Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

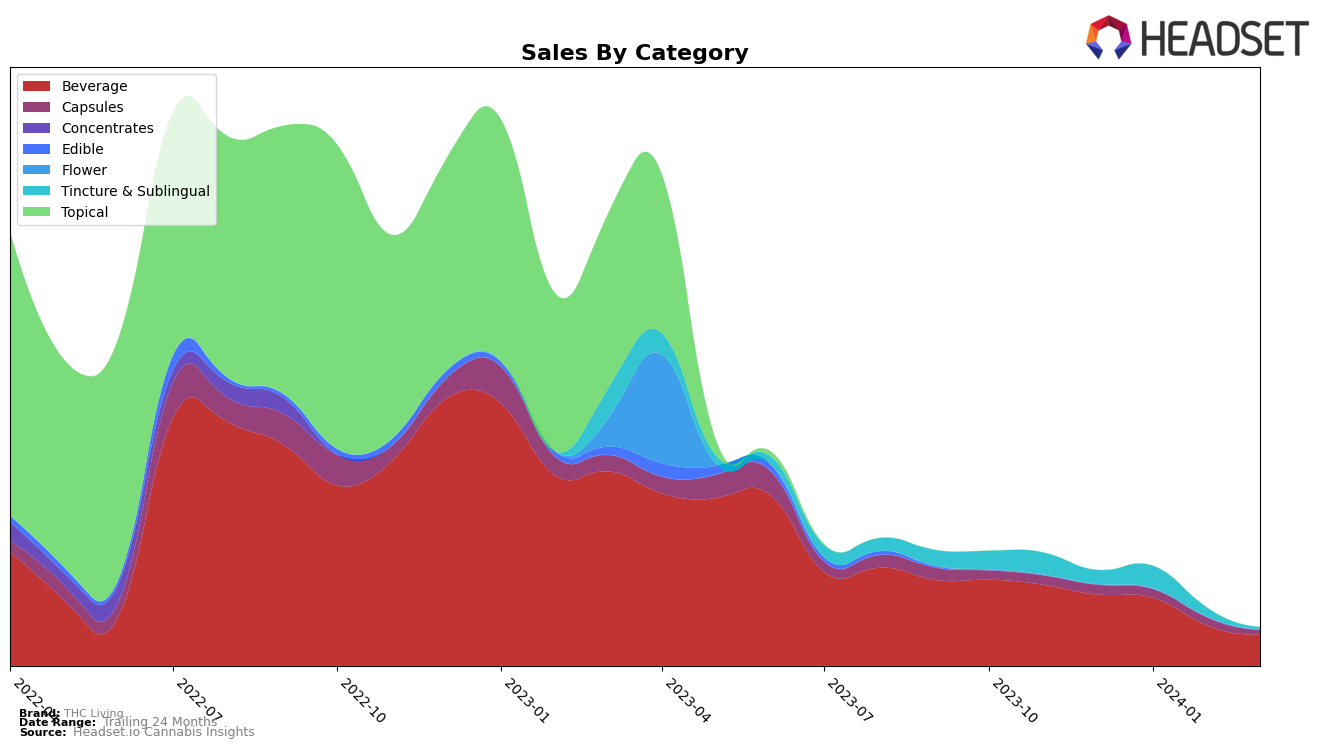

In Arizona, THC Living has shown a notable presence across several categories, including Beverages, Capsules, and Tinctures & Sublinguals. Particularly, their Capsules category has maintained a strong position within the top 5 rankings from December 2023 to March 2024, peaking at rank 2 in February 2024. This consistent performance could indicate a solid demand for their capsules product line. However, their Beverages and Tinctures & Sublinguals categories have experienced slight declines in rankings during the same period, with Beverages dropping from rank 11 in December 2023 to rank 12 in March 2024, and Tinctures & Sublinguals falling from rank 5 to rank 9. This downward trend, especially in the Tinctures & Sublinguals category, which saw a significant sales dip from 4055 units in January 2024 to just 359 units in March 2024, suggests a potential area of concern for the brand in maintaining its market share in these categories.

In contrast, THC Living's venture into the California market presents a different picture, particularly in the Capsules category where they made their entry in February 2024, securing the 18th rank. The absence of rankings for December 2023, January 2024, and March 2024 in California indicates a recent introduction or possibly a strategic focus shift towards this market. While the initial ranking in California suggests room for growth, the lack of data for other months and categories does not provide a comprehensive view of their performance trajectory in this larger market. This entry into California, a significant cannabis market, could represent an important strategic move for THC Living, potentially offsetting any challenges faced in the Arizona market, but the limited data points available necessitate a watchful eye on future trends to gauge the true impact of this expansion.

Competitive Landscape

In the competitive landscape of the beverage category in Arizona, THC Living has experienced fluctuations in its market position, indicating a dynamic competition among leading brands. Initially ranked 11th in December 2023, THC Living improved to 9th in January 2024 but saw a slight decline to 12th by March 2024. This shift in rank is reflective of its sales trajectory, which, after peaking in January, experienced a significant drop by March. Competing closely with THC Living, Mellow Vibes (formerly Head Trip) and Wyld have shown more stability in their rankings, with Mellow Vibes consistently outperforming THC Living in sales. Sweet Dreams Vineyard, despite a fluctuation in rank, has demonstrated a strong sales performance, particularly in February 2024, overshadowing THC Living. Meanwhile, Halo Infusions has made notable gains, moving from a position outside the top 20 in December 2023 to 13th by March 2024, showcasing a rapid ascent in both rank and sales. These trends suggest that THC Living faces stiff competition, not only from established brands but also from emerging players in the Arizona beverage market.

Notable Products

In March 2024, THC Living saw the Pink Lemonade Drink 10-Pack (100mg) from the Beverage category as its top-performing product, with sales reaching 158 units. Following closely behind in sales was the Arnold Palmer Lemonade (100mg), also from the Beverage category, securing the second rank. The CBD:THC 1:1 Horchata Tincture (100mg CBD, 100mg THC) from the Tincture & Sublingual category climbed to the third position, showcasing a notable improvement from its previous rankings. The CBD/THC 1:1 Nano Suppositories 6-Pack (180mg CBD, 180mg THC) from the Capsules category and the CBD:THC 1:1 Chocolate Mint Tincture (100mg CBD, 100mg THC) from the Tincture & Sublingual category rounded out the top five, ranking fourth and fifth respectively. This month's rankings indicate a growing consumer preference for beverages within THC Living's product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.