Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

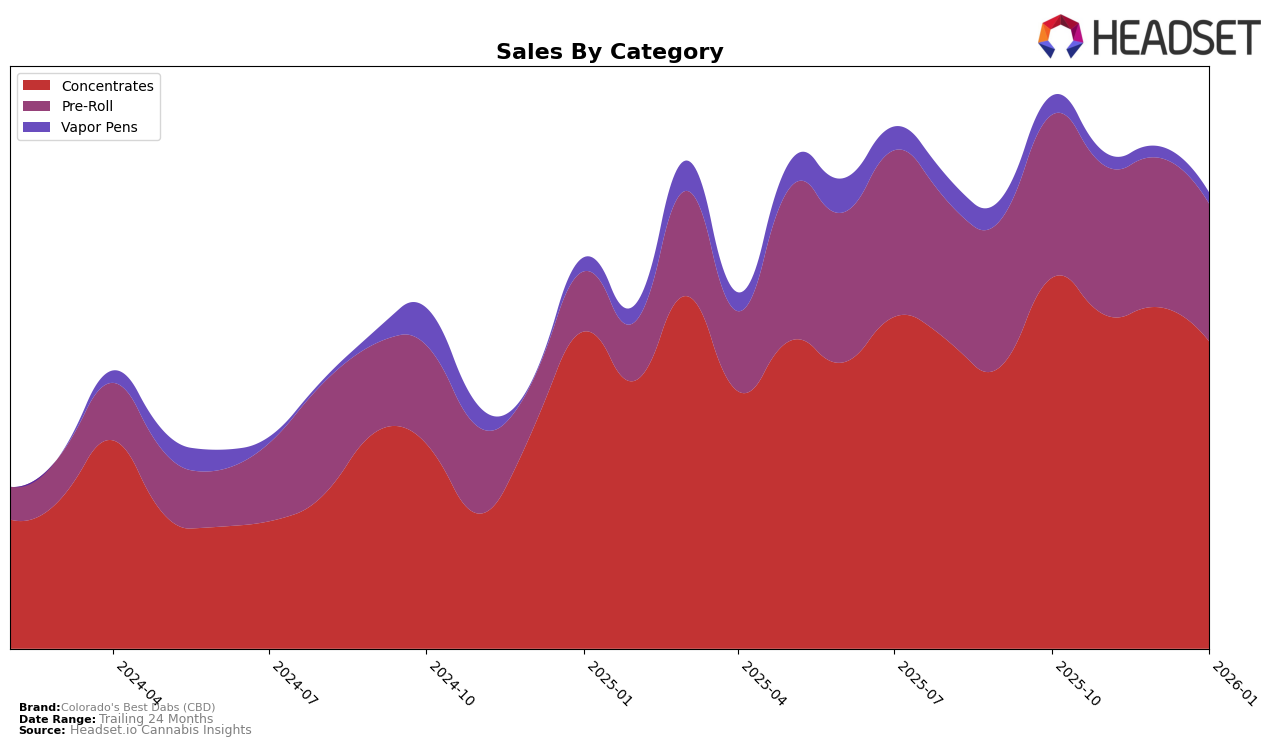

Colorado's Best Dabs (CBD) has been experiencing a gradual decline in its ranking within the Concentrates category in Colorado. Starting from a rank of 16 in October 2025, the brand slipped to 20 by January 2026. This downward trend is mirrored in their sales figures, which decreased from $155,889 in October to $129,083 in January. The brand's movement in the rankings suggests increased competition or possibly a shift in consumer preferences within the state's Concentrates market, which could be a point of concern for the brand's market strategy.

In the Pre-Roll category, Colorado's Best Dabs (CBD) has not managed to break into the top 30, maintaining a rank outside this threshold consistently over the months. Despite this, there is a slight improvement from October to November, where the brand moved from 36 to 33, but it did not sustain this momentum in subsequent months. The sales figures also reflect a steady decline, from $68,424 in October to $57,729 in January. This performance indicates that while there might be some brand recognition, it hasn't translated into significant market penetration within the Pre-Roll category in Colorado.

Competitive Landscape

In the competitive landscape of the Concentrates category in Colorado, Colorado's Best Dabs (CBD) has experienced a gradual decline in its rankings from October 2025 to January 2026, moving from 16th to 20th place. This downward trend in rank is mirrored by a decrease in sales over the same period. Meanwhile, competitors like Lazercat Cannabis and AO Extracts have shown more dynamic movements, with Lazercat Cannabis notably climbing to 15th place in November 2025 before dropping to 21st in January 2026, and AO Extracts peaking at 13th in November 2025. Despite these fluctuations, TFC (The Flower Collective LTD) and I-70 Extracts (I70E) have maintained relatively stable positions, indicating a competitive market where Colorado's Best Dabs (CBD) faces challenges in maintaining its rank and sales momentum.

Notable Products

In January 2026, the top-performing product from Colorado's Best Dabs (CBD) was the Wax Stix - Gelato Cake Infused Pre-Roll (1g) in the Pre-Roll category, achieving the number one rank with sales of 870 units. Alien Rock Kandy THCA Diamonds (1g) in the Concentrates category secured the second position, marking a strong entry with 756 units sold. The Diamond Doobie - Kush Mintz THCa Infused Pre-Roll (1g) followed closely in third place, with notable sales of 732 units. The Chocolate Cake Diamond Infused Pre-Roll (1g) and Wax Stix - Cali Sunset Infused Pre-Roll (1g) rounded out the top five, highlighting a strong preference for pre-rolls. Compared to previous months, these products showed significant upward movement, particularly the Wax Stix - Gelato Cake, which jumped from the fifth position in October 2025 to the top spot in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.