Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

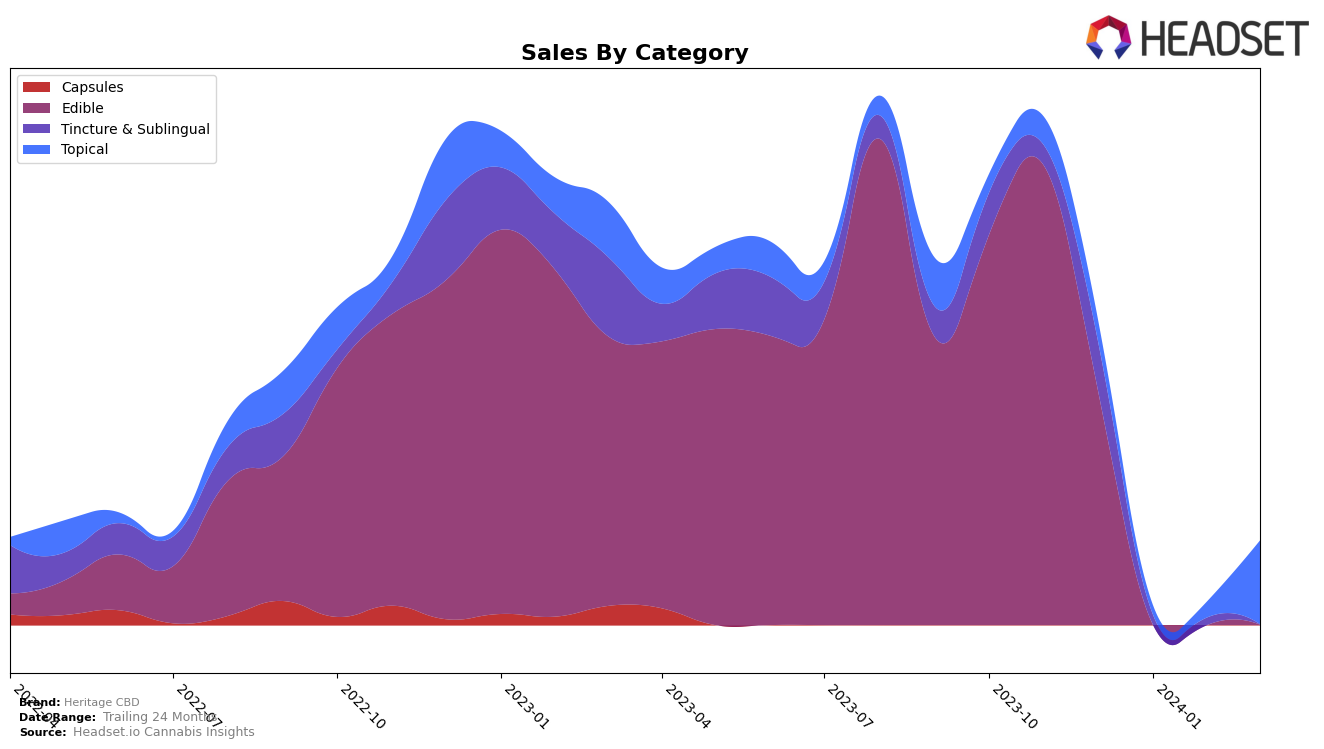

In the Massachusetts market, Heritage CBD has shown a mixed performance across different categories, with notable movements in rankings that indicate varying levels of consumer interest and market competition. The brand's presence in the Edible category was short-lived, as it ranked 59th in December 2023 with sales of $10,562 but did not make it into the top 30 in the following months, signaling a potential decline in this segment or a need for strategic realignment. Conversely, Heritage CBD has maintained a consistent presence in the Tincture & Sublingual category, although it experienced a slight downward trend, moving from 12th place in December 2023 to 17th by February 2024. This could suggest a competitive challenge within this category, despite an initial strong showing.

Interestingly, Heritage CBD's performance in the Topical category within the same Massachusetts market tells a different story. The brand improved its ranking from 17th in December 2023 to 12th in March 2024, coupled with a significant increase in sales from $955 in December 2023 to $3,718 by March 2024. This upward trajectory not only highlights Heritage CBD's growing dominance in the Topical category but also suggests a successful adaptation to consumer demands or effective marketing strategies that have enhanced its market position. The contrasting trends across categories underscore the complexity of the cannabis market and the importance of strategic flexibility and market responsiveness for brands like Heritage CBD.

Competitive Landscape

In the competitive landscape of the topical cannabis category in Massachusetts, Heritage CBD has shown a notable upward trajectory in terms of rank and sales, moving from the 17th position in December 2023 to the 12th by March 2024. This improvement is significant, especially when considering the performance of its competitors. For instance, Sanctuary Medicinals and Freshly Baked have maintained their positions within the top 11, with Sanctuary Medicinals experiencing a slight fluctuation but remaining strong in sales. Freshly Baked, on the other hand, saw a notable increase in sales by March 2024, securing the 10th position. Other competitors like INSA and The Heirloom Collective have also shown consistent performance but did not exhibit the same level of growth as Heritage CBD. This upward movement for Heritage CBD, despite not disclosing raw sales numbers, suggests a positive trend in consumer preference and market share within the state, potentially attributed to effective marketing strategies, product quality, or consumer loyalty.

Notable Products

In March 2024, Heritage CBD's top-performing product was the CBD Body Lotion (500mg CBD) from the Topical category, marking a significant sales increase to 104 units. Following closely, the CBD Arnica Salve (1000mg CBD), also within the Topical category, secured the second spot with a notable rise in its ranking from the previous months, ending with 43 units sold. The third position was claimed by the CBD Muscle Salve Stick (2000mg CBD), indicating a consistent preference for topicals among consumers. Interestingly, the CBD Anytime Gummies 30-Pack (750mg CBD) and the CBD Calm Hemp Extract Gummies 30-Pack (750mg CBD), both from the Edible category, did not maintain their sales momentum from December 2023, dropping out of the top ranks by March 2024. This shift underscores a growing consumer interest in topical products over edibles within the Heritage CBD brand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.