Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

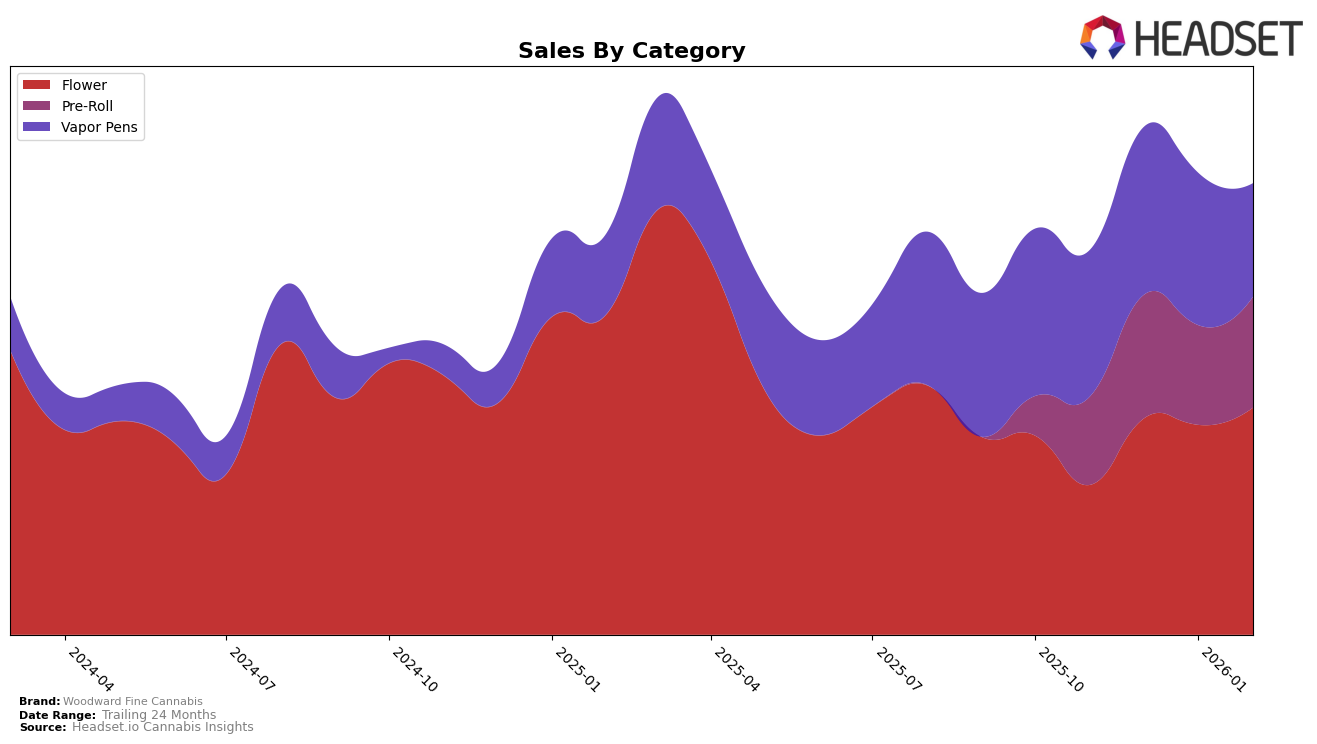

Woodward Fine Cannabis has shown notable performance in the Ohio market, particularly in the Flower category. Although they were not in the top 30 brands in November 2025, their ranking improved to 27th place by December and January, and further to 23rd by February 2026. This upward trend indicates a strengthening presence in the Flower category, suggesting successful strategies or product reception during this period. However, the absence of a top 30 ranking in November highlights a significant improvement that may have been driven by strategic changes or seasonal factors.

In the Pre-Roll category within Ohio, Woodward Fine Cannabis maintained a consistent ranking, staying within the top 10 brands from November 2025 through February 2026. This stability suggests a strong foothold and customer loyalty in this segment. Conversely, in the Vapor Pens category, the brand experienced a slight decline, dropping from 20th position in December and January to 23rd in February 2026, which may indicate increasing competition or shifting consumer preferences. Despite these mixed results across categories, the brand's overall sales performance reflects resilience and adaptability in a competitive market.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Woodward Fine Cannabis has demonstrated a notable upward trend in rankings, moving from 33rd place in November 2025 to 23rd by February 2026. This improvement in rank suggests a positive reception in the market, despite the presence of strong competitors. For instance, Appalachian Pharm consistently outperformed Woodward with higher rankings, maintaining a position within the top 21 brands throughout the same period. Meanwhile, Find. showed a slight decline, dropping from 18th to 22nd, which may indicate a potential opening for Woodward to capture more market share. Additionally, Moxie and Ohio Clean Leaf have fluctuated in the lower ranks, providing further opportunities for Woodward to capitalize on its upward momentum. The data suggests that Woodward's strategic initiatives are beginning to pay off, positioning it as a rising contender in the Ohio flower market.

Notable Products

In February 2026, Grapehead (5.66g) emerged as the top-performing product for Woodward Fine Cannabis, climbing from a fifth-place rank in January to secure the number one spot with significant sales of 1491 units. Candy Rain (5.66g) maintained its strong performance, consistently holding the second position from December through February. Rainbow Marker Pre-Roll 5-Pack (2.5g) also showed stability, retaining its third-place rank from January. Notably, Cheery Jungle Pre-Roll 5-Pack (2.5g) debuted in the rankings at fourth place, indicating a positive reception. Mystery Marker (5.66g), previously ranked first in January, fell to fifth place, suggesting a shift in consumer preferences or increased competition.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.