Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

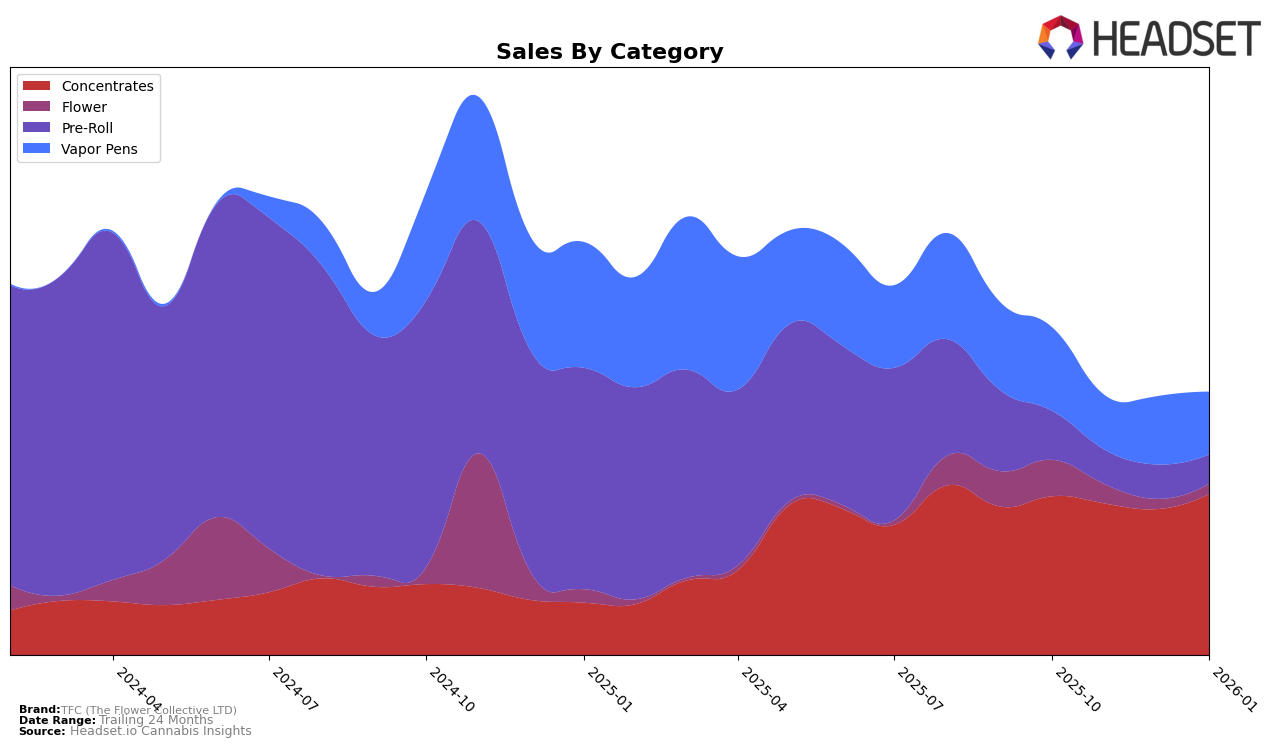

TFC (The Flower Collective LTD) has shown a somewhat fluctuating performance across different cannabis product categories in Colorado. In the Concentrates category, TFC maintained a relatively stable presence, moving from the 18th position in October 2025 to 22nd in both November and December, before returning to 18th in January 2026. This suggests a resilience and potential growth in this segment, as evidenced by a slight increase in sales from November to January. Meanwhile, their performance in the Flower category reveals some challenges, with rankings slipping from 92nd in October to 99th in November, and notably, not making it into the top 30 in December. However, a rebound to the 94th position in January indicates a possible recovery or strategic adjustment by TFC.

In the Pre-Roll category, TFC's rankings shifted slightly, moving from 50th in October to 56th in both November and December, before improving to 51st in January. This movement suggests some volatility, possibly due to market competition or seasonal demand changes. The Vapor Pens category also reflects an interesting trend, with TFC's ranking experiencing fluctuations from 57th in October, dropping to 60th in November, then climbing to 55th in December, and settling at 58th in January. Despite these ranking changes, the sales data indicates a peak in December, which could point to a successful promotional strategy or product launch during that period. These insights into TFC's performance across categories and months highlight both challenges and opportunities for growth within the Colorado market.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, TFC (The Flower Collective LTD) has experienced notable fluctuations in its market position from October 2025 to January 2026. TFC's rank dropped to 22nd place in November and December 2025, indicating a challenging period, but it rebounded to 18th place by January 2026, suggesting a recovery in market dynamics. This recovery is significant when compared to competitors like Colorado's Best Dabs (CBD), which saw a steady decline from 16th to 20th place over the same period. Meanwhile, El Sol Labs maintained a stronger position, consistently ranking higher than TFC, although it also experienced a slight decline. Interestingly, 14er Boulder made a remarkable jump from 23rd to 16th place by January 2026, surpassing TFC. These shifts highlight the competitive pressures TFC faces and underscore the importance of strategic adjustments to enhance its market standing amidst dynamic competitors.

Notable Products

In January 2026, TFC (The Flower Collective LTD) saw the Indica Bubble Infused Blunt (1g) leading the sales chart, securing the top position among its products. Following closely, the Indica Bubble Hash (1g) ranked second, indicating a strong preference for Indica-based products. Pie Dance Bubble Hash (1g) climbed from fifth place in December 2025 to third in January 2026, with sales reaching 274 units. Sugar Peel Bubble Hash (1g) maintained its position at third, while Mitch's Wreck Bubble Hash (1g) rounded out the top five, ranking fourth. Notably, all these products are concentrated forms, reflecting a consistent consumer interest in concentrated cannabis products over the months leading to January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.