Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

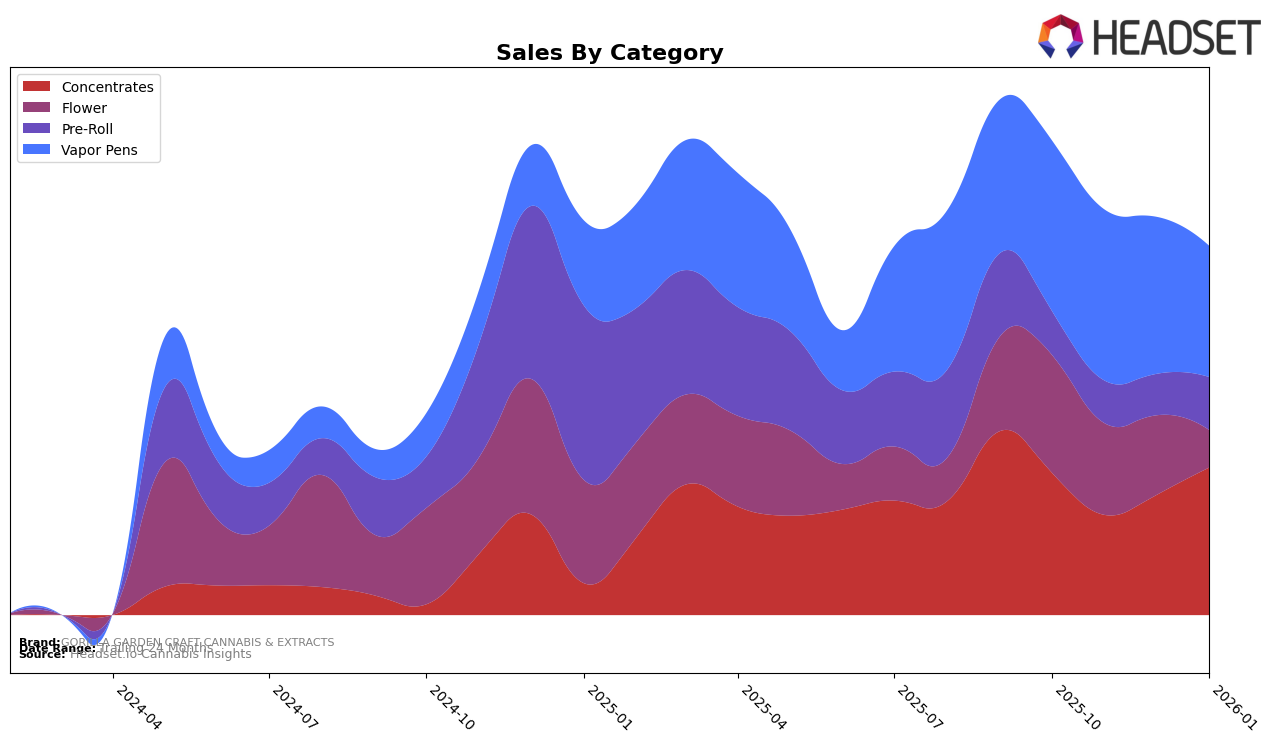

In the Alberta market, GORILLA GARDEN CRAFT CANNABIS & EXTRACTS has shown varied performance across different product categories. Concentrates have been a strong suit for the brand, with a notable rise in rankings from 19th in November 2025 to 10th by January 2026, indicating a positive trend in consumer preference or market penetration. This upward movement is mirrored in their sales figures, which increased from approximately $59,876 in November to $88,305 in January. However, the Flower category tells a different story, where the brand has struggled to maintain a competitive position, dropping from 60th in October to 94th by January. This decline suggests a potential area for strategic improvement or market repositioning.

In contrast, the Vapor Pens category has seen a more stable performance, maintaining a consistent presence within the top 40 rankings, albeit with a slight decline from 33rd to 36th between October 2025 and January 2026. This stability may reflect a loyal customer base or consistent product quality. On the other hand, the Pre-Roll category shows a concerning trend, with the brand only appearing in the rankings in January 2026 at 96th position, indicating a lack of visibility or competitiveness in this segment. This could be a strategic opportunity for the brand to explore further, especially given the growing popularity of pre-rolled products in the cannabis market. Overall, while there are areas of strength, GORILLA GARDEN CRAFT CANNABIS & EXTRACTS might benefit from a focused strategy to bolster their presence in underperforming categories.

Competitive Landscape

In the Alberta concentrates market, GORILLA GARDEN CRAFT CANNABIS & EXTRACTS has shown a dynamic shift in its competitive positioning over the past few months. Starting from a rank of 14th in October 2025, the brand experienced a dip to 19th in November, before climbing back to 17th in December and achieving a notable improvement to 10th by January 2026. This upward trend in rank suggests a positive reception to their products, likely driven by strategic marketing or product innovation. In contrast, competitors such as Virtue Cannabis and Vortex Cannabis Inc. have fluctuated in their rankings, with Virtue Cannabis dropping from 7th to 13th and Vortex Cannabis Inc. maintaining a more stable but slightly declining trajectory from 8th to 11th. Meanwhile, The Goo! has consistently outperformed, holding a top 10 position throughout the period. GORILLA GARDEN CRAFT CANNABIS & EXTRACTS' ability to improve its rank amidst such competition highlights its potential for growth and increased market share in the coming months.

Notable Products

In January 2026, the top-performing product for GORILLA GARDEN CRAFT CANNABIS & EXTRACTS was the Stinky Fuel Pre-Roll 3-Pack (1.5g) in the Pre-Roll category, maintaining its position at rank 1 with sales of 1592. The Gorilla Grease Full Spectrum Honey Oil Rechargeable Disposable (1g) in the Vapor Pens category improved its rank from 3 in the previous months to 2. Gorilla Grease FSE Honey Oil Syringe (1g) in Concentrates held a steady performance, dropping slightly to rank 3 from its previous rank 2 in December. The new entry, Magic Meatball Live Hash Rosin (1g) in Concentrates, debuted impressively at rank 4. Lastly, Gorilla Full Spectrum Honey Oil Cartridge (1g) in Vapor Pens entered the rankings at position 5, indicating a strong start.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.