Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

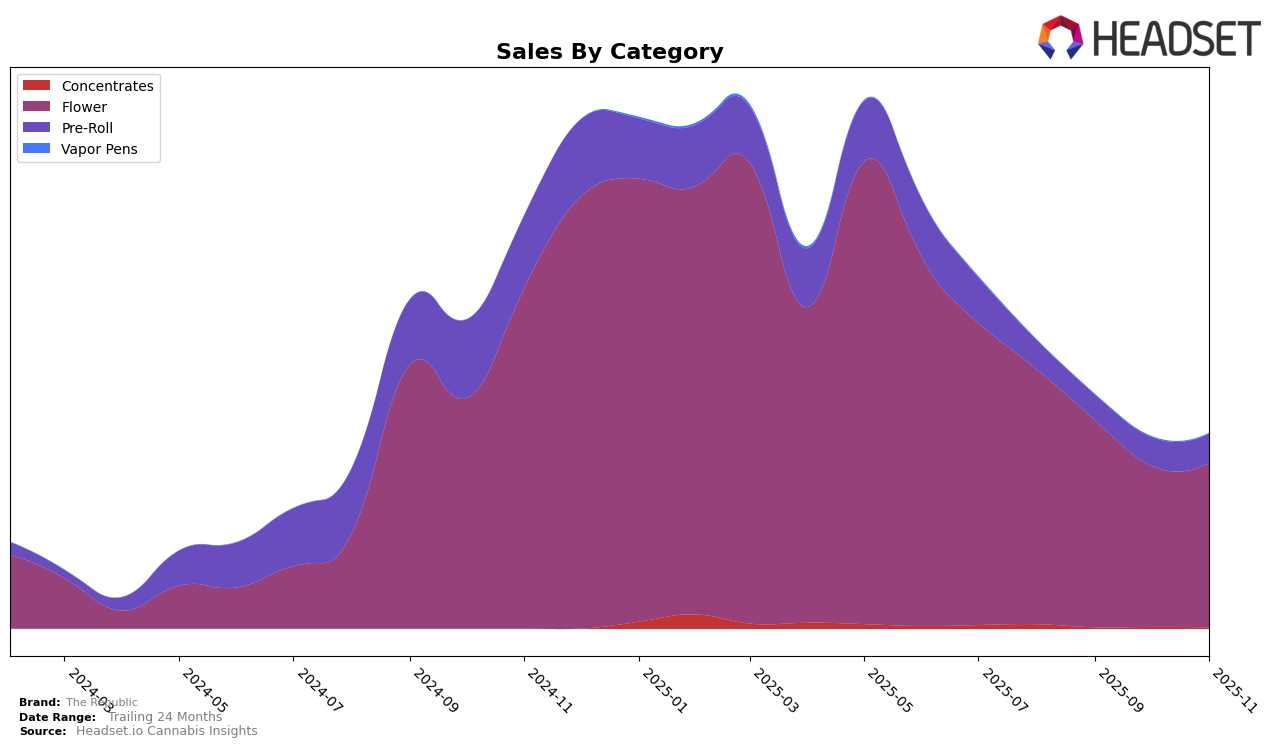

In the Canadian market, The Republic's performance in the Flower category has shown varying trends across different provinces. In Alberta, the brand has experienced a steady decline in rankings from August to November 2025, moving from 41st to 60th place. This downward trajectory is mirrored in their sales figures, which have decreased consistently over the months. In contrast, Saskatchewan presents a more optimistic scenario, where The Republic improved its position significantly in November, climbing to 27th place after previously ranking in the 40s. This improvement is accompanied by a notable increase in sales for that month, suggesting a positive reception of their products in the region.

Meanwhile, in Ontario, The Republic's ranking has consistently hovered around the 60s to 80s range, indicating a challenge in breaking into the top 30. Despite this, the brand's sales in Ontario have followed a downward trend, similar to Alberta, with a significant drop from August to November. This suggests potential difficulties in maintaining market share amidst competitive pressures. The varying performance across these provinces highlights the importance of regional strategies and market adaptation for cannabis brands like The Republic, as they navigate the diverse Canadian market landscape.

Competitive Landscape

In the competitive landscape of the flower category in Ontario, The Republic has experienced a notable decline in both rank and sales over the past few months. Starting from a strong position at 65th in August 2025, The Republic's rank fell to 84th by November 2025, indicating a significant drop in market presence. This downward trend in rank is mirrored by a decrease in sales, from a high in August to a lower figure in November. In contrast, competitors like Papa's Herb and Zips have shown resilience, with Papa's Herb improving its rank from not being in the top 20 to 73rd in September and maintaining a better position than The Republic in subsequent months. Similarly, Zips has consistently improved its rank, surpassing The Republic by October. This competitive pressure suggests that The Republic may need to reassess its market strategies to regain its earlier standing and counteract the upward momentum of its rivals.

Notable Products

For November 2025, The Republic's top-performing product remained Reserve 25%+ (28g) in the Flower category, maintaining its first-place rank despite a steady decline in sales, with a final figure of 846 units. Republic Reserve Pre-Roll 10-Pack (5g) moved up to second place from third in October, showcasing an increase in demand with sales reaching 708 units. Black Label Pre-Roll 2-Pack (2g) shifted down to third place, while Reserve 25%+ Milled (28g) entered the rankings at fourth place. Black Label (28g) dropped from fourth to fifth place, continuing its downward trend over the past months. These changes indicate a shifting preference among consumers towards pre-roll products, particularly the Republic Reserve Pre-Roll 10-Pack.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.