Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

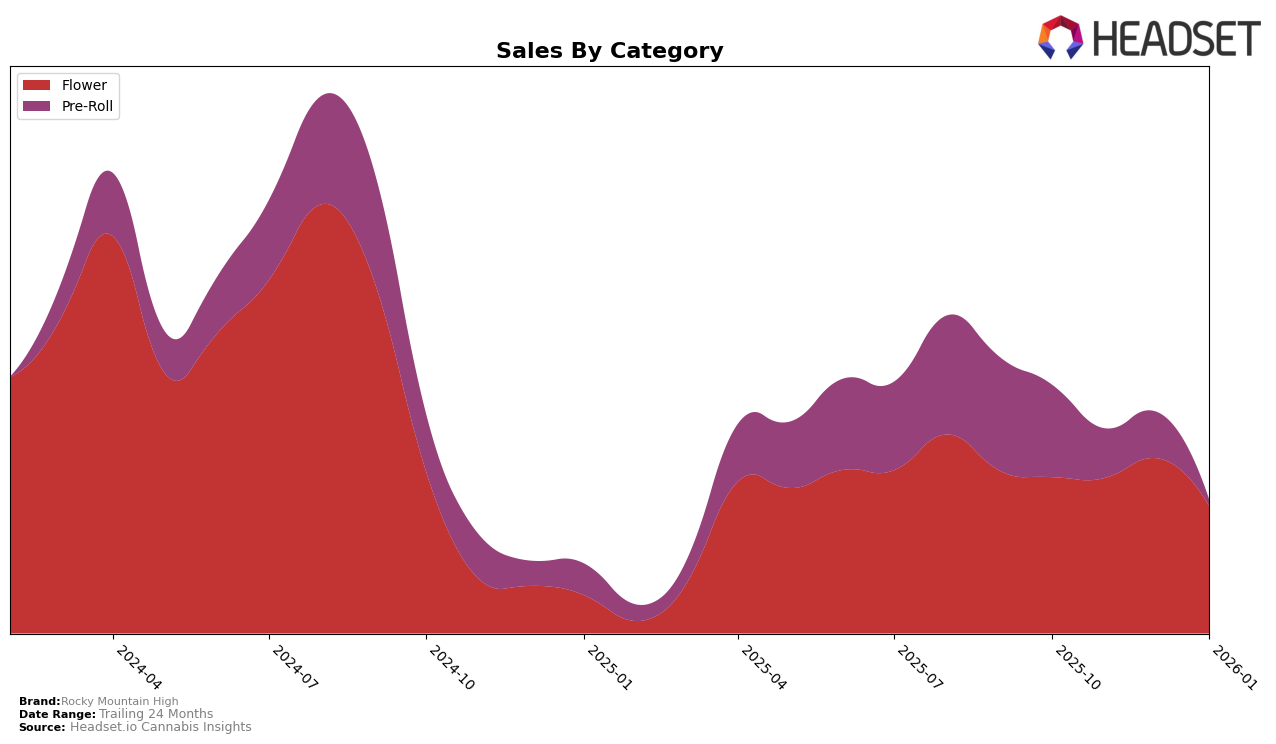

Rocky Mountain High has shown varied performance across different categories and states, with some notable trends in their rankings. In the Flower category within Colorado, the brand has consistently struggled to break into the top 30, maintaining positions in the 40s over the months from October 2025 to January 2026. This indicates a challenge in gaining significant market share in this highly competitive category. Despite a brief improvement in December 2025, where they climbed to rank 44, the subsequent drop back to rank 49 in January 2026 suggests volatility and possible issues with sustaining growth or consumer interest.

In contrast, the Pre-Roll category in Colorado has seen Rocky Mountain High maintaining a more stable yet declining trajectory. The brand managed to stay within the top 30, albeit at the lower end, moving from rank 24 in October 2025 to rank 30 by January 2026. This downward trend could be indicative of increasing competition or shifts in consumer preferences. Moreover, the sales figures reflect a downward trend over these months, with a notable decrease from November 2025 to January 2026, which might be a signal for the brand to reassess its strategy in this category to regain momentum.

Competitive Landscape

In the competitive landscape of the Colorado flower category, Rocky Mountain High has shown a consistent presence, maintaining a steady rank between 44th and 49th from October 2025 to January 2026. Despite not breaking into the top 40, Rocky Mountain High's sales have remained relatively stable, with a slight dip in January 2026. This stability contrasts with competitors like Viola, which experienced a notable decline in rank from 37th to 52nd, and Seed and Smith (LBW Consulting), which also saw a drop from 42nd to 54th. Meanwhile, Bloom County improved its position from 45th to 46th, showing resilience in sales performance. Fresh Cannabis experienced fluctuations but ended January 2026 at 44th, slightly ahead of Rocky Mountain High. These dynamics suggest that while Rocky Mountain High maintains a consistent market presence, there is an opportunity to leverage its stability to climb the ranks amidst the volatility of its competitors.

Notable Products

In January 2026, Andromeda Pre-Roll (0.5g) maintained its position as the top-performing product for Rocky Mountain High, with sales reaching 5,674 units, marking a notable increase from previous months. Animal Face x Kush Mints #11 Pre-Roll (0.5g) climbed back to the second spot, after briefly dropping to third in December 2025, indicating a resurgence in popularity. Zulufire 85 Pre-Roll (0.5g) emerged as the third best-seller, successfully breaking into the top rankings after not being ranked in November and December 2025. Bubble Gum Pre-Roll (1g) experienced a drop to fourth place, despite being the second best-seller in December 2025, suggesting a shift in consumer preference. Miracle Alien Cookies Pre-Roll (1g) consistently held the fifth position, showing steady demand despite a slight decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.