Dec-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

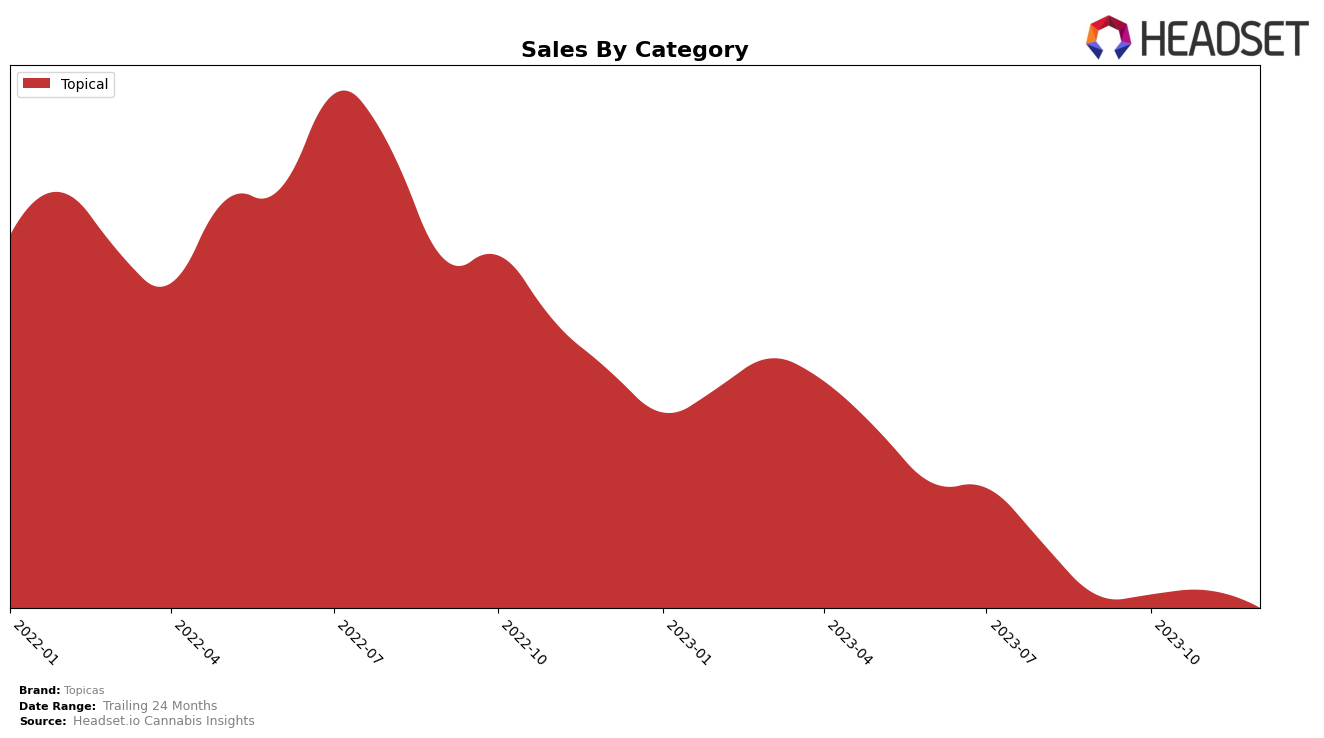

Topicas, a well-known cannabis brand, has shown some interesting movements across categories and states. In the Topical category, Topicas has demonstrated a notable performance in Massachusetts. The brand started in September 2023 at rank 14 and managed to improve its position to rank 12 by November 2023. However, by December, there was a slight dip in its ranking to 15. This fluctuation might suggest a shifting demand or increased competition in the market. It's important to note that despite the drop in ranking, Topicas remained in the top 20 brands for the entire period, which is a commendable achievement.

On the sales front, Topicas showed a steady increase from September to November 2023, with sales peaking at 3356 units in November. However, there was a significant drop in sales to 1559 units in December. This decrease could be attributed to a number of factors such as seasonal trends, market dynamics, or changes in consumer preferences. Despite this, the brand has maintained a consistent presence in the market, which is a positive sign. A deeper analysis would reveal more about the factors influencing these trends and help in strategizing for future growth.

Competitive Landscape

In the Massachusetts Topical category, Topicas has shown a fluctuating performance over the last quarter of 2023. Starting from a rank of 14 in September, it moved up to 12 in November, only to drop back to 15 in December. This indicates a slight decrease in its market position compared to competitors like Freshly Baked and Manna Molecular Science, which have shown a more stable performance. However, Topicas still outperforms other brands like Heritage CBD and Western MA Hemp Inc., which have consistently ranked lower. Despite the drop in rank, Topicas has shown a generally upward trend in sales, suggesting that it may still be a strong contender in the market.

Notable Products

In December 2023, Topicas' top-performing product was the 'CBD/THC 4:1 Cooling Mint Shea Butter Salve (400mg CBD, 100mg THC)', maintaining its first place rank from previous months and achieving a sales figure of 106 units. The 'Meditate - CBD/THC 1:1 Shea Butter Salve (100mg CBD, 100mg THC)' came second, showing a consistent performance from September to November. The 'CBD/THC 1:1 Lavender Massage Body Oil (100mg CBD, 100mg THC)' dropped out of the top rankings in December, after having been third in October and November. The 'Chill - CBD/THC 2:1 Cooling Mint Shea Butter Salve (200mg CBD, 100mg THC)' was not ranked in December, indicating lower sales. Overall, the rankings show a strong preference for the 'CBD/THC 4:1 Cooling Mint Shea Butter Salve' and a steady demand for the 'Meditate - CBD/THC 1:1 Shea Butter Salve'.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.