Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

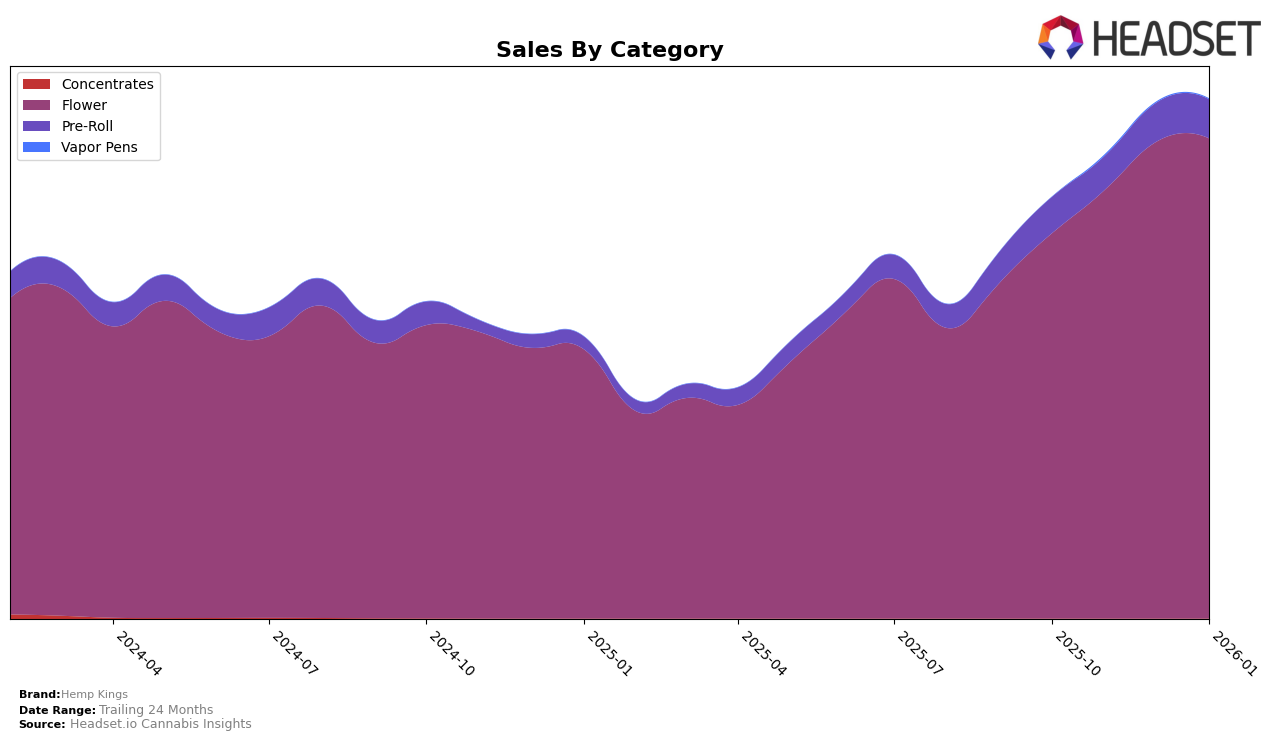

Hemp Kings has shown a steady performance in the Washington market, particularly in the Flower category. Over the months from October 2025 to January 2026, the brand has improved its ranking from 20th to 16th, indicating a positive trend in consumer preference or market strategy. This upward movement is accompanied by a consistent increase in sales, from $298,101 in October to $371,713 in January, suggesting a robust demand or effective sales tactics. However, it's worth noting that Hemp Kings did not secure a top 30 position in the Pre-Roll category until January 2026, where they debuted at 94th. This could be seen as a missed opportunity in a potentially lucrative segment, or it may indicate a strategic focus on other categories.

The absence of Hemp Kings from the top 30 rankings in the Pre-Roll category for several months raises questions about their market strategy or product performance in this segment. It could signal either a lack of competitive edge or a deliberate decision to concentrate resources on strengthening their presence in the Flower category, where they have shown significant progress. The debut at 94th in January 2026 might reflect initial efforts to penetrate this category, but the gap in earlier months suggests that there's considerable room for growth. Observing how Hemp Kings navigates these dynamics in the coming months could provide further insights into their strategic priorities and market adaptability.

