Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

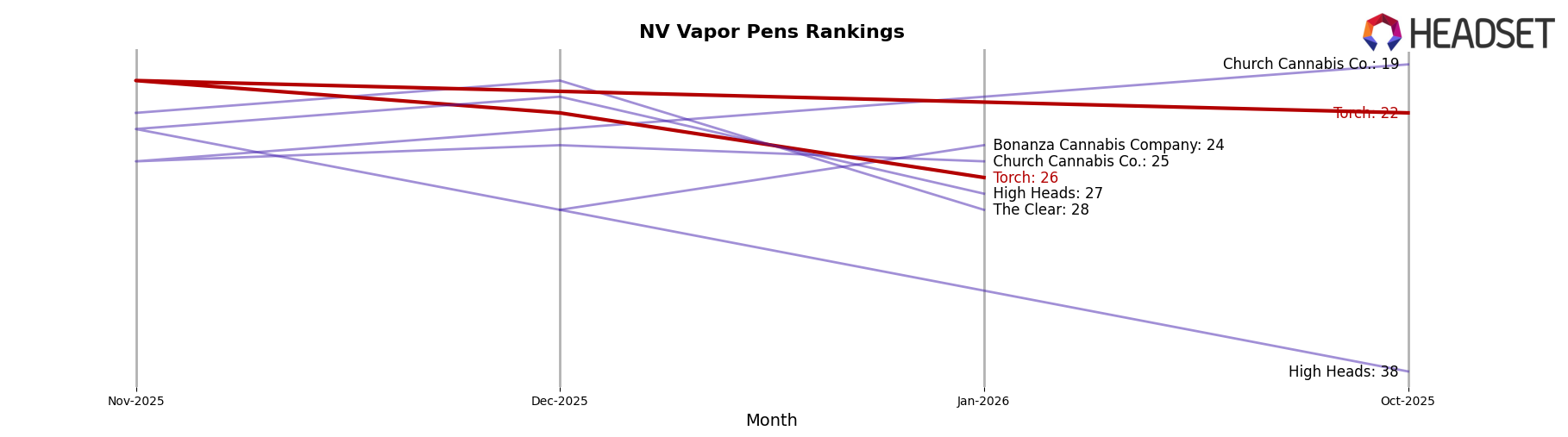

In the Nevada market, Torch has demonstrated a fluctuating performance across the Vapor Pens category. Starting from October 2025, Torch was ranked 22nd, showing a slight improvement to 20th in November before dropping back to 22nd in December and further down to 26th by January 2026. This movement indicates a challenging competitive landscape, where Torch's ability to maintain a stable position is being tested. Notably, the brand's sales figures in Nevada have seen a downward trend from October to December, although there was a slight recovery in January. This could suggest a seasonal impact or a response to market dynamics that might be worth exploring further.

It's important to highlight that Torch's absence in the top 30 rankings in certain months within the Nevada market could be viewed as a setback, especially when competitors are gaining ground. The brand's performance in the Vapor Pens category suggests that while there is some resilience, there are also areas that may require strategic adjustments to regain or enhance market position. As Torch navigates these changes, understanding the competitive pressures and consumer preferences within Nevada could be crucial for future growth and stability. Further analysis could provide insights into how Torch can better align its offerings with market demands.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Torch has experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 22nd in October 2025, Torch climbed to 20th in November, showcasing a momentary gain in market traction. However, the brand's rank slipped to 22nd in December and further to 26th in January 2026, indicating a downward trend in its competitive standing. This decline in rank is mirrored by a decrease in sales, suggesting potential challenges in maintaining customer loyalty or market share. In contrast, High Heads demonstrated a significant rise from 38th in October to 21st in December, before slightly dropping to 27th in January. Meanwhile, Church Cannabis Co. maintained a relatively stable position, fluctuating between 19th and 25th, while The Clear and Bonanza Cannabis Company showed varied rankings, indicating a dynamic and competitive market environment. These shifts highlight the importance for Torch to innovate and strategize effectively to regain and sustain its market position.

Notable Products

In January 2026, the top-performing product from Torch was Pineapple OG Live Resin Diamonds Disposable (1g) in the Vapor Pens category, which reclaimed its top position from October 2025 with sales of 447 units. LA Kush Cake Live Resin Diamond Disposable (1g) rose to second place, showing a notable improvement from its fifth-place ranking in December 2025. Kush Mints Live Resin Diamonds Disposable (1g) entered the rankings for the first time, securing the third position. Purple Slushy Live Resin Diamonds Disposable (1g) dropped from its leading position in December 2025 to fourth place. Passion Orange Guava Live Resin Disposable (1g) experienced a decline, moving from first place in November 2025 to fourth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.