Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

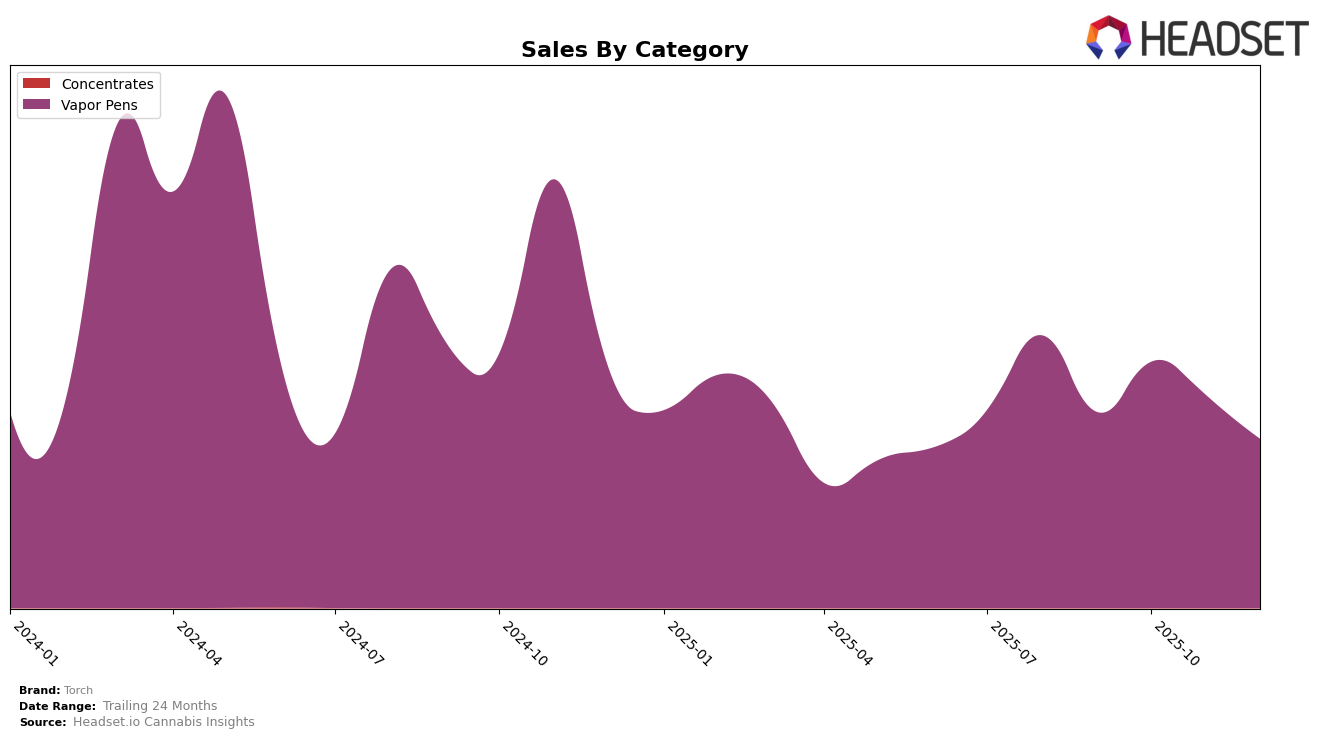

In the state of Nevada, Torch has shown a dynamic performance within the Vapor Pens category over the last few months of 2025. Starting from a rank of 24 in September, Torch improved to 22 in October and further climbed to 19 in November. However, December saw a slight dip back to 21. This fluctuation indicates Torch's competitive presence in the Nevada market, with periods of upward momentum, although they did not maintain a steady climb. Despite the drop in December, the overall trend suggests that Torch remains a significant player within the top 30 brands, reflecting a robust engagement with consumers in this category.

It's noteworthy that Torch's sales figures in Nevada saw a peak in October, with a significant increase from September, before experiencing a decline in the subsequent months. This peak suggests a successful marketing or product strategy during that period, which could be a point of interest for further analysis. The absence of Torch from the top 30 in any other state or category during these months highlights both an opportunity for expansion and a need to bolster their presence beyond Nevada. This localized performance suggests Torch has a strong foothold in Nevada but may need to explore strategies to replicate this success in other markets.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Torch has demonstrated notable resilience and adaptability. From September to December 2025, Torch's rank fluctuated, starting at 24th, peaking at 19th in November, and settling at 21st by December. This movement reflects a competitive market where brands like Alternative Medicine Association / AMA and High Heads also experienced significant rank changes, with AMA improving from 23rd to 20th in November before dropping to 22nd in December, while High Heads saw a dramatic drop from 19th to 36th in October, only to recover to 19th by December. Interestingly, The Clear re-entered the top 20 in December after missing the ranks in previous months, indicating a potential upward trend. Torch's ability to maintain a relatively stable position amidst these fluctuations suggests a strong brand presence and customer loyalty, despite the competitive pressures from both established and emerging brands in the Nevada vapor pen market.

Notable Products

In December 2025, Purple Slushy Live Resin Diamonds Disposable (1g) emerged as the top-performing product for Torch, climbing from a rank of 5 in November to secure the number 1 spot with sales of 512 units. Pineapple OG Live Resin Diamonds Disposable (1g) maintained a strong position, ranking 2nd after being the top product in October, with a notable decline in sales from 580 units in October to 467 units in December. Mango Mimosa Live Resin Diamonds Disposable (1g) held steady at the 3rd position for two consecutive months despite a decrease in sales. Pink Lemonade Live Resin Diamond Disposable (1g) consistently ranked 4th, experiencing a decline in sales from 399 units in November to 258 units in December. LA Kush Cake Live Resin Diamond Disposable (1g) dropped to 5th place in December after being 2nd in November, indicating a significant decrease in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.