Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

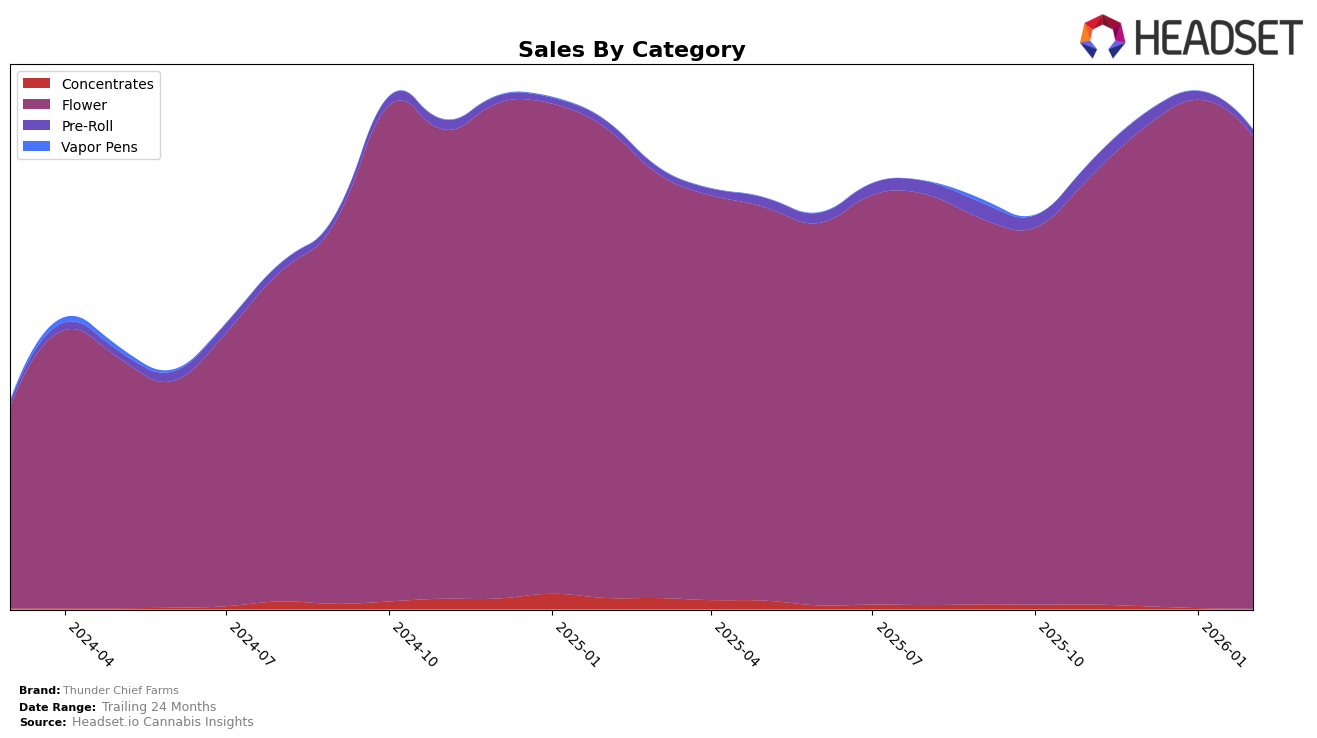

Thunder Chief Farms has demonstrated a notable upward trajectory in the Washington flower category. Starting in November 2025, the brand held the 18th position, steadily climbing to the 12th position by February 2026. This consistent improvement in rankings over four months is indicative of their growing market presence and appeal in the state. Despite a slight dip in sales from January to February 2026, the overall trend shows positive growth, suggesting effective strategies in product offerings or marketing that resonate well with consumers.

However, it is important to note that Thunder Chief Farms' performance is not uniform across all markets or categories. The absence of rankings in other states or categories suggests that the brand is not yet within the top 30 in those areas, highlighting potential opportunities or challenges they may face in expanding their footprint. This uneven performance across regions and categories could point to differences in market dynamics or consumer preferences that the brand may need to address to achieve broader success. Understanding these variations can provide valuable insights into their strategic focus and areas for potential growth.

Competitive Landscape

In the competitive landscape of the Washington flower market, Thunder Chief Farms has shown a promising upward trajectory in recent months. Starting from a rank of 18 in November 2025, Thunder Chief Farms improved its position to 12 by February 2026, indicating a consistent rise in its market presence. This upward movement is significant when compared to competitors like Artizen Cannabis, which experienced fluctuations, dropping from 12 to 15 before climbing back to 11. Meanwhile, Redbird (formerly The Virginia Company) saw a decline from a steady 5 to 10, suggesting potential volatility. Hemp Kings and K Savage (WA) also exhibited varying ranks, with Hemp Kings moving from 17 to 13 and K Savage (WA) experiencing a slight dip. These shifts highlight Thunder Chief Farms' ability to capitalize on market dynamics and enhance its sales performance, positioning it as a rising contender in the Washington flower category.

Notable Products

In February 2026, Butter (3.5g) from Thunder Chief Farms continued its dominance as the top-performing product, maintaining its first-place rank for the fourth consecutive month, with sales reaching 1005 units. Cotton Candy (3.5g) saw a significant rise, moving up to second place from its previous fourth position in December 2025, with notable sales figures. Big Perm (3.5g) re-entered the rankings in third place after being absent in January 2026, demonstrating a strong comeback. Frosted Flakes (3.5g) dropped to fourth place from its previous second position in January 2026. Grape Jelly (3.5g) made its debut in the rankings, securing the fifth position with a sales figure of 346 units.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.