Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

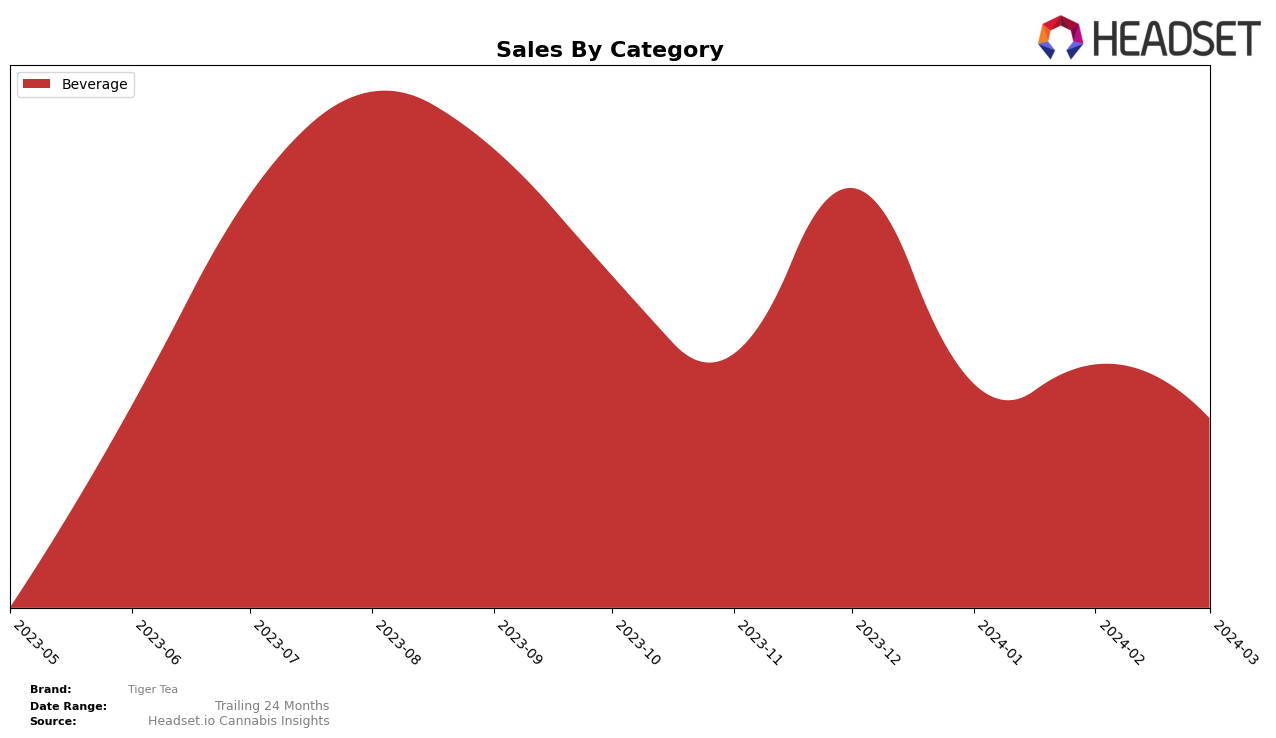

In Massachusetts, Tiger Tea has shown a consistent performance within the Beverage category, maintaining its presence in the top 20 brands over the last four months. Starting at rank 19 in December 2023 and slightly improving its position to rank 17 by March 2024, Tiger Tea's journey indicates a stable demand for its products among consumers. Despite a noticeable drop in sales from December 2023's $11,747 to $6,479 in March 2024, the brand's ability to improve its ranking suggests a competitive edge in a possibly crowded market space. This trend of maintaining or improving ranking, even in the face of declining sales, points towards a broader market dynamic at play in Massachusetts, possibly indicating shifts in consumer preferences or competitive strategies within the beverage sector.

However, the data does not provide insights into Tiger Tea's performance across other states or provinces, limiting our understanding of the brand's overall market footprint. The consistent ranking within Massachusetts's top 30 brands across the observed months is a positive sign, but the absence of rankings for other states or categories leaves a gap in our analysis. This information could have helped in understanding whether Tiger Tea's market strategies or product offerings are tailored specifically to Massachusetts or if they have a broader appeal. The lack of expansion into other states or categories, if that is the case, could be seen as an area for potential growth or an indication of strategic focus. Nevertheless, Tiger Tea's performance in the Massachusetts beverage category highlights its relevance and potential resilience in a competitive market environment.

Competitive Landscape

In the competitive landscape of the beverage category in Massachusetts, Tiger Tea has shown a notable performance amidst its competitors. Initially ranked 19th in December 2023, Tiger Tea managed to improve its position to 17th by March 2024, despite a fluctuation in sales. In comparison, Select maintained a steady presence in the top 20, consistently ranking around the 15th to 16th position, with a noticeable increase in sales over the same period. High Tide experienced a slight decline, moving from 13th to 15th, alongside a dip in sales. Bubby's Baked saw a significant drop, falling out of the top 20 in January and February, and only managing to climb back to 19th by March, with a sharp decrease in sales. Sip showed remarkable improvement, jumping from not being in the top 20 in December to securing the 18th spot by March, coupled with a substantial increase in sales. This analysis highlights Tiger Tea's resilience and potential for growth amidst fluctuating market dynamics, suggesting a need for strategic initiatives to further enhance its market position and sales trajectory.

Notable Products

In March 2024, Tiger Tea's top-performing product was Strawberry Green Tea (5mg THC, 12oz) within the Beverage category, securing the first rank with sales reaching 848 units. Following closely was Wild Berry Green Tea (5mg THC, 12oz), also in the Beverage category, which ranked second. Notably, the rankings of these products have seen a bit of fluctuation over the past months, with Strawberry Green Tea moving from the first position in December 2023 to second in January 2024, and then back to first in February and March 2024. Wild Berry Green Tea, on the other hand, swapped positions with Strawberry Green Tea, starting as the second-best in December 2023, moving up to first in January 2024, and then settling back into the second position for February and March 2024. This movement indicates a competitive dynamic between the two flavors, with Strawberry Green Tea ultimately leading in the most recent month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.