Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

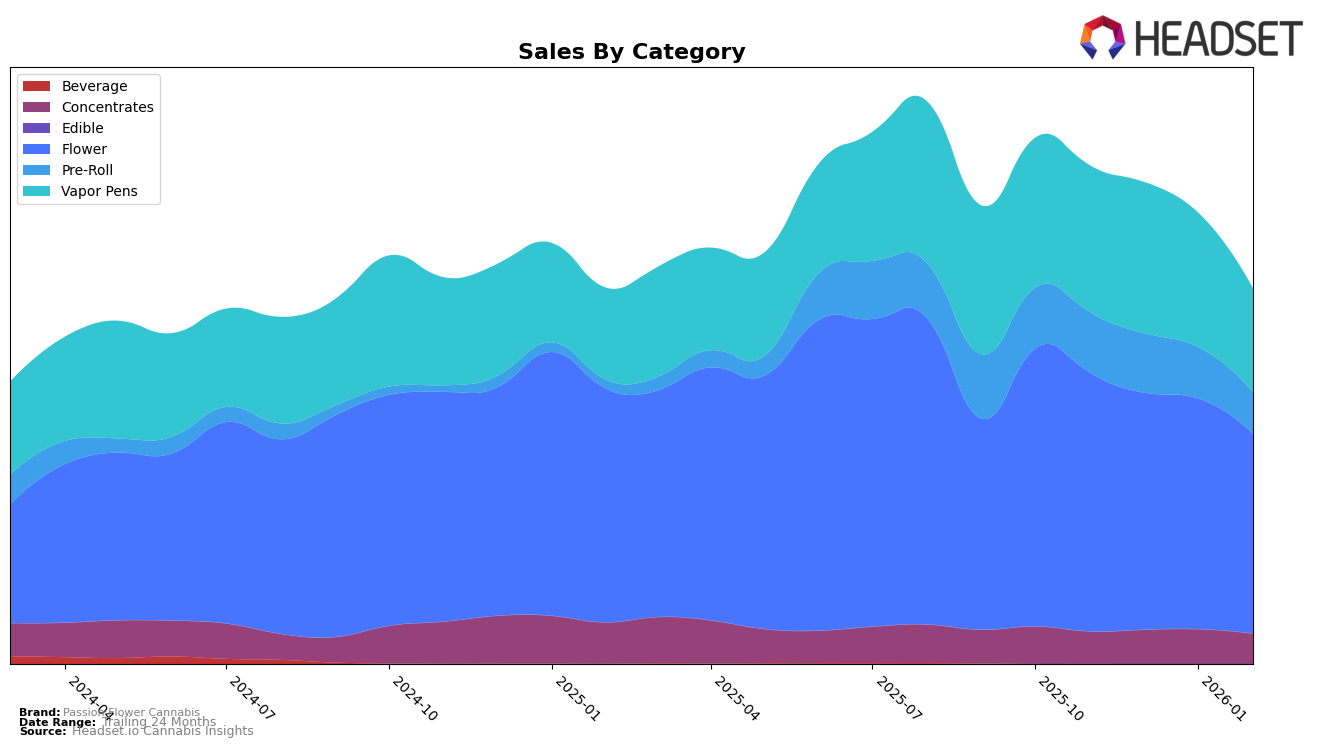

Passion Flower Cannabis has shown varying performance across different product categories in Washington. In the Concentrates category, the brand has seen a slight improvement in its ranking, moving from 48th in November 2025 to 42nd by February 2026. This upward trend is indicative of a strengthening position in the market, despite not breaking into the top 30. However, their performance in the Flower category has been more stable, with a ranking that fluctuates around the mid-20s. The brand was ranked 19th in November 2025, but slipped to 25th by February 2026, reflecting some challenges in maintaining its market share in this competitive segment.

On the other hand, the Pre-Roll category hasn't been as favorable for Passion Flower Cannabis, as the brand consistently remained outside the top 50, with a rank of 61st in both January and February 2026. This suggests potential difficulties in gaining traction in this segment. Meanwhile, in the Vapor Pens category, the brand experienced a decline from 30th in November 2025 to 39th by February 2026, indicating a need for strategic adjustments to regain its footing. Overall, while there are promising signs in some areas, Passion Flower Cannabis faces challenges in others, hinting at the need for targeted efforts to enhance its competitive edge in the Washington market.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Passion Flower Cannabis has experienced fluctuations in its ranking, reflecting a dynamic market environment. From November 2025 to February 2026, Passion Flower Cannabis saw its rank drop from 19th to 25th, indicating increased competition and potential challenges in maintaining market share. Notably, Forbidden Farms also experienced a decline, moving from 16th to 27th, suggesting a broader trend of volatility among top brands. Meanwhile, Hustler's Ambition improved its position from 26th to 23rd, potentially capturing some of the market share lost by others. Additionally, Legendary Laboratories, Llc maintained a relatively stable position, hovering around the 24th rank, which could indicate a steady consumer base. These shifts highlight the importance for Passion Flower Cannabis to innovate and differentiate in order to reclaim and enhance its competitive standing in the Washington Flower market.

Notable Products

In February 2026, Strawberry Mango Haze (3.5g) emerged as the top-performing product for Passion Flower Cannabis, maintaining its leading position from December 2025, with sales reaching 1587 units. Purple Punch (3.5g) slipped from its January 2026 top spot to second place, indicating a slight decline in its dominance. Lilac Sunset (3.5g) climbed to third place, showing an improvement from its fourth position in January. Biscotti Cereal (3.5g) made its debut in the rankings, securing the fourth position, while Purple Punch (7g) followed closely in fifth place. This reshuffling highlights a dynamic shift in consumer preferences, with Strawberry Mango Haze solidifying its popularity over consecutive months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.