Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

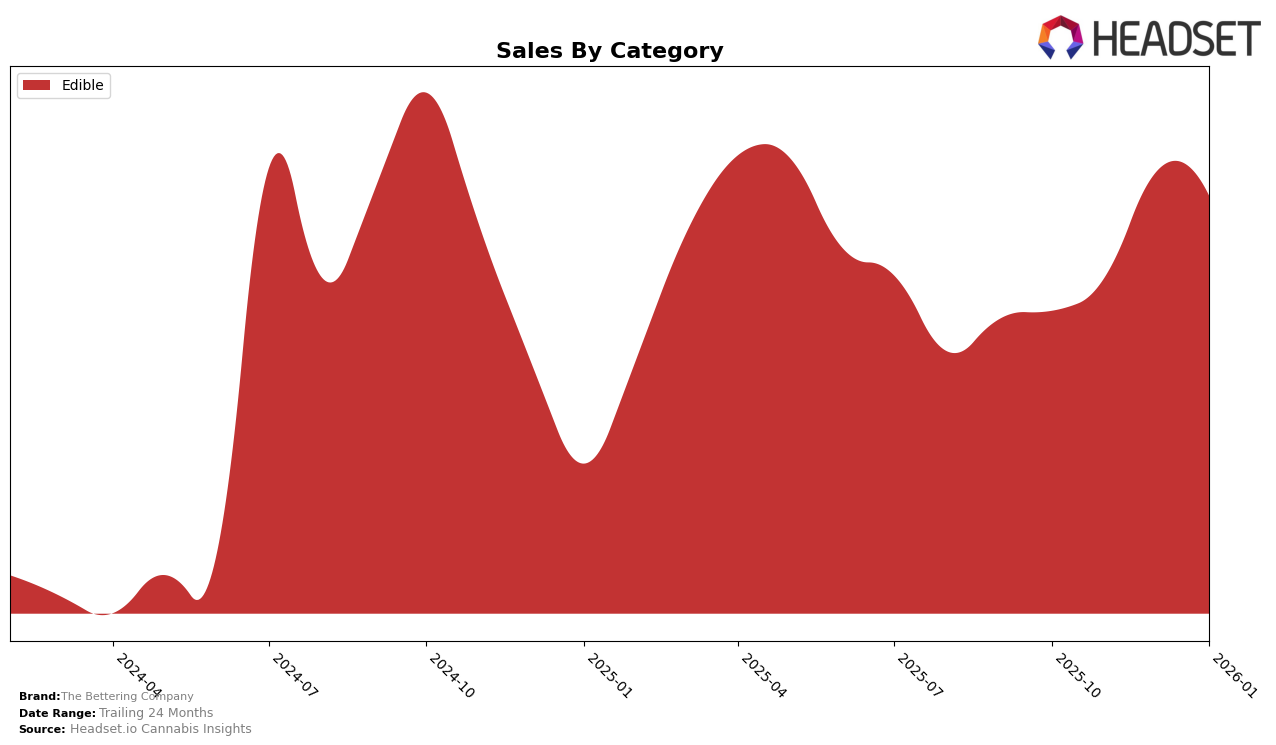

The Bettering Company has shown a steady presence in the New York edible market, maintaining a consistent rank of 22nd from October to December 2025. However, by January 2026, there was a slight dip as they moved to the 25th position. This change in ranking, despite a notable increase in sales from October to December, suggests a competitive and dynamic market where other brands may have outpaced The Bettering Company's growth. The steady sales increase during the last quarter of 2025 highlights their potential to reclaim or improve their standing if they can adjust to the shifting market dynamics.

Despite the drop in ranking in January, the overall performance of The Bettering Company in the New York edible category indicates a solid foothold in the market. Their ability to maintain a top 30 position consistently, except for the slight decline in January, is a positive indicator of their brand strength and consumer preference. The absence of their ranking outside the top 30 in any of these months is a testament to their resilience and market presence, even as new competitors emerge and consumer preferences evolve.

Competitive Landscape

In the competitive landscape of the New York edible cannabis market, The Bettering Company has experienced notable fluctuations in its ranking and sales over the past few months. Consistently holding the 22nd rank from October to December 2025, The Bettering Company saw a slight dip to the 25th position in January 2026, indicating a potential challenge in maintaining its competitive edge. Meanwhile, Flav and FINCA have shown varied performance, with Flav dropping out of the top 20 in November and December, while FINCA consistently hovered around the mid-20s. Interestingly, PAX re-entered the rankings in December at 23rd, slightly ahead of The Bettering Company by January. This dynamic suggests that while The Bettering Company has maintained a relatively stable position, the competitive pressure from brands like PAX and FINCA could necessitate strategic adjustments to regain upward momentum in both rank and sales.

Notable Products

In January 2026, The Bettering Company's top-performing product was Laugh - Blackberry Lemonade Gummies 10-Pack (100mg), maintaining its position as the number one ranked product with sales of 1610 units. Energize - THC/THCv 2:1 Lemon Zest Gummies 10-Pack (100mg THC, 50mg THCv) held steady at rank two, showing consistent performance across the previous months. Slumber - CBD/THC/CBN 2:2:1 Midnight Cherry Gummies 10-Pack (100mg CBD, 100mg THC, 50mg CBN) also retained its third-place position, demonstrating stable demand. Notably, Create - THC/CBG 5:1 Raspberry Mandarin Gummies 10-Pack (100mg THC, 20mg CBG) improved its ranking from fifth in December 2025 to fourth in January 2026. Conversely, Chill Out - CBD/THC 3:2 Blood Orange Gummies 10-Pack (150mg CBD, 100mg THC) dropped from fourth to fifth place, indicating a decrease in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.