Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

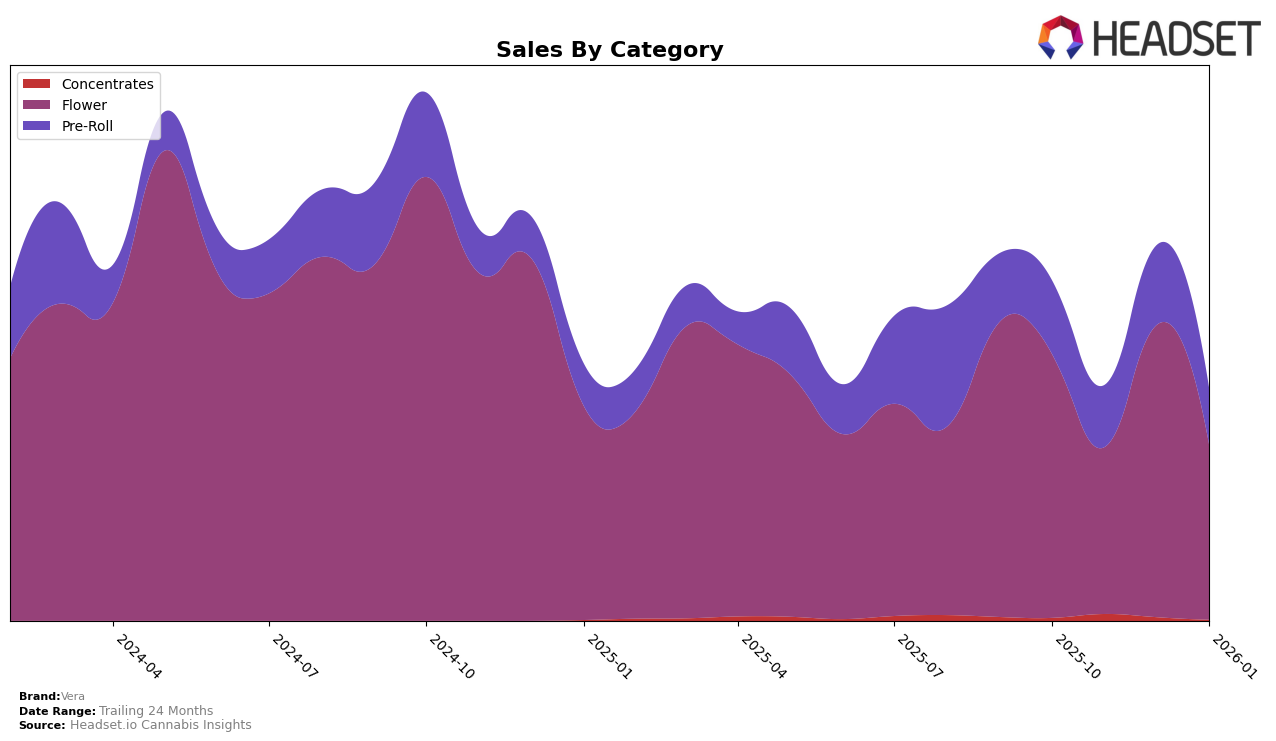

Vera's performance in the Colorado market has shown varying trends across different product categories. In the Flower category, Vera experienced fluctuations in its ranking, starting at 21st in October 2025, dropping to 39th in November, then climbing back to 29th in December, before settling at 34th in January 2026. This movement indicates a competitive landscape where Vera managed to regain some ground after a notable dip. In the Concentrates category, Vera did not make it into the top 30 rankings during the months observed, which could suggest challenges in gaining traction or a highly competitive segment. On the other hand, Vera maintained a more stable position in the Pre-Roll category, with rankings consistently around the mid-20s, indicating a steady performance despite slight fluctuations.

Examining sales trends, Vera's Flower sales in Colorado showed a peak in October 2025, followed by a decline in November, before increasing again in December. However, January 2026 saw another dip, suggesting potential seasonal influences or shifts in consumer preferences. In the Pre-Roll category, Vera's sales mirrored a similar pattern, with a peak in December 2025 but a notable drop in January 2026. The absence from the top 30 in the Concentrates category throughout the observed months could indicate either a strategic focus on other categories or the need for increased market penetration efforts. These insights into Vera's performance across categories and months provide a snapshot of the brand's positioning and potential areas for growth or strategic realignment.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Vera has experienced some fluctuations in its rank and sales over the past few months. Starting from October 2025, Vera was ranked 21st but saw a significant drop to 39th in November, before recovering slightly to 29th in December, and then slipping again to 34th by January 2026. This volatility in rank is mirrored in its sales figures, which peaked in October at a level higher than Old Pal and LoCol Love (TWG Limited), but then experienced a downward trend through November and January. Notably, Old Pal saw a dramatic rise in December, surpassing Vera's sales, which may indicate a shift in consumer preference or effective promotional strategies by competitors. Meanwhile, Mischief, which was not in the top 20 in October, made a notable leap to 29th by January, suggesting an aggressive market entry or an appealing product offering that could pose a future threat to Vera's market share. These dynamics highlight the importance for Vera to adapt its strategies to maintain and grow its position in this competitive market.

Notable Products

In January 2026, the top-performing product for Vera was Bombshell Pre-Roll (1g) in the Pre-Roll category, achieving the highest sales rank. Following closely behind, Jack Herer Pre-Roll (1g) secured the second position, although its sales dropped slightly from December 2025. Grape Hindu Cake (3.5g) in the Flower category climbed to third place, despite not being ranked in the previous months. Jack Herer (Bulk) and Donny Burger (7g), both in the Flower category, rounded out the top five, marking their debut in the rankings for January. Notably, Bombshell Pre-Roll (1g) achieved a significant sales figure of 2047 units, indicating strong consumer demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.