Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

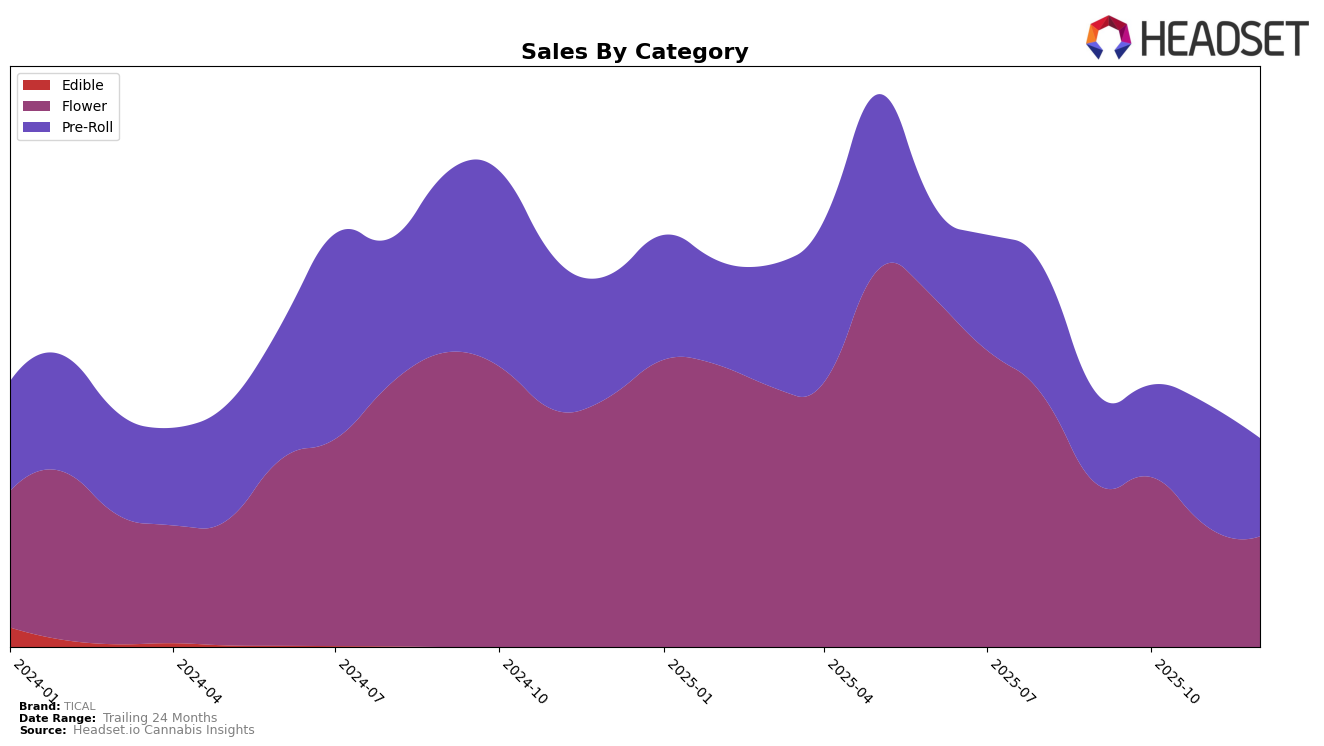

TICAL's performance in the Colorado market demonstrates notable fluctuations across different categories. In the Flower category, TICAL has shown a steady improvement in its ranking from 75th in September to 65th in December 2025, which indicates a positive reception or strategic adjustments that are resonating with consumers. However, despite this upward trend, the brand has not yet broken into the top 30, suggesting there is still room for growth. On the other hand, the Pre-Roll category tells a different story, with TICAL making a significant leap from 43rd to 22nd in November, before slightly dipping to 24th in December. This strong performance in Pre-Rolls might be a key area for TICAL to focus on, given its potential for higher market penetration.

In Illinois, TICAL's journey in the Flower category has been relatively stable but less dynamic compared to its Colorado performance. The brand's ranking hovered around the mid-70s, with a brief drop to 81st in November before climbing back to 74th in December. This consistency, albeit outside the top 30, suggests a steady but slow engagement with the market. The fluctuation in rankings indicates challenges in gaining a competitive edge in Illinois, potentially due to market saturation or consumer preferences. The sales figures in Illinois remain modest compared to Colorado, hinting at the need for strategic initiatives to boost visibility and appeal in this region.

Competitive Landscape

In the competitive landscape of the Colorado Pre-Roll category, TICAL has demonstrated a significant upward trajectory in its market position from September to December 2025. Initially ranked at 43rd in September, TICAL surged to 22nd by November, before slightly adjusting to 24th in December. This improvement in rank is indicative of a strong growth in sales, particularly notable when compared to brands like Binske, which experienced a decline from 18th to 26th over the same period. Meanwhile, Vera and My Brother's Flower showed more stability, with Vera finishing December at 23rd and My Brother's Flower at 25th. The performance of Joints (CO) also reflects a downward trend, dropping from 15th in November to 22nd in December. TICAL's ability to climb the ranks amidst these shifts highlights its growing influence and potential to capture a larger share of the market, making it a brand to watch in the coming months.

Notable Products

In December 2025, TICAL's top-performing product was Baby Jokerz Pre-Roll (1g), which climbed to the number one spot with sales reaching 2790 units. Following closely, Stimuli Pre-Roll (1g) secured the second position. Asteral Plane Pre-Roll (1g) and Power Pre-Roll (1g) took the third and fourth ranks respectively, while Sub Crazy Pre-Roll (1g) rounded out the top five. Notably, Baby Jokerz Pre-Roll (1g) rose from the third position in September 2025 to first place by December, indicating a significant increase in popularity. The other products, all newly ranked in December, suggest a reshuffling in customer preferences towards the end of the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.