Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

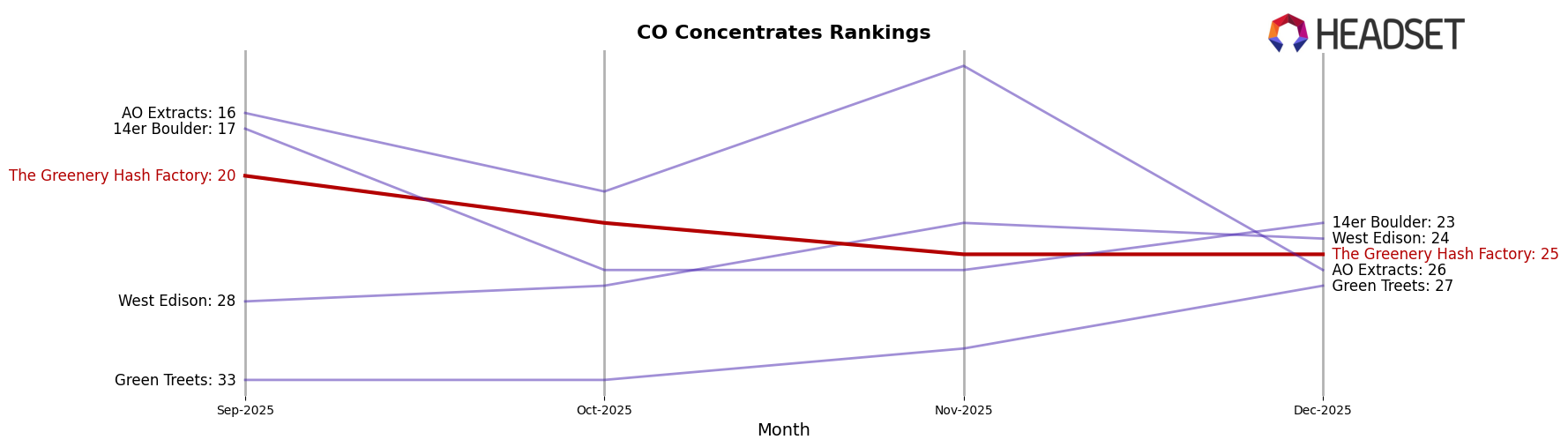

In the state of Colorado, The Greenery Hash Factory has experienced some fluctuations in its performance within the Concentrates category. Starting in September 2025, the brand was ranked 20th but saw a gradual decline over the following months, dropping to 23rd in October and further down to 25th by November and December. This downward trend may be a signal of increased competition or changing consumer preferences in the Colorado concentrates market. Despite this, the brand's presence in the top 30 throughout these months indicates a sustained level of competitiveness, although maintaining or improving this rank might require strategic adjustments.

Interestingly, the sales figures for The Greenery Hash Factory in Colorado also reflect this trend, with a noticeable decrease from September to December. While the brand managed to secure a position within the top 30, the consistent drop in ranking suggests that it may not have been able to keep pace with its competitors in terms of sales volume. This could highlight potential areas for growth or improvement, such as product innovation or marketing strategies, to regain momentum and improve its standing in the upcoming months.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, The Greenery Hash Factory experienced a slight decline in rank from September to December 2025, moving from 20th to 25th place. This shift indicates a competitive pressure from brands like AO Extracts, which saw a significant fluctuation, peaking at 13th in November before dropping to 26th in December. Meanwhile, 14er Boulder maintained a relatively stable position, ending the year at 23rd, slightly ahead of The Greenery Hash Factory. Additionally, West Edison showed a consistent upward trend, improving its rank from 28th in September to 24th in December, which could be indicative of increasing sales momentum. The Greenery Hash Factory's sales figures also reflect a gradual decrease over the months, suggesting a need for strategic adjustments to regain market share and improve its competitive standing in the Colorado concentrates market.

Notable Products

In December 2025, Jackie Treehorn Lebanese Hash (1g) emerged as the top-performing product for The Greenery Hash Factory, climbing from the third position in the previous two months to first place with sales reaching $270. Swampwater Fumez Lebanese Hash (1g) made a notable entry into the rankings, securing the second spot. Black Maple Lebanese Hash (1g) improved its standing, moving up from fourth in November to third in December. Platinum Ice Moroccan Hash (1g), which was the leader in November, saw a decline to fourth place in December. Zero Cool Moroccan Hash (1g) maintained its fifth position, rounding out the top performers for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.