Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

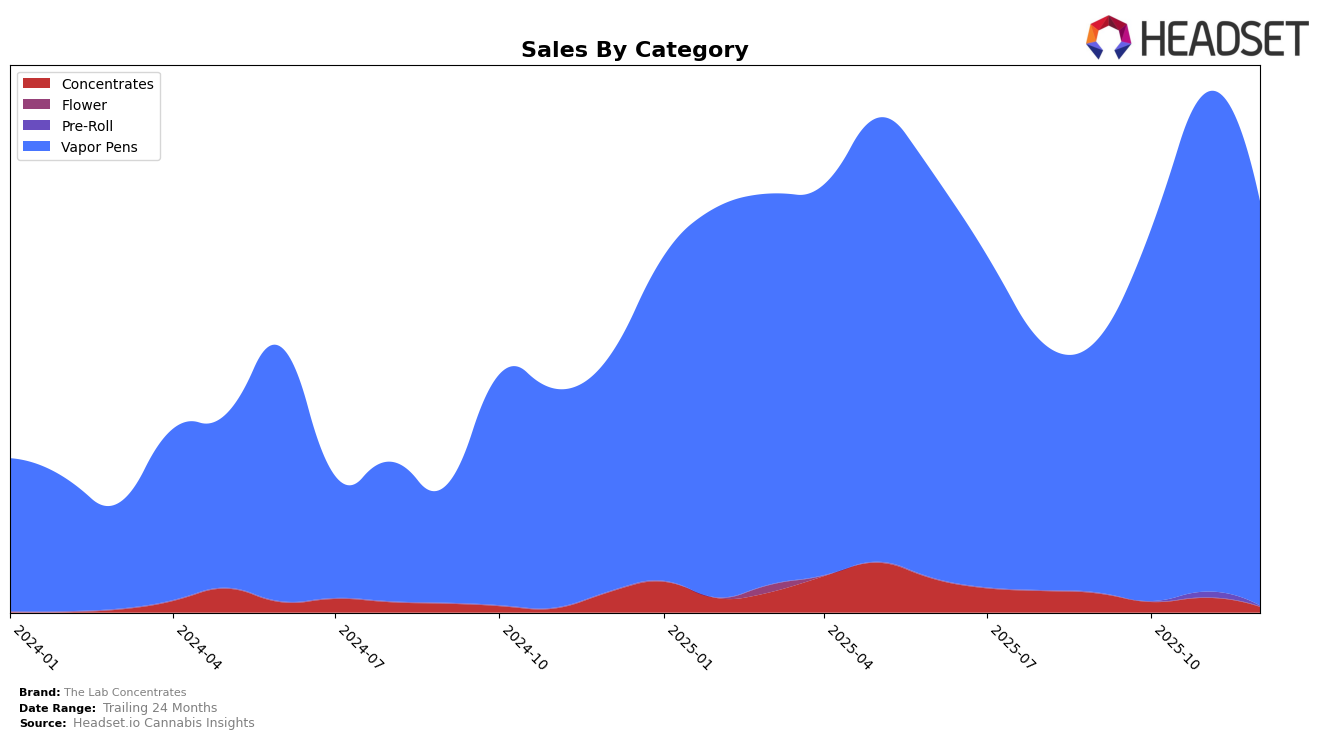

The Lab Concentrates has shown varied performance across different states and categories, with notable movements in rankings and sales. In Massachusetts, the brand's presence in the Vapor Pens category has been somewhat volatile, with rankings fluctuating from 71st in September 2025 to 62nd by December 2025. While this indicates a positive upward trend, the brand has not yet broken into the top 30, which suggests there is still significant room for growth in this particular market. The sales figures in Massachusetts reflect this trajectory, with a notable increase from September to October, followed by a slight decline towards the end of the year.

In contrast, Ohio presents a more promising picture for The Lab Concentrates in the Vapor Pens category. The brand's rankings improved significantly, moving from 37th in September 2025 to 24th in November before settling at 27th in December. This positive shift is supported by a substantial rise in sales during the same period, particularly in November, indicating strong consumer interest and market penetration. However, despite these gains, the brand still falls short of entering the top 20, highlighting potential challenges or opportunities for further market expansion in Ohio.

Competitive Landscape

In the competitive landscape of vapor pens in Ohio, The Lab Concentrates has shown a notable upward trajectory in rankings over the last few months of 2025. Starting from a rank of 37 in September, The Lab Concentrates climbed to 24 by November, before settling at 27 in December. This improvement in rank is indicative of a significant increase in sales, particularly between October and November, where sales surged, contrasting with the more stable performance of competitors like Standard Farms and Pure Ohio Wellness. Despite Firebrand Infusions maintaining a higher rank throughout the period, The Lab Concentrates' growth trajectory suggests a strengthening market position, potentially closing the gap with leading brands. Meanwhile, Ohio Processing Plant experienced a decline, highlighting a shift in consumer preference that favors The Lab Concentrates' offerings.

Notable Products

In December 2025, the top-performing product for The Lab Concentrates was the Red Orchard Distillate Cartridge (1g), securing the number one rank with sales of 556 units. Following closely was the Tropicana Cookies Distillate Cartridge (1g), which dropped one spot from its previous top position in November to rank second with 551 units sold. The Maui Wowie Distillate Cartridge (1g) debuted in the rankings at third place, while the 33 Weddings Distillate Cartridge (1g) and Limoncello Distillate Cartridge (1g) took the fourth and fifth spots, respectively. Notably, Tropicana Cookies saw a significant rise from fifth in October to first in November before settling in second place in December. Overall, the rankings showcase a dynamic shift in consumer preferences among vapor pen products over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.