 25th positions from July to October 2025. This consistency suggests a solid foothold in the market, despite a dip in sales in October compared to September. Conversely, the Edible category saw Lily Extracts gradually decline in rankings, moving from 34th to 44th place over the same period. This downward trend may indicate increased competition or shifting consumer preferences in the state.

In the Vapor Pens category, Lily Extracts experienced a modest improvement, climbing from the 71st position in August to 68th by October. This upward trajectory, especially significant given the competitive nature of the vapor pen market, could be indicative of successful marketing strategies or product innovations. However, it's worth noting that the Pre-Roll category did not see Lily Extracts break into the top 30, with its ranking missing in September and October, which could be a cause for concern regarding their product offerings or market penetration in this category. Overall, while Lily Extracts shows strengths in certain areas, there are opportunities for growth and improvement in others, particularly in expanding their presence in the Pre-Roll and Edible sectors.

Competitive Landscape

In the competitive landscape of the edible cannabis market in New Jersey, Lily Extracts has experienced a notable shift in its rankings over the past few months. Starting in July 2025, Lily Extracts held a strong position at rank 34, but it has seen a gradual decline, dropping to rank 44 by October 2025. This downward trend in rank is accompanied by fluctuations in sales, with a peak in July followed by a decrease in August and a slight recovery in September before another dip in October. In contrast, competitors like HAMSA Edibles have maintained a more stable presence, consistently ranking within the top 50, despite a slight dip in September. Meanwhile, Breakwater emerged in the rankings in September and October, indicating a potential rise in market presence. The competitive dynamics suggest that while Lily Extracts remains a key player, it faces increasing pressure from both established and emerging brands in the New Jersey edible market.

Notable Products

In October 2025, the top-performing product from Lily Extracts was Bubba Kush Bubble Hash (1g) in the Concentrates category, which climbed to the number one rank from its previous absence in September. Hashberry Live Rosin Gummies 10-Pack (100mg) secured the second spot in the Edible category, showing a significant improvement from its fifth position in September, with sales reaching 258 units. Pina Express Colada Live Rosin Gummies 10-Pack (100mg) maintained its steady performance, holding the third rank consistently since September. Bubba Kush Live Rosin Disposable (0.5g) entered the rankings for the first time this month, placing fourth in the Vapor Pens category. Wild Cherry Cannapunch Live Rosin Gummies 10-Pack (100mg) made its debut at the fifth position in the Edible category, indicating a promising entry into the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.