Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

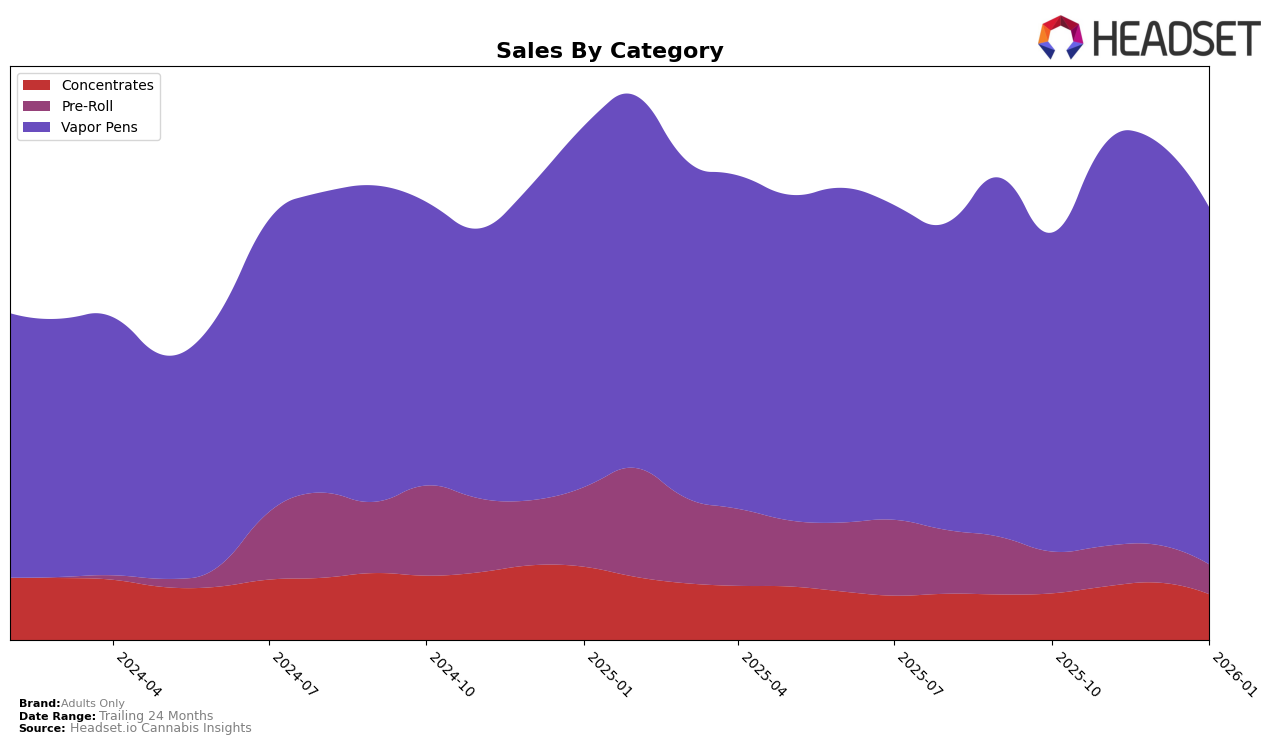

Adults Only has shown varied performance across different categories and provinces, with some notable movements in rankings. In Alberta, the brand's presence in the Concentrates category has seen a decline, moving from 16th place in October 2025 to 22nd in January 2026. This downward trend could be a point of concern as it indicates a decrease in market presence. However, in the Vapor Pens category within the same province, Adults Only has maintained a relatively stable position, improving slightly from 23rd in October to 21st in January. This suggests a stronger foothold in the Vapor Pens market in Alberta, despite the challenges faced in Concentrates.

In contrast, Ontario presents a mixed bag for Adults Only. The brand has consistently held the 7th position in the Vapor Pens category from October 2025 to January 2026, indicating a solid and stable performance. However, the Pre-Roll category tells a different story, with Adults Only not even making it into the top 30, which highlights a significant gap in their market strategy in this segment. Meanwhile, in Saskatchewan, the brand has shown a positive trajectory in the Vapor Pens category, climbing from 11th to 9th place over the same period. This upward movement reflects growing consumer interest and possibly effective marketing strategies in that region.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in Ontario, Adults Only has maintained a consistent rank of 7th place from October 2025 through January 2026. Despite this stability, the brand faces stiff competition from other players such as Tribal and XPLOR, which have consistently ranked higher, with XPLOR even surpassing Tribal in December 2025 before dropping to 6th in January 2026. Meanwhile, Versus experienced fluctuations, dropping to 13th in December 2025 but rebounding to 9th in January 2026, while DEBUNK has shown consistent performance, maintaining the 8th position. Adults Only's sales figures have seen a slight decline from October to January, which may be attributed to the competitive pressure from these brands, especially as Tribal and XPLOR have demonstrated stronger sales performance in the same period. This competitive environment suggests that Adults Only may need to innovate or enhance its marketing strategies to climb the ranks and boost sales in the Ontario Vapor Pens market.

Notable Products

In January 2026, the top-performing product from Adults Only was the Cheeky Cherry NSFW Liquid Diamond Cartridge (1g) in the Vapor Pens category, maintaining its first-place rank consistently from October 2025, despite a decrease in sales to 11,069 units. The Bumpin' Blue Raspberry NSFW Liquid Diamond Cartridge (1g) also held its ground in second place with steady performance across the months. Missionary Mango NSFW Liquid Diamond Cartridge (1g) remained in third place, showing a slight increase in sales compared to December 2025. The Grape Kush NSFW Blunt Liquid Diamond Cartridge (1g) consistently ranked fourth since November 2025. Lastly, Promicuous Peach NFSW Liquid Diamond Cartridge (1g) reclaimed its fifth position after being unranked in November 2025, indicating a rebound in its sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.