Competitive Landscape

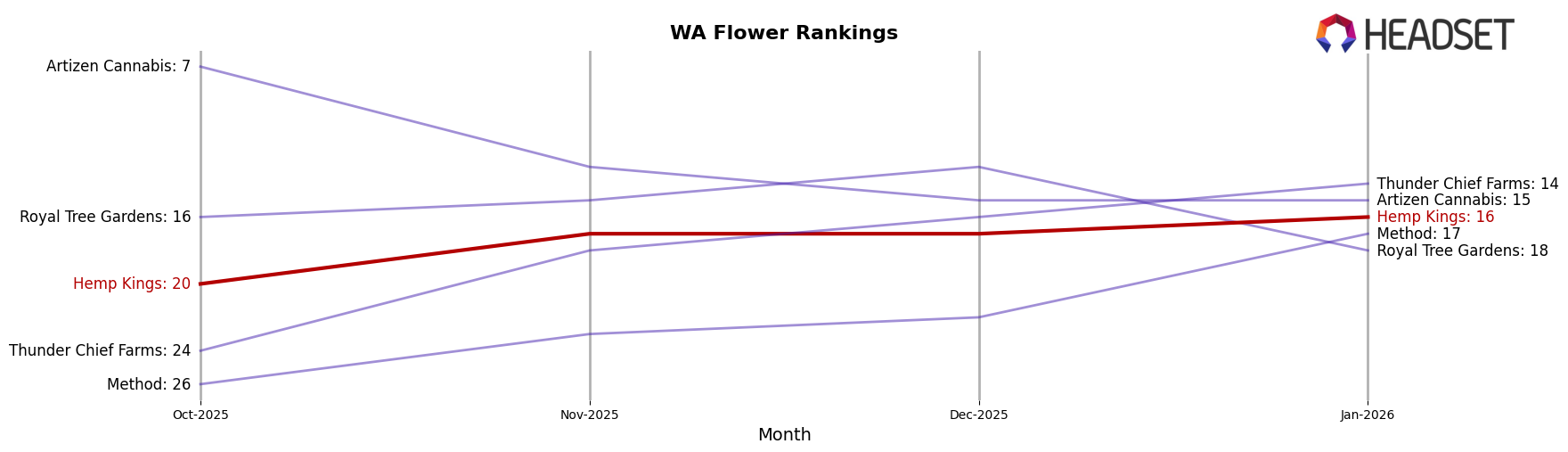

In the competitive landscape of the flower category in Washington, Hemp Kings has shown a steady improvement in its ranking from October 2025 to January 2026. Starting at the 20th position in October, Hemp Kings climbed to the 16th spot by January, indicating a consistent upward trajectory in the market. This improvement is notable when compared to competitors like Artizen Cannabis, which saw a decline from 7th to 15th place over the same period, and Royal Tree Gardens, which fluctuated but ultimately dropped to 18th place in January. Meanwhile, Thunder Chief Farms surpassed Hemp Kings, moving from 24th to 14th place, showcasing a more aggressive growth. Hemp Kings' sales figures have also mirrored this positive trend, with a steady increase each month, suggesting that their strategies are effectively capturing more market share despite the competitive pressures from brands like Method, which also showed significant improvement, moving from 26th to 17th place by January. Overall, Hemp Kings' upward movement in rank and sales highlights its growing influence in the Washington flower market.

Notable Products

In January 2026, the top-performing product for Hemp Kings was Wedding Cake (3.5g) in the Flower category, ascending to the number one rank with sales of 2439 units. This product showed consistent performance, maintaining the second position from October to December 2025 before climbing to the top. Gorilla Glue #4 (3.5g), previously the leader, moved to the second position, indicating a slight dip in sales compared to previous months. Wedding Cake (1g) held steady at the third position throughout the last three months, while Wedding Cake (7g) improved its rank from fifth in November and December to fourth in January. Gorilla Glue #4 (1g) experienced a decline, dropping to the fifth position from its third-place start in October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.