Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

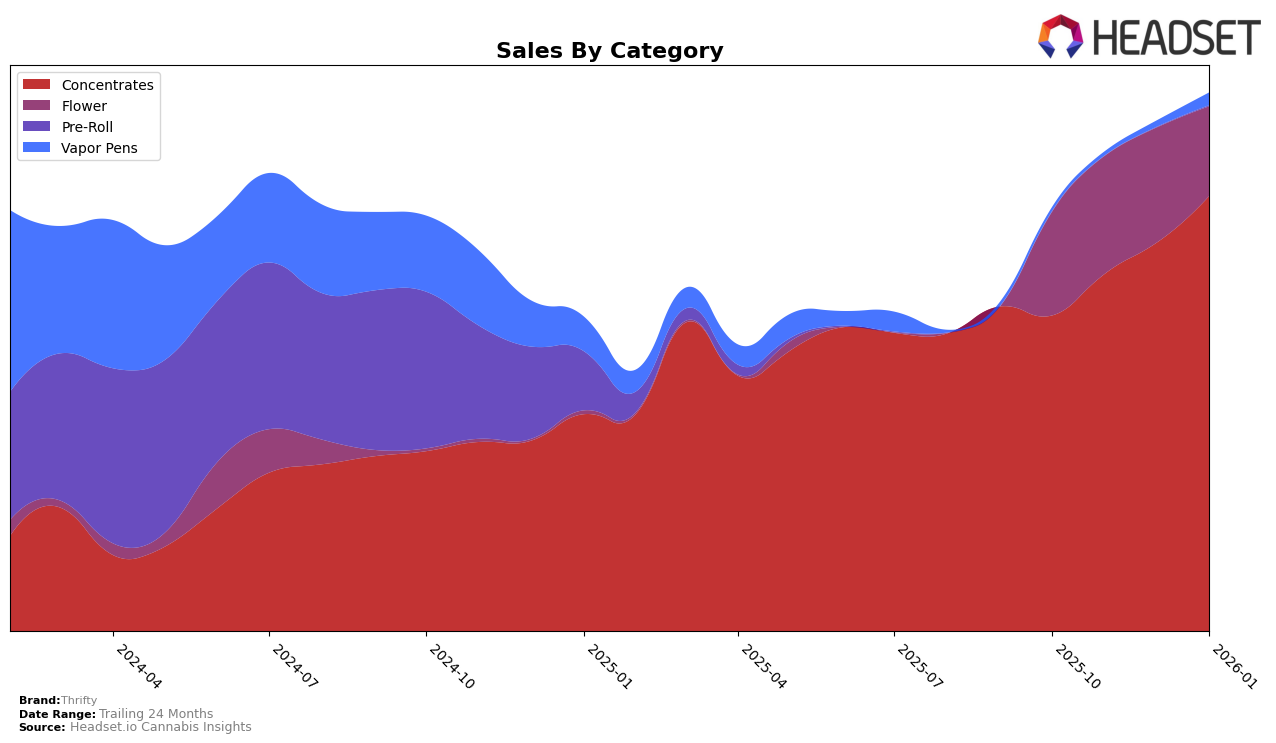

In the Alberta market, Thrifty has shown a notable upward trajectory in the Concentrates category, moving from a ranking of 42 in October 2025 to breaking into the top 30 by January 2026. This progression indicates a strengthening presence and growing consumer preference for Thrifty's concentrate products. Conversely, their performance in the Flower category has been less consistent, with rankings hovering around the 60s throughout the same period, suggesting potential challenges in gaining a foothold in this category. This could indicate a need for strategic adjustments to enhance their competitiveness in the Flower segment.

In British Columbia, Thrifty's presence in the Concentrates category has been gradually improving, starting from outside the top 30 in October 2025 to securing the 32nd position by January 2026. While this progress is commendable, it also highlights the competitive nature of the market. Meanwhile, in Ontario, Thrifty has consistently maintained a strong standing in the Concentrates category, ranking within the top 10 throughout the period and improving to 5th place by January 2026. This consistent performance in Ontario underscores the brand's established reputation and consumer trust in this specific category.

Competitive Landscape

In the Ontario concentrates market, Thrifty has demonstrated a notable upward trajectory in its ranking, moving from the 7th position consistently in the last quarter of 2025 to securing the 5th spot by January 2026. This improvement in rank is indicative of Thrifty's growing market presence and competitive edge. In contrast, MTL Cannabis has experienced a decline, dropping from 5th to 7th place over the same period, which suggests that Thrifty may be capturing some of their market share. Meanwhile, Endgame and Pura Vida have maintained stable positions at the top, consistently ranking 3rd and 4th respectively, indicating strong brand loyalty and market performance. Thrifty's sales growth, which has been on an upward trend, particularly in January 2026, underscores its strategic efforts to enhance its market position amidst stiff competition.

Notable Products

In January 2026, Big Steal Live Resin (1g) maintained its position as the top-performing product for Thrifty, with sales reaching 10,608 units, continuing its consistent number one rank from previous months. Following closely, Big Steal Live Resin Dispenser (1g) also retained its second-place ranking, showing stable sales figures across the months. Mango Sapphire (28g) improved its ranking to third place, recovering from a dip in December 2025. BC Organic Sun Grown Bonkers (28g) experienced a slight drop to fourth place, despite a strong performance in November and December. Notably, the new entry, Grab Bag Full Spectrum Distillate Cartridge (1g), debuted in fifth place, indicating a promising start in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